Tesla TSLA is set to post first-quarter 2024 results on Apr 23, after the closing bell. The Zacks Consensus Estimate for the to-be-reported quarter’s earnings and revenues is pegged at 47 cents per share and $22.7 billion, respectively.

The consensus mark for first-quarter earnings per share has declined 6 cents in the past seven days. The estimate for the bottom line also implies a year-over-year decline of 44.7%. The Zacks Consensus Estimate for quarterly revenues suggests a year-over-year contraction of 2.6%.

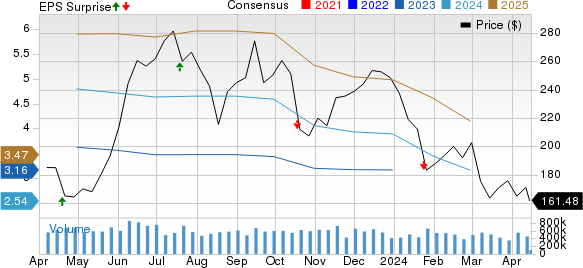

Tesla’s 10-quarter winning streak snapped in the third quarter of 2023. Earnings missed estimates in the fourth quarter of 2023 as well and might miss again in the upcoming results.

Tesla delivered a trailing four-quarter negative earnings surprise of 0.40%, on average.

Tesla, Inc. Price, Consensus and EPS Surprise

Tesla, Inc. price-consensus-eps-surprise-chart | Tesla, Inc. Quote

Factors at Play

Tesla delivered 386,810 cars (369,783 Model 3 and Y, and 17,027 Model S and X) worldwide in the first quarter, down 8.5% year over year and below the estimate of 457,000 as compiled by FactSet. This marked the first year-over-year drop in quarterly deliveries since 2020.

The decline was due to “the early phase of the production ramp-up” of its updated Model 3 at its Fremont factory and plant shutdowns resulting from shipping diversions caused by the Red Sea conflict and an arson attack at Gigafactory Berlin, which led to a weeklong production halt in its Germany factory.

Discounts and incentives seem to have a limited impact on boosting sales but might have constrained gross margins.

While Tesla does not give a sales breakup by geographical region, the pressure was especially high in China. Tesla faced intense competition in China from local EV makers like BYD Co. and new entrants such as Xiaomi. After slow sales in January and February, Tesla cut Model 3 and Model Y production at its Shanghai plant and reduced workers’ schedules to five days a week. Tesla’s share in China’s EV and hybrid market segment slid in the first two months of the year.

While automotive revenues and profits are expected to contract on a yearly basis in the quarter to be reported, Tesla has been benefiting from increasing energy generation and storage revenues, thanks to the positive reception of Megapack and Powerwall products.

Our estimate for Services/Other unit is pegged at $2.27 billion, implying growth of 23.8% year over year. We expect revenues from the Energy Generation/Storage segment to be $1.84 billion, suggesting growth of 20.5% on a yearly basis.

Meanwhile, continued investments for capacity expansion of not just vehicle factories but also supercharging network service, internal applications and battery processes are expected to have limited operating profits. Tesla’s capital expenditure has been consistently rising as the EV giant makes efforts to boost output capacity at its gigafactories, ramp up 4680 battery cell production, enhance the Supercharger infrastructure and develop AI-related technologies such as full self-driving Optimus and Dojo. High capex might have dented free cash flow levels.

What Does Our Model Say?

Our proven model doesn’t conclusively predict an earnings beat for Tesla this earnings season. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. That is not the case here.

Earnings ESP: Tesla has an Earnings ESP of -6.73%. This is because the Most Accurate Estimate is pegged 3 cents below the Zacks Consensus Estimate. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Tesla currently carries a Zacks Rank #5 (Strong Sell).

Stock With the Favorable Combination

While an earnings beat looks uncertain for Tesla, here are a few players from the auto space that, per our model, have the correct ingredients to post an earnings beat this time.

General Motors GM will release first-quarter 2024 results on Apr 23. The company has an Earnings ESP of +4.37% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for GM’s to-be-reported quarter’s earnings and revenues is pegged at $2.06 per share and $40.61 billion, respectively. General Motors surpassed earnings estimates in each of the trailing four quarters, the average surprise being 19.95%.

BorgWarner BWA will release first-quarter 2024 results on May 2. The company has an Earnings ESP of +0.87% and a Zacks Rank #3.

The Zacks Consensus Estimate for BWA’s to-be-reported quarter’s earnings and revenues is pegged at 88 cents per share and $3.54 billion, respectively. BorgWarner surpassed earnings estimates in two of the trailing four quarters and missed twice, the average surprise being 4.84%.

American Axle AXL will release first-quarter 2024 results on May 3. The company has an Earnings ESP of +674.43% and a Zacks Rank #3.

The Zacks Consensus Estimate for AXL’s to-be-reported quarter’s earnings and revenues is pegged at 1 cent per share and $1.52 billion, respectively. American Axle surpassed earnings estimates in three of the trailing four quarters and missed once, the average surprise being 0.52%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BorgWarner Inc. (BWA) : Free Stock Analysis Report

American Axle & Manufacturing Holdings, Inc. (AXL) : Free Stock Analysis Report

General Motors Company (GM) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report