-

Revenue: Reported $2,615 million, marking a 5% increase year-over-year, surpassing the estimated $2,590.11 million.

-

Earnings Per Share (EPS): Achieved $1.52, representing a 77% increase from the previous year, exceeding the estimate of $1.41.

-

Adjusted EPS: Reached $1.58, up 76% year-over-year, also surpassing the estimated $1.41.

-

Operating Margin: Improved to 7.4% from 5.1% a year earlier, showing strong profitability gains.

-

Adjusted Operating Margin: Increased to 7.6%, up from 5.3% in the previous year.

-

Operating Cash Flow: Improved significantly to $122 million, recovering from a negative $46 million in the prior year.

-

Return on Capital Employed: Enhanced to 19.7% from 13.0% year-over-year, indicating efficient use of capital.

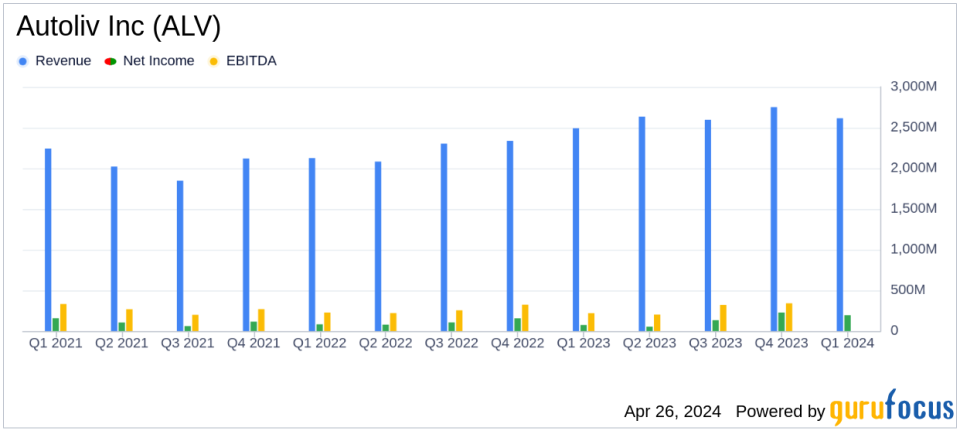

Autoliv Inc (NYSE:ALV), a global leader in automotive safety systems, released its 8-K filing on April 26, 2024, revealing significant growth in its financial performance for the first quarter of 2024. The company reported earnings per share (EPS) of $1.52, surpassing the estimated $1.41, and adjusted EPS of $1.58. Net sales reached $2,615 million, exceeding the forecast of $2,590.11 million, marking a 5% increase from the previous year.

Autoliv, renowned for its comprehensive range of automotive safety products including seat belts, air bags, and steering wheels, continues to lead the market with significant contributions from its largest customers: the Renault-Nissan-Mitsubishi alliance, Stellantis, and Volkswagen. Geographically, the Americas remain its largest market, followed by Europe and China.

Financial and Operational Highlights

The company’s robust performance in Q1 2024 is attributed to a combination of organic sales growth, strategic cost reductions, and successful new product launches. Autoliv’s operating income surged by 52% to $194 million, with an operating margin of 7.4%, and an adjusted operating margin of 7.6%. This improvement reflects a strategic shift towards higher-margin products and efficiency gains across operations.

President and CEO Mikael Bratt highlighted the company’s success in outperforming global light vehicle production, which slightly declined by 1% according to S&P Global. Bratt emphasized the significant organic growth in sales, particularly noting a 27% increase in India, which now accounts for more than 4% of global sales.

Challenges and Market Conditions

Despite the positive outcomes, Autoliv faces ongoing challenges including inflationary pressures, particularly from labor costs in Europe and the Americas, and volatility in customer call-offs. The company has managed these challenges by implementing price adjustments and maintaining rigorous cost control measures.

Financial Statements Analysis

The balance sheet remains solid with a leverage ratio of 1.3x, demonstrating prudent financial management and commitment to maintaining a strong credit profile. Cash flow from operations showed a remarkable improvement, turning a previous negative $46 million into a positive $122 million, which underscores the company’s focus on cash conversion and balance sheet efficiency.

Outlook and Strategic Moves

Looking forward, Autoliv has set a full-year guidance anticipating around 5% organic sales growth and an adjusted operating margin of about 10.5%. The company plans to continue its focus on innovation, with a record number of product launches expected in 2024, particularly in electric vehicle platforms.

Autoliv’s strategic investments in capacity expansion in key growth markets like Vietnam, China, and India are set to bolster its market position and support sustained growth. These initiatives, coupled with ongoing structural and strategic cost reduction efforts, are expected to drive profitability and shareholder returns moving forward.

Conclusion

Autoliv Inc (NYSE:ALV) has demonstrated a strong start to 2024, with financial metrics not only exceeding analyst expectations but also setting a robust foundation for continued growth. The company’s strategic initiatives and operational adjustments are pivotal in navigating market challenges and positioning Autoliv as a leader in the automotive safety industry.

For detailed financial figures and future projections, stakeholders and interested parties are encouraged to view the full 8-K filing.

Explore the complete 8-K earnings release (here) from Autoliv Inc for further details.

This article first appeared on GuruFocus.