Based on my analysis of the Goodyear Tire & Rubber Co. (NASDAQ:GT), I am convinced on a hold recommendation due the the current uncertainty regarding the company’s strategic overhaul, as it delves into signifcant rationalizations, asset sales and debt reduction under its Goodyear Forward Plan. This strategic revamp, while potentially promising, introduces a level of uncertainty regarding its effectiveness and the company’s future, prompting investors to be cautious in the interim.

Company overview

Headquartered in Ohio, Goodyear has a strong global presence, with 950 tire and retail outlets and 57 manufacturing facilities in 23 countries, operating through three distinct operating segments, each representing their regional tire businesses: Americas (60% of revenues), Europe, the Middle East and Africa (28%) and Asia Pacific (12%). Currently, with approximately 10% of the global market share, Goodyear is the third-largest player in the global tire market, behind Michelin (XPAR:ML) and Bridgestone (TSE:5108). The company sells tires under the Goodyear, Cooper, Dunlop, Kelly, Debica, Sava, Fulda and Mastercraft brands and private-label brands for certain customers. Further, with the acquisition of Cooper Tire & Rubber Co. in 2021 for $2.80 billion, Goodyear strengthened its position in the U.S. and China.

The current state of the business

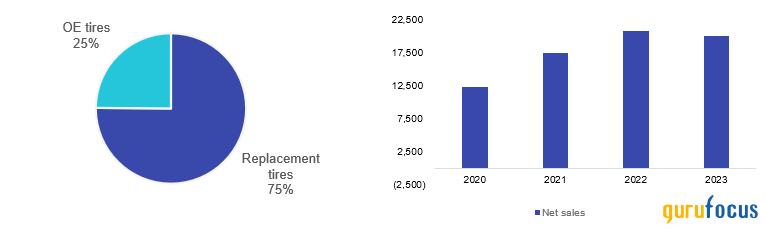

Complemented by Goodyear’s globally recognized brand and substantial market share, particularly in the U.S., the company enjoys a relatively stable revenue base as a result of its significant exposure to the replacement tire market (which accounts for 75% of its revenue), compared to 25% from the original equipment segment. Unlike the OE segment, which is exposed to the cyclicality of the auto industry, the replacement market demonstrates greater resilience as tires are deemed essential components of vehicles regardless of the type of engine propelling them. Moreover, the company has been future-proofed and currently supplies 50% of tires for new electric vehicles in the U.S., providing positive momentum on top of its stable revenue base.

Figure 1: Goodyear Revenue Mix and Net Sales Progression (USD Million)

Source: Goodyear Investor Relations

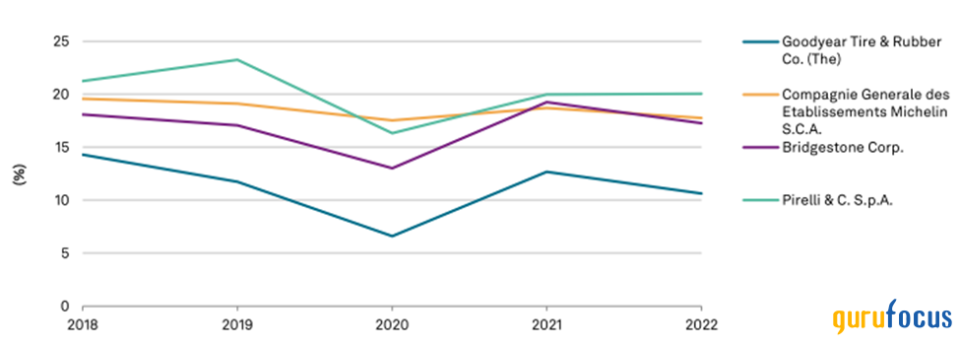

However, despite its strong market position and stable revenue base, Goodyear has historically trailed behind its peers in terms of profitability, despite restructuring efforts aimed at narrowing this gap (unsuccessful so far it spent approximately $1.20 billion between 2015 and 2023 on restructuring).

Figure 2: Tire company Ebitda margins

Source: S&P Global

Transformation plan

In response to activist investor Elliott Investment Management’s recommendations in May 2023, Goodyear unveiled its Goodyear Forward transformation plan, aimed at unlocking value and realizing its full potential. This comprehensive plan includes the following strategic initiatives:

-

Planned divestments of its chemical business, the Dunlop brand and the off-the-road equipment tire business (from which the company expects to generate around $2 billion)

-

Segment operating margin expansion from around 5% in 2023 to 10% by the end of 2025 through its restructuring cost savings (expected to reach annual run-rate cost savings of $1 billion from the estimated spend of $1.10 billion on restructuring from 2024-25)

-

Utilize proceeds from its asset divestments to decrease debt by $1.50 billion and reduce leverage with the combination of margin expansion from cost savings and debt reduction.

Goodyear’s transformation plan represents a more aggressive approach compared to its historical efforts (spent around $1.20 billion between 2015 and 2023 on restructuring versus projected spend of $1.10 billion through 2024-25), underscoring Goodyear’s determination to narrow the profitability gap with its peers.

