- British CV production records best Q1 since 2008, rising by 27.4% to 32,626 units.

- Export volumes grow 57.9% in first three months, while manufacturing for the UK declines -13.1%.

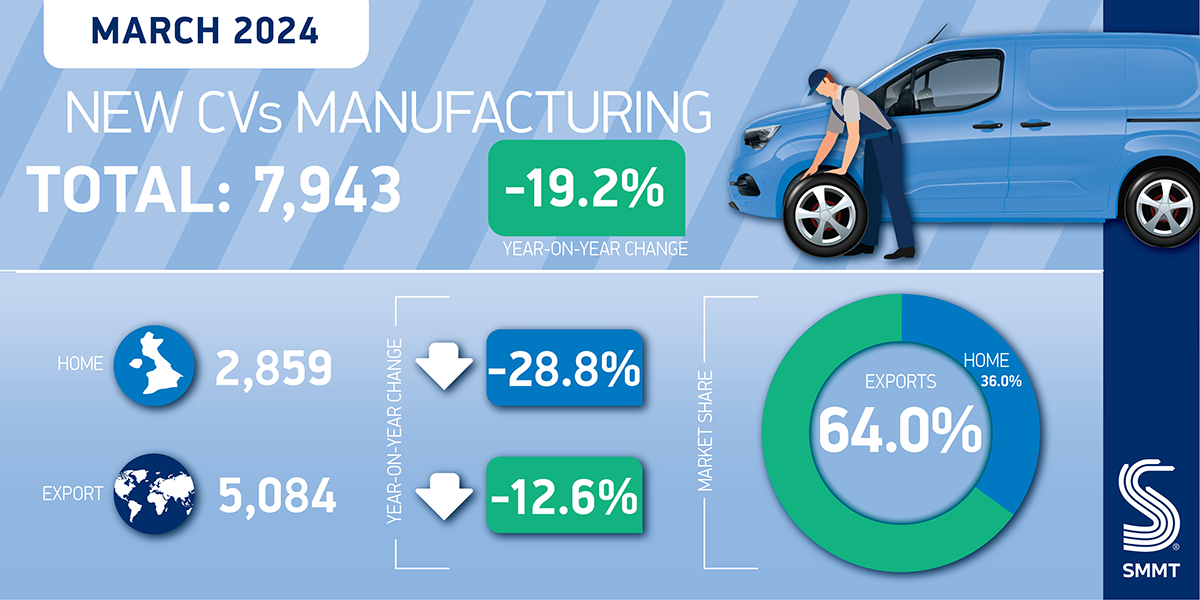

- Growth in January and February followed by -19.2% March decline to 7,943 units.

