Wall Street witnessed an impressive bull run in the past 15 months. The rally was primarily led by growth stocks, especially, technology stocks. Consequently, the tech-heavy Nasdaq Composite Index took the lead role in enabling U.S. stock markets to resume their northward journey after a highly disappointing 2022.

Moreover, the ongoing tech rally was led by a massive thrust toward artificial intelligence (AI), especially generative AI. The rapid penetration of digital technologies and the Internet worldwide during the lockdown ushered in significant adoption of AI.

Aside from technology stocks, several stocks from non-technology sectors have also flourished year to date. Moreover, companies that have extensive applications of AI in their final products have become multi-baggers in the past 15 months.

As a result, their current overstretched valuation makes them less attractive to investors. Market participants are shifting more toward cyclical sectors. This trend is likely to gather pace in the second quarter of 2024.

Our Top Picks

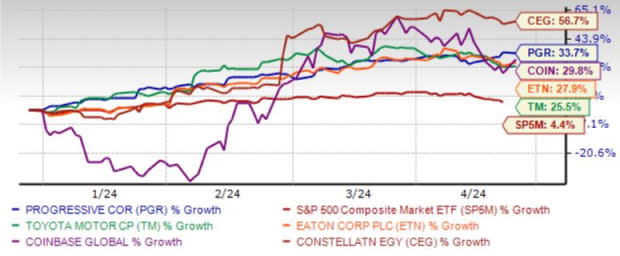

We have narrowed our search to five non-technology giants (market capital > $50 billion) as these companies have a robust business model, a solid financial position and globally acclaimed brand value. These stocks have returned more than 25% year to date with upside left for 2024.

Further, these stocks have seen positive earnings estimate revisions in the last 60 days. Finally, each of our picks carries either a Zacks Rank #1 (Strong Buy) or 2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The chart below shows the price performance of our five picks year to date.

Image Source: Zacks Investment Research

The Progressive Corp. PGR continues to gain on higher premiums, given its compelling product portfolio, leadership position and strength in both Vehicle and Property businesses. Focus on becoming a one-stop insurance destination, catering to customers opting for a combination of home and auto insurance, augurs well for PGR’s growth.

Policies in force and retention ratio should remain healthy. Competitive pricing to retain current customers and address customer needs with new offerings should continue to drive policy life expectancy.

Zacks Rank #1 The Progressive has an expected revenue and earnings growth rate of 17.8% and 83.6%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 4.5% over the last seven days. The stock price of PGR has jumped 34.7% year to date.

Coinbase Global Inc. COIN provides financial infrastructure and technology for the crypto economy in the United States and internationally. COIN offers the primary financial account in the crypto space for consumers, a marketplace with a pool of liquidity for transacting in crypto assets for institutions; and technology and services that enable developers to build crypto-based applications and securely accept crypto assets as payment.

Zacks Rank #1 Coinbase Global has an expected revenue and earnings growth rate of 45.7% and more than 100%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 45.2% over the last 30 days. The stock price of COIN has climbed 29.9% year to date.

Toyota Motor Corp. TM put up a stellar show in the fiscal third quarter of 2024. A robust lineup of trucks and sport utility vehicles is set to fuel TM’s sales volumes. Its electric vehicle (EV) push is a major tailwind. TM aims to generate 40% of its global sales from EVs by 2025 and 70% by 2030. It aims to expand global sales of EVs to 1.5 million units in 2026.

Upbeat projections for profit and revenues for fiscal 2024 spark optimism. Revenues and operating income for the current fiscal are projected at ¥43.5 trillion and ¥4.9 trillion, indicating a year-over-year surge of 18% and 79.8%, respectively. TM’s commitment to maximizing shareholders’ value via dividends and buybacks is also praiseworthy.

Zacks Rank #1 Toyota Motor has an expected revenue and earnings growth rate of 3.1% and 0.5%, respectively, for the current year (ending March 2025). The Zacks Consensus Estimate for current-year earnings has improved 4.6% over the last 60 days. The stock price of TM has appreciated 25.5% year to date.

Eaton Corp. plc’s ETN ongoing research and development are allowing it to develop new products for providing efficient power management solutions. ETN will benefit from improving end-market conditions, increasing demand from the new AI data center and contributions from its organic assets.

ETN is expanding via acquisitions and its rising backlog shows demand for its products. ETN’s strategy to manufacture in the zone of sale has helped it cut costs. Our model projects total revenues to improve in the 2024 to 2026 time period.

Zacks Rank #2 Eaton has an expected revenue and earnings growth rate of 7.6% and 12.7%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.5% over the last 60 days. The stock price of ETN has surged 27.9% year to date.

Constellation Energy Corp. CEG generates and markets electricity. CEG’s operating segment consists of the Mid-Atlantic, Midwest, New York, ERCOT and Other Power Regions. CEG sells natural gas, renewable energy and other energy-related products and services. CEG serves distribution utilities, municipalities, cooperatives, and commercial, industrial, governmental, and residential customers.

Zacks Rank #2 Constellation Energy has an expected revenue and earnings growth rate of 1.4% and 47.9%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 3.6% over the last 30 days. The stock price of CEG has soared 56.7% year to date.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Toyota Motor Corporation (TM) : Free Stock Analysis Report

Constellation Energy Corporation (CEG) : Free Stock Analysis Report

Eaton Corporation, PLC (ETN) : Free Stock Analysis Report

The Progressive Corporation (PGR) : Free Stock Analysis Report

Coinbase Global, Inc. (COIN) : Free Stock Analysis Report