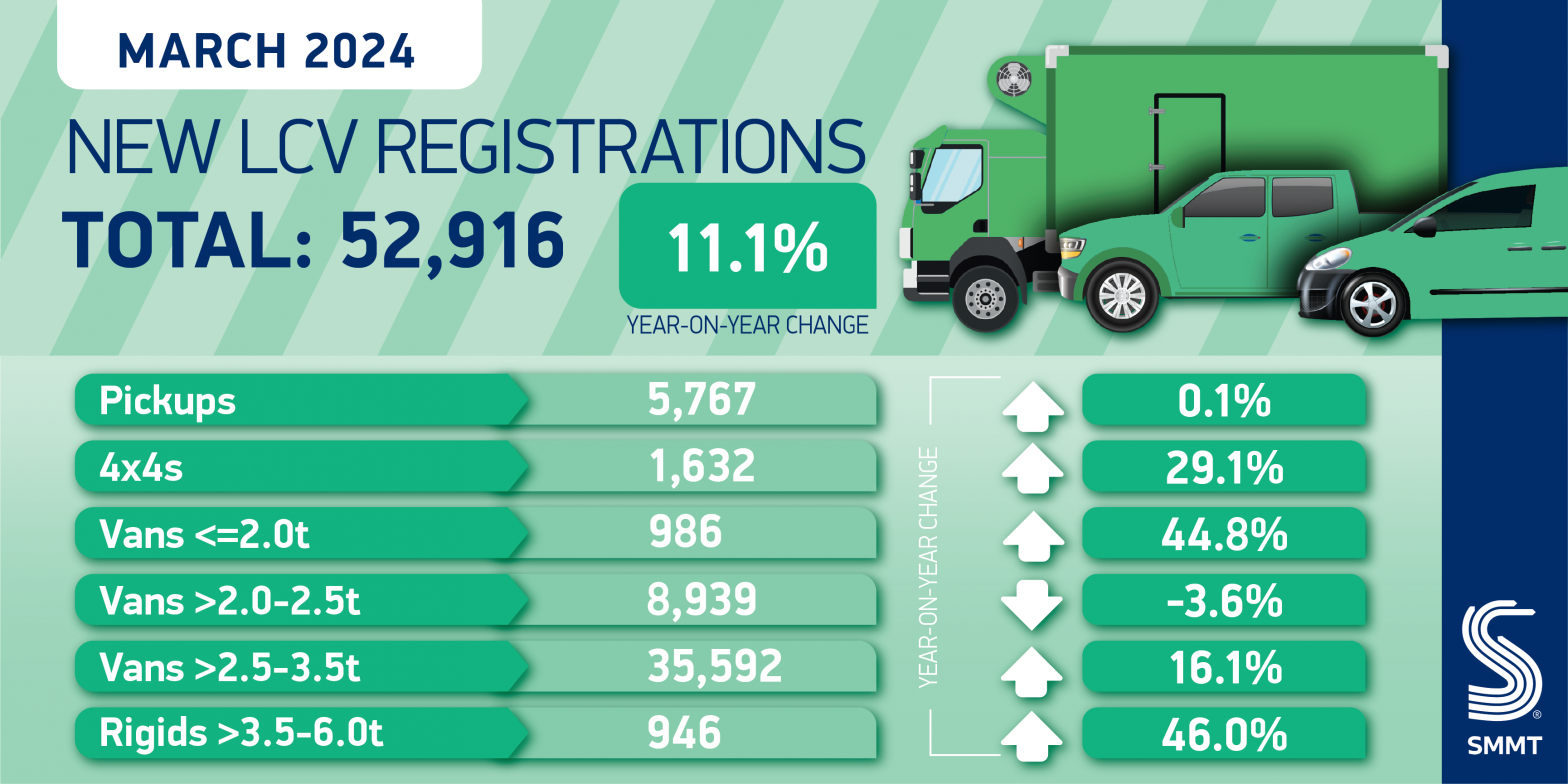

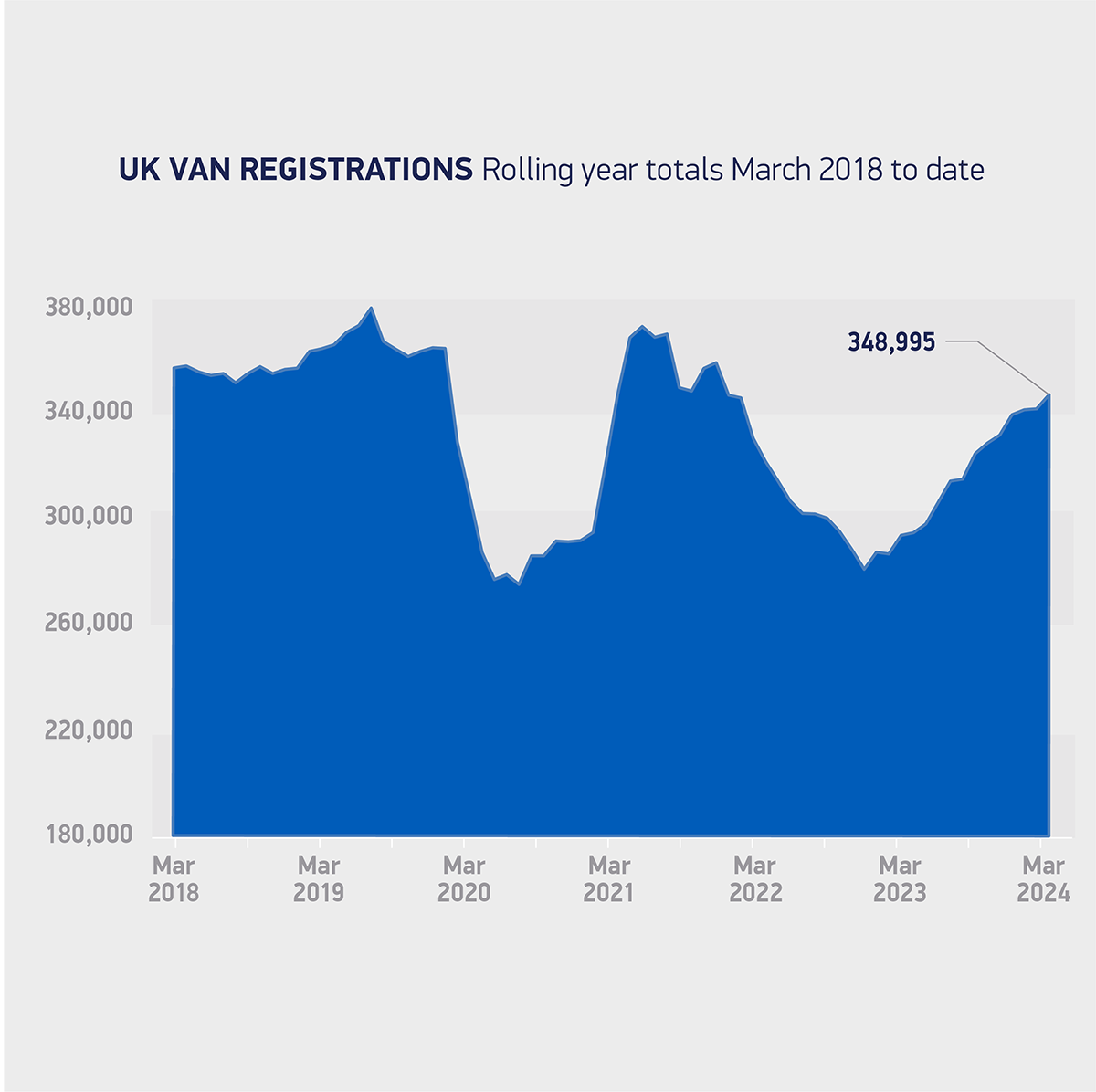

- Britain’s new light commercial vehicle (LCV) market grows 11.1% to 52,916 units in best March performance for three years.

- Growth in uptake of all LCVs besides medium-sized vans, with the largest models up 16.1% as demand for smaller vans bounces back with a 44.8% rise.