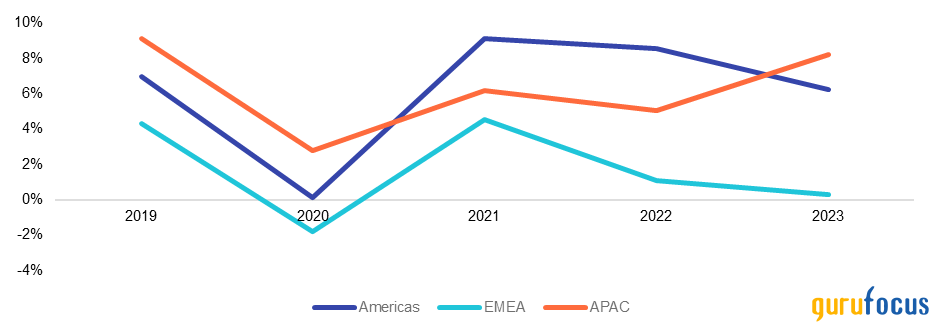

Further, the company’s historical restructuring efforts have been mainly concentrated in Europe. Despite Goodyear’s historical efforts, challenges have continued to persist in its European business, where margins lag significantly behind that of its other geographical segments. Since previous attempts to turn around the European business have been unsuccessful, there are doubts about the company’s ability to fully realize its cost-saving targets, but I believe the assertive measures taken by Goodyear are encouraging signs as it strives to bridge the profitability disparity.

Figure 3: Geographical segment operating margins (margin weaknesses in the European business)

Source: Goodyear Investor Relations

The company is expected to complete the planned divestments within the next six to nine months, and I expect these transactions to be relatively straightforward. However, the revenue effect of divesting these three business units, which collectively contribute about 12% of revenue, may result in some revenue contractions over the next few years. Nevertheless, Goodyear appears willing to accept this trade-off to enhance its cost structure and streamline its operations.

Following the announcement of the transformation plan, there have been notable improvements in governance. Richard Kramer’s retirement in January (after serving the company for 24 years [14 years as Chairman and CEO]) and the appointment of Mark Stewart as CEO signal a significant change of pace, particularly given Stewart’s background in leading the Stellantis (NYSE:STLA) EV transformation in North America, positioning him well to spearhead Goodyear’s transformation efforts.

Furthermore, Goodyear has restructured its board, separating the CEO and Chairman positions and appointing three directors, mutually agreed upon by both the company and Elliott Investment Management, to the board. With Elliott Investment Management holding a significant stake in the company (approximately 10%), their support for the transformation plan may have meaningful positive impacts on Goodyear’s future trajectory, given they were the driving force behind the establishment of a clear-cut transformation plan to begin with.

Valuation

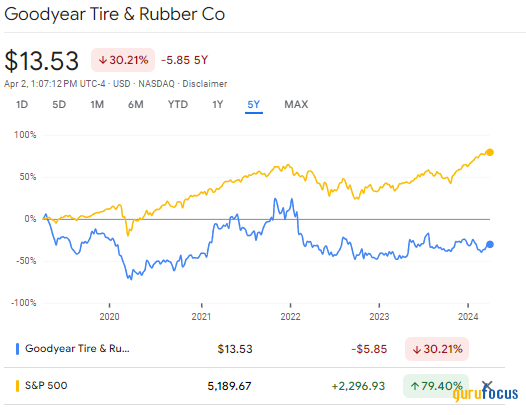

Figure 4: Goodyear vs. S&P 500 (last five years)

Source: Google Finance

When looking at Goodyear’s historical performance, the stock has declined by approximately 30% over the past five years, contrasting sharply with the S&P 500’s robust return of nearly 70%. This downturn primarily mirrors the broader challenges the automotive industry has encountered since the onset of the Covid-19 pandemic. However, the stock has also underperformed compared to its industry peers.

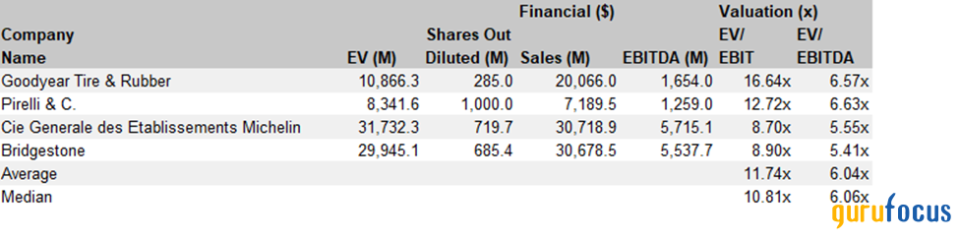

Figure 5: Peer comparable analysis

Source: Factset

The stock is also currently trading at an enterprise value/Ebitda multiple of 6.60, which is broadly in line with its peer group (peer average of 6 [Source: Factset]). In my view, as the company reduces its leverage and enhances margins and cash flow under its Goodyear Forward plan, its shares should trade at a higher valuation, possibly reaching a multiple closer to a 7.50 times EV/Ebitda (at least 25% to 30% higher than what it trades for today). However, it is essential to acknowledge the uncertainty surrounding the achievement of these objectives, which could impact how the market values the stock. In the coming quarters, we may get more clarity on the company’s progress and its trajectory moving forward.

Recommendation

While there are mixed feelings regarding the transformation plan, the path forward for Goodyear largely hinges on its success. Although I do not expect full cost savings to materialize by the end of 2025, I expect the company to make significant progress from its current position, albeit with some revenue contraction due to divestments. Given these factors, I recommend a hold on the stock, with the potential for it to transition to a buy position pending further clarity on the progress of the transformation plan in the coming months.

This article first appeared on GuruFocus.