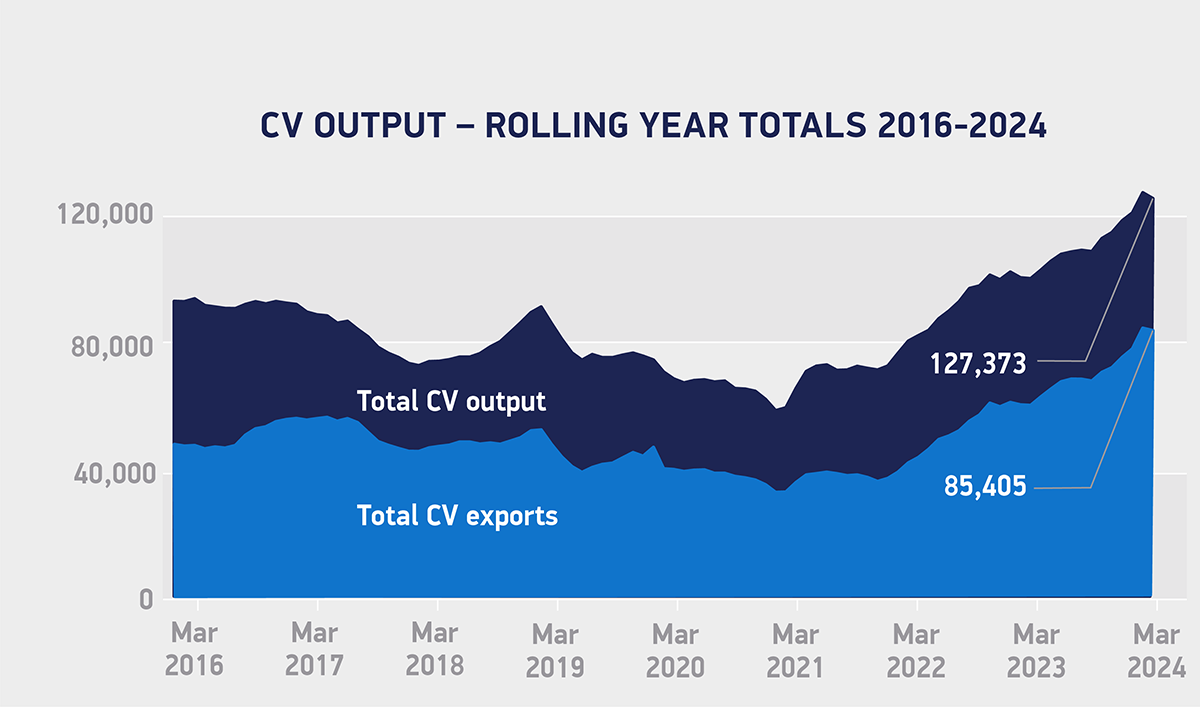

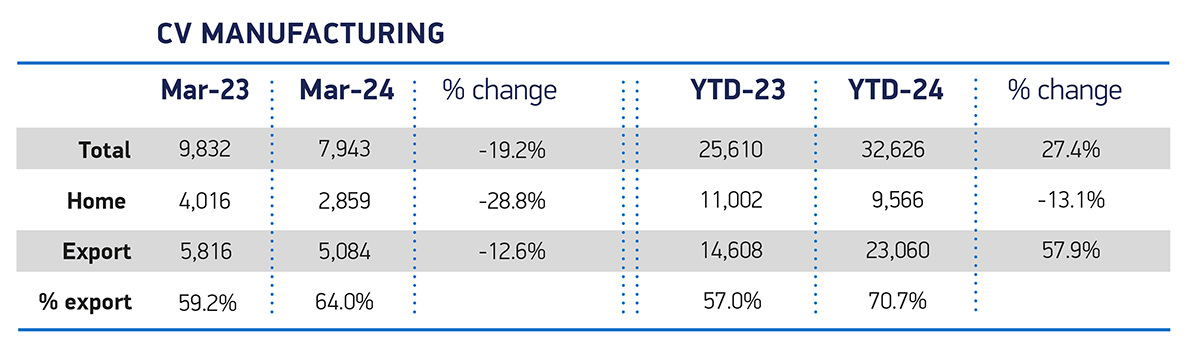

UK commercial vehicle (CV) output rose by 27.4% in the first quarter of 2024, the best Q1 performance since 2008, according to figures published today by the Society of Motor Manufacturers and Traders (SMMT).1 32,626 vans, trucks, taxis, buses and coaches left factory lines, up 18.6% on pre-pandemic 2019 volumes, with demand driven by overseas orders.2

Exports rose 57.9% to 23,060 units in the first quarter ¬– an increase of 8,452 vehicles to account for 70.7% of year to date output, up from 57.0% in Q1 2023 – thanks to demand for the latest cutting edge and increasingly zero emission British-built CVs. The EU remained the top export destination, with more than nine in 10 vehicles (96.7%) heading for the bloc. Production for the UK market, meanwhile, declined -13.1% to 9,566 units.

Growth in January and February, however, was followed by a -19.2% decline in March output to 7,943 units – the first monthly fall since September 2023. Exports declined by -12.6% to 5,084 units against the same month last year, with 732 fewer units made, while production for the UK fell -28.8% to 2,859 units. The performance reflects market normalisation as manufacturers have worked hard to meet strong pent up pandemic-related demand, as well as some temporary supply chain shortages and the early Easter bank holiday reducing working days in the month compared with 2023. Growth is still expected this year, with the latest independent outlook expecting light van production volumes to hit over 135,000 units – a result of electric vehicle output ramping up.3

Mike Hawes, SMMT Chief Executive, said,

It’s good to see UK CV production record its best Q1 performance in some 16 years, success testament to the determination of manufacturers to deliver for this vital sector, while investing in the latest cutting edge, ultra low and zero emission technology. Global demand continues for British-built commercial vehicles, emphasising the need for favourable market conditions to sustain our production capabilities for increasingly green vehicles. This means reducing energy costs, upskilling our workforce and maintaining free and fair trade deals, the result of which will allow us to attract further investment to improve productivity and decarbonise automotive manufacturing and its supply chain.

Notes to editors

1: Jan-March performance, 2008: 60,294 units

2: Jan-March performance 2019: 27,513 units

3: Based on AutoAnalysis independent outlook, March 2024