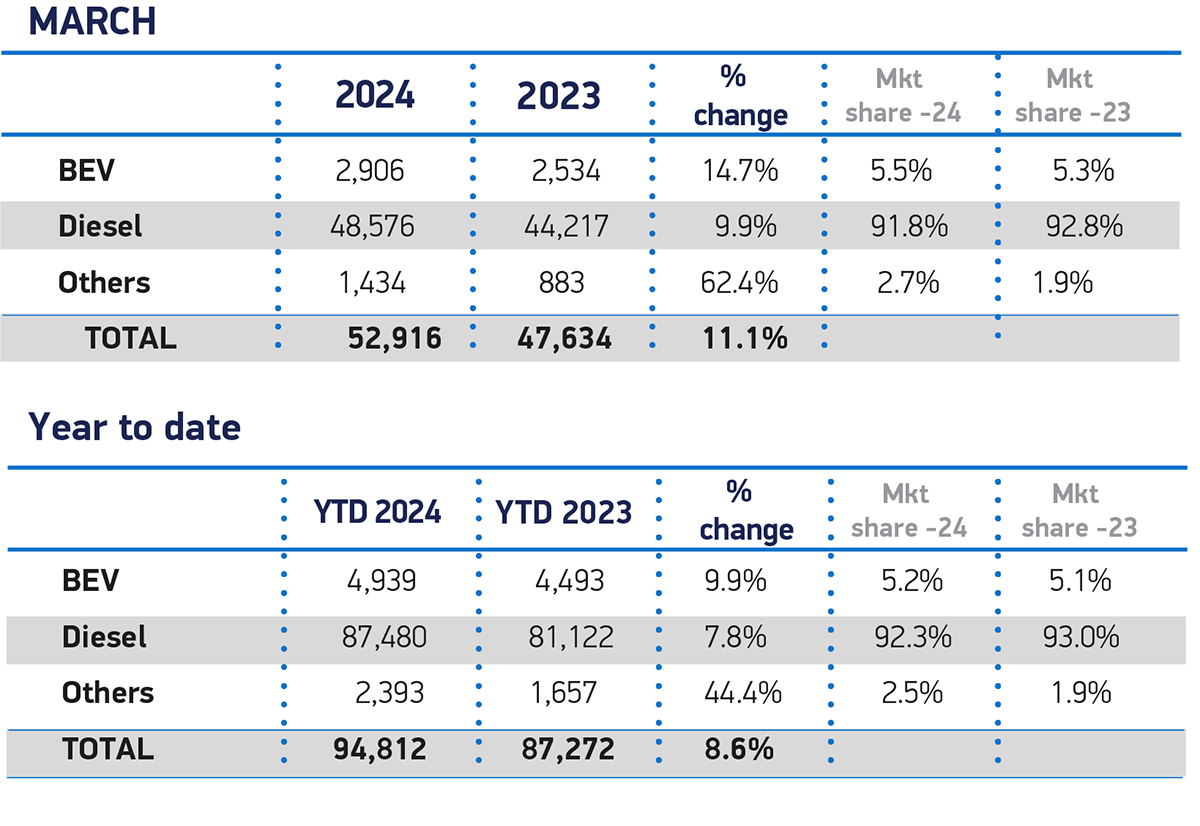

- Electric van uptake reaches highest volume on record for a new plate month – but a national plan for van-suitable public chargepoints remains crucial to tackling fleet charging anxiety.

