Amid a backdrop of fluctuating global markets, Hong Kong’s Hang Seng Index recently showcased a robust surge, climbing 8.8% as investor optimism grows around the region’s economic prospects. In such an environment, companies with high insider ownership can be particularly appealing, as they often signal strong confidence from those closest to the business in its growth potential and governance.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

|

Name |

Insider Ownership |

Growth Rating |

|

New Horizon Health (SEHK:6606) |

16.6% |

★★★★★★ |

|

iDreamSky Technology Holdings (SEHK:1119) |

20.1% |

★★★★★★ |

|

Fenbi (SEHK:2469) |

32.2% |

★★★★★☆ |

|

Meitu (SEHK:1357) |

38% |

★★★★★☆ |

|

Adicon Holdings (SEHK:9860) |

22.3% |

★★★★★☆ |

|

Zhejiang Leapmotor Technology (SEHK:9863) |

14.2% |

★★★★★☆ |

|

Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) |

15.7% |

★★★★★☆ |

|

Tian Tu Capital (SEHK:1973) |

34% |

★★★★★☆ |

|

Beijing Airdoc Technology (SEHK:2251) |

25.1% |

★★★★★☆ |

|

Ocumension Therapeutics (SEHK:1477) |

17.7% |

★★★★★☆ |

Here’s a peek at a few of the choices from the screener.

Simply Wall St Growth Rating: ★★★★★☆

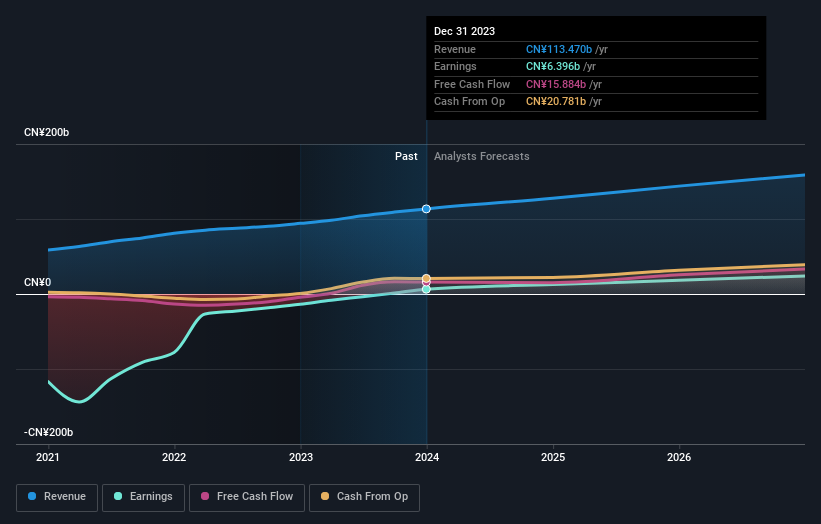

Overview: Kuaishou Technology operates as an investment holding company in the People’s Republic of China, offering services such as live streaming and online marketing, with a market capitalization of approximately HK$245.82 billion.

Operations: The company generates revenue primarily through domestic operations totaling CN¥111.19 billion and a smaller segment from overseas activities, amounting to CN¥2.28 billion.

Insider Ownership: 19.3%

Revenue Growth Forecast: 10% p.a.

Kuaishou Technology has recently transitioned to profitability, with a significant increase in net income from a loss last year, as evidenced by its latest annual earnings report. The company’s revenue and earnings are expected to grow at 10% and 29.64% per year respectively, outpacing the Hong Kong market averages. Analysts predict a potential price increase of 36.1%, noting the stock is trading well below its estimated fair value. This growth trajectory is supported by strong insider ownership, aligning interests with shareholders, though no recent insider transactions were reported.

Simply Wall St Growth Rating: ★★★★☆☆

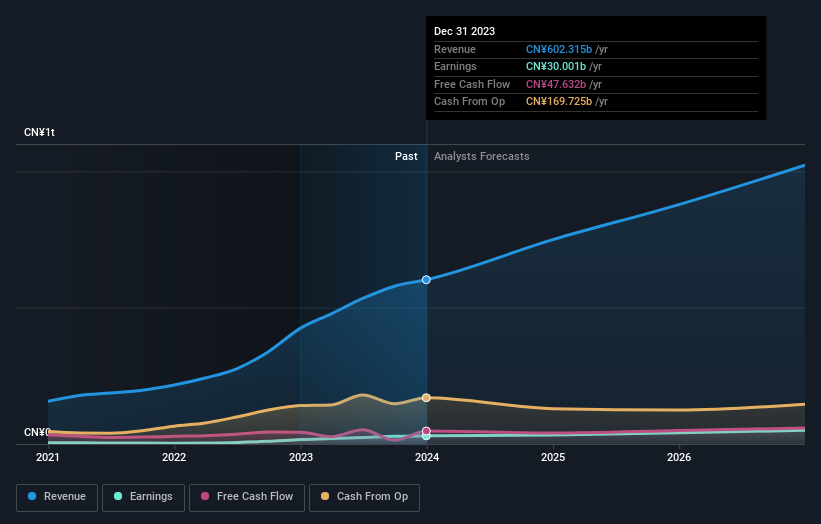

Overview: BYD Company Limited operates in the automobile and battery sectors across China, including Hong Kong, Macau, Taiwan, and other international markets, with a market capitalization of approximately HK$669.47 billion.

Operations: BYD’s revenue is primarily derived from its automobiles and related products segment, generating CN¥489.23 billion, and its mobile handset components and assembly services, contributing CN¥131.43 billion.

Insider Ownership: 30.1%

Revenue Growth Forecast: 13.8% p.a.

BYD Company Limited, a frontrunner in new energy vehicles (NEVs) and battery production, reported a solid increase in Q1 2024 sales to CNY 124.94 billion and net income of CNY 4.57 billion. The company is enhancing its manufacturing efficiency through strategic alliances and technological integrations, such as the recent partnership with ForwardX Robotics for advanced automation in battery production lines. This move not only boosts productivity but also aligns with BYD’s commitment to sustainable practices. Despite high growth prospects, revenue growth forecasts are slightly below the high-growth benchmark for the sector.

Simply Wall St Growth Rating: ★★★★★☆

Overview: Meituan is a technology-driven retail company operating both in China and internationally, with a market capitalization of approximately HK$691.01 billion.

Operations: The company generates revenue primarily through two segments: Core Local Commerce at CN¥206.91 billion and New Initiatives at CN¥69.84 billion.

Insider Ownership: 12.1%

Revenue Growth Forecast: 12.8% p.a.

Meituan, a prominent player in Hong Kong’s tech sector, demonstrated a robust financial turnaround with its 2023 earnings, posting sales of CNY 276.74 billion and transitioning from a net loss to a profit of CNY 13.86 billion. This growth is supported by earnings projected to increase by 38% annually, outpacing the Hong Kong market’s average. Despite this positive trajectory, the company’s revenue growth rate of 12.8% yearly falls short of the high-growth benchmark and recent governance adjustments aim to align corporate practices with new regulatory standards.

Key Takeaways

Contemplating Other Strategies?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities.

Companies discussed in this article include SEHK:1024SEHK:1211SEHK:3690 and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com