The electric vehicle (EV) frenzy, witnessed in 2020 and 2021, has lost its spark. Skepticism among investors is rising as EV startups tread on thin financial ice, facing the make-or-break challenge of proving their mettle in a fiercely competitive market. The industry’s capital-intensive nature is fast depleting the cash reserves of startups.

Last week, Canoo released its quarterly results and concurrently expressed doubts about its ability to continue as a going concern. The following day, Canoo revealed a significant development by securing a vehicle sales agreement with Jazeera Paints. The agreement entails the initial purchase of 20 Canoo EVs, with an option to expand the fleet by an additional 180 vehicles potentially.

Lucid Motors announced that it is raising another $1 billion from Saudi Arabia amid diminishing cash reserves. According to Peter Rawlinson, CEO of Lucid, the automaker is burning around $1 billion in cash per quarter. That makes us wonder if funding of $1 billion would prove to be sufficient for a company that is currently burning the same amount per quarter.

Another EV startup, Fisker, has withdrawn its guidance for 2024 as it is evaluating strategic alternatives to keep itself afloat. The company, which has filed for bankruptcy, is also facing an NHTSA probe now.

Meanwhile, major EV companies like Tesla TSLA, Rivian RIVN and China-based NIO Inc. NIO, Li Auto LI and XPeng Inc. XPEV released their delivery results for the first quarter of 2024.

Inside the Headlines

Tesla delivered 386,810 cars (369,783 Model 3 and Y, and 17,027 Model S and X) worldwide in the first quarter, down 8.5% year over year. This marked the first year-over-year drop in quarterly deliveries since 2020.The decline was due to “the early phase of the production ramp-up” of its updated Model 3 at its Fremont factory and plant shutdowns resulting from shipping diversions caused by the Red Sea conflict and an arson attack at Gigafactory Berlin, which led to a weeklong production halt in its German factory. The EV king produced 433,371 vehicles (412,376 Model 3 and Y, and 20,995 Model S and X) during the quarter, down 1.7% from the year-ago quarter.

NIO delivered 11,866 vehicles last month, comprising 6,737 premium smart electric SUVs and 5,129 premium smart electric sedans. Deliveries rose 14.3% year over year and 45.9% from the month of February. However, first-quarter 2024 deliveries declined 3.2% year over year to 30,053 units. As of Mar 31, 2024, NIO’s cumulative vehicle deliveries totaled 479,647 units. NIO started deliveries of its 2024 ES8, ES6, EC7, EC6 and ET5T in March 2024. It aims to begin the deliveries of the 2024 ES7, ET7 and ET5 in the second quarter of 2024.

XPeng delivered 9,026 EVs last month, rising 29% year over year and 99% from the month of February. With the deliveries of 3,946 units in March, the XPENG X9 remained the top-selling all-electric multi-purpose vehicle in China. Around 8,000 units of XPENG X9 have been sold since its launch. In the first quarter of 2024, XPeng delivered 21,821 smart EVs, up 20% year over year. In March, XPEV introduced the launch edition of the G9 SUV and the P7 sedan in Germany. It also entered into strategic partnerships with leading automotive dealerships in Thailand, Singapore and Malaysia.

Li Auto reported monthly deliveries of 28,984 vehicles in March, representing an uptick of 39.2% year over year and 43.1% from the month of February. It delivered 80,400 vehicles in the first quarter of 2024, rising 52.9% year over year. LI’s cumulative deliveries reached 713,764 as of Mar 31, 2024, making it China’s first emerging new energy automaker to cross a milestone of 700,000 cumulative deliveries.As of Mar 31, 2024, Li Auto had 474 retail stores in 142 cities. Its servicing centers totaled 356 and Li Auto-authorized body and paint shops were in 209 cities. The company has 357 supercharging stations with 1,544 charging stalls in China.

Li Auto currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Rivian manufactured 13,980 vehicles at its Illinois factory, down from 17,541 units in the fourth quarter of 2023. Deliveries of 13,588 units in the first quarter of 2024 were down 2.8% from 13,972 units in the fourth quarter of 2023. The company had expected first-quarter 2024 deliveries to fall 10-15% sequentially. Despite the planned closure of operations at its factory from April 5th to 30th, Rivian maintains its full-year delivery guidance of 57,000 units. The factory has been shut down for retooling purposes, which is expected to reduce the company’s fixed cost per vehicle delivered by 2024 end. It would also increase the production line rate by 30%. Once operations resume after the retooling, Rivian’s production capacity and efficiency are likely to increase.

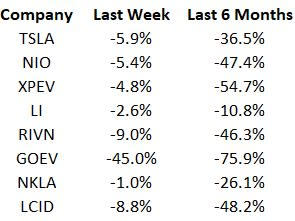

Price Performance

The following table shows the price movement of some of the major EV players over the last week and six-month period.

Image Source: Zacks Investment Research

What’s Next in the Space?

Stay tuned for announcements of upcoming EV models and any important updates from the red-hot industry.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

NIO Inc. (NIO) : Free Stock Analysis Report

Li Auto Inc. Sponsored ADR (LI) : Free Stock Analysis Report

XPeng Inc. Sponsored ADR (XPEV) : Free Stock Analysis Report

Rivian Automotive, Inc. (RIVN) : Free Stock Analysis Report