SEE LCV REGISTRATIONS BY BRAND

DOWNLOAD PRESS RELEASE AND DATA TABLE

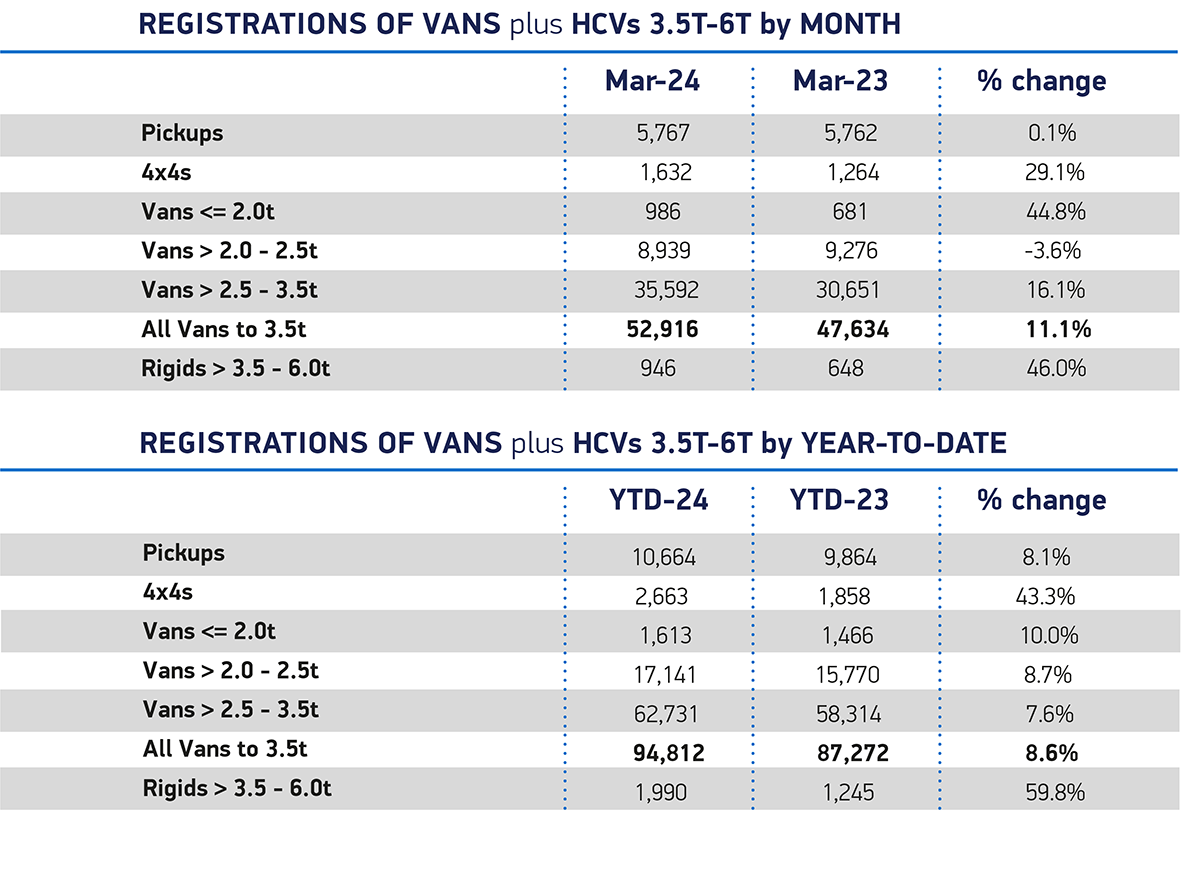

More than 50,000 new light commercial vehicles (LCVs) joined UK roads in a bumper March for fleet renewal as more businesses upgraded to the very latest models than in any other month during the past three years. 52,916 new vans, 4x4s and pickups were registered, up 11.1% as Britons increasingly depend on vans for everything from online shopping to local trades.1 As a result, the van sector in 2024 delivered its best first quarter for three years,2 with volumes now just -7.7% below Q1 2019.3

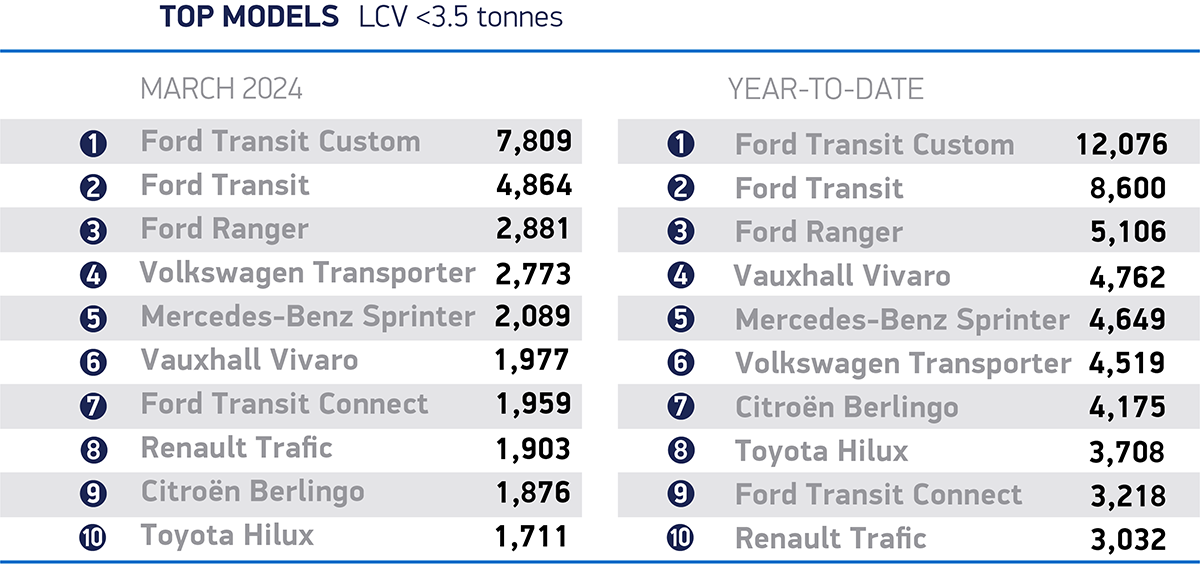

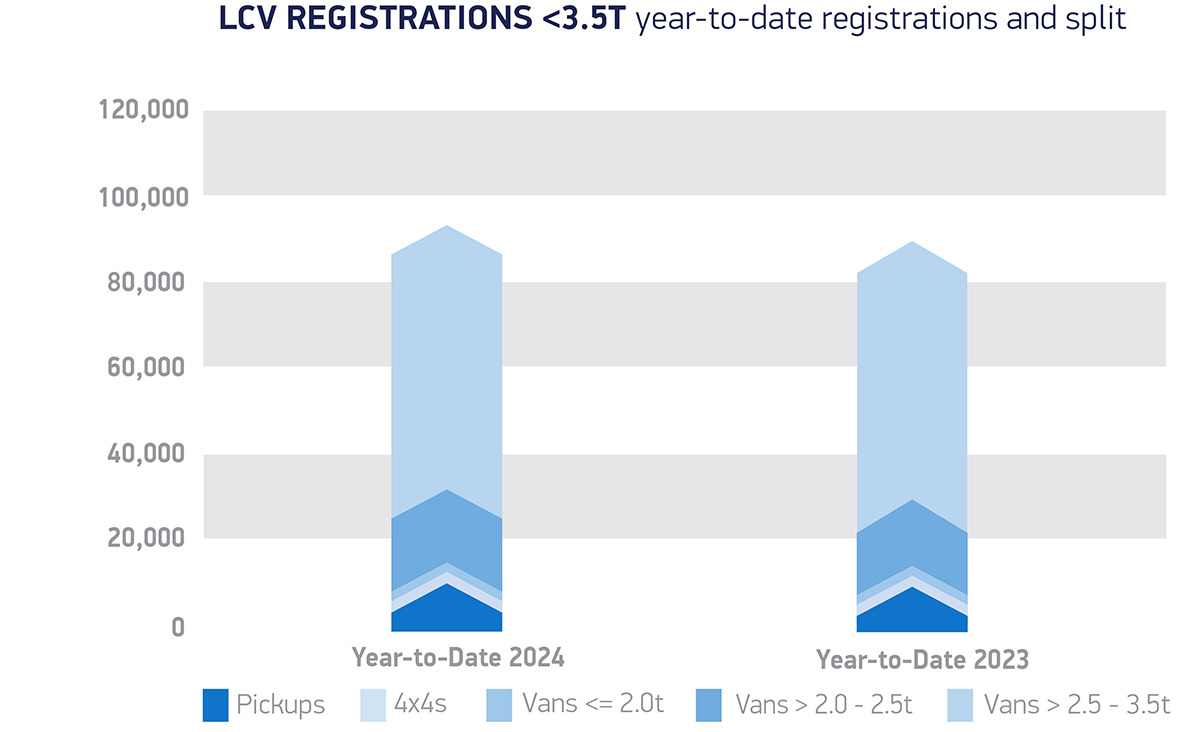

Registrations were driven by popular demand for the largest models – those weighing more than 2.5 tonnes to 3.5 tonnes – up 16.1% to represent more than two thirds (67.3%) of the market. The biggest percentage increase in uptake was of the smallest vans, up 44.8% to 986 units, while demand for medium-sized vans fell slightly by -3.6% to 8,939 units. Pick-up volumes increased to 5,767, up 0.1% compared with a particularly strong month last year, while demand for the latest 4x4s rose by 29.1% to 1,632 units.

More fleets went green last month than in any other new numberplate month to date, with new battery electric vans (BEVs) continuing to rise, up 14.7% to 2,906 units.4 It means the very greenest vans represented 5.5% of the whole LCV market, but up only slightly from 5.3% in March last year. With manufacturers now mandated to achieve increasingly ambitious proportions of zero emission sales,5 urgent action is needed to improve the confidence of operators – from large fleets to small businesses and the self-employed – to switch to the growing range of BEV models on offer.

Maintaining existing purchase incentives is essential, but urgent action is also needed to address the concerns of some businesses. This includes tackling charging anxiety by ramping up van-suitable public infrastructure across the UK, from motorways to residential streets, so that operators have full confidence to charge wherever and whenever they need. At the same time, with the cost of VAT on public charging four times higher than private or home charging, this disparity presents another obstacle for businesses planning to transition to a net zero fleet, which is essential if the UK’s world-leading net zero market is to be met.

Mike Hawes, SMMT Chief Executive, said,

A strong new plate month with the greatest number of zero emission vans joining UK roads is a bellwether of the sector’s progress, cutting emissions while keeping British businesses on the move. Industry is ready to deliver further, but with green uptake still below mandated levels, swift action is needed to give new van buyers the confidence to go electric. Rapid delivery of van-suitable public charging points and removing the hurdle of taxation on their use are key to greener fleets and a greener future.

Notes to editors

1 LCV registrations, March 2021: 56,122 units.

2 LCV registrations, Q1 2021: 97,356 units.

3 LCV registrations, Q1 2019: 102,743 units.

4 Only December 2023, at 2,964 units, has had a higher monthly BEV registration total than March 2024.

5 The Zero Emission Vehicle Mandate requires 10% of manufacturers’ new LCV sales be zero emission in 2024.