-

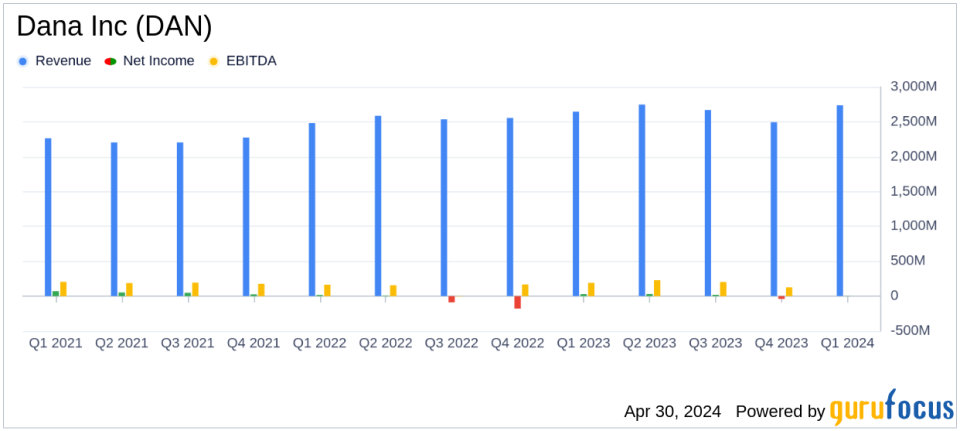

Revenue: Reached $2.74 billion, up from $2.64 billion year-over-year, exceeding estimates of $2.69 billion.

-

Net Income: Reported at $3 million, significantly below the previous year’s $28 million and fell short of estimates of $18.97 million.

-

Earnings Per Share (EPS): Came in at $0.02, well below the prior year’s $0.19 and the estimated $0.19.

-

Adjusted EBITDA: Increased to $223 million from $204 million in the same quarter last year.

-

Free Cash Flow: Improved significantly, with a use of $172 million compared to a use of $290 million in the prior year.

-

Operating Cash Flow: Showed improvement, using $102 million compared to $170 million in the previous year.

-

Full-Year Free Cash Flow Guidance: Raised, reflecting better management of working capital and operational efficiencies.

Dana Inc (NYSE:DAN) disclosed its first-quarter financial results for 2024 on April 30, 2024, through its 8-K filing. The company, a leader in designing and manufacturing propulsion and energy-management solutions, reported a notable increase in sales and adjusted EBITDA, alongside a significant improvement in free cash flow. However, net income per share fell short of analyst expectations, primarily due to a one-time loss from the divestiture of a non-core business.

Financial Highlights and Analyst Expectations

Dana Inc reported first-quarter sales of $2.74 billion, up from $2.64 billion in the previous year, slightly surpassing the estimated revenue of $2.69 billion. Adjusted EBITDA also increased to $223 million from $204 million year-over-year. However, the company reported a net income of $3 million, or $0.02 per share, significantly lower than the expected $0.19 per share and down from $28 million, or $0.19 per share, in the first quarter of 2023.

The decrease in EPS was largely due to a $29 million loss related to the sale of its European Off-Highway non-core hydraulics business, impacting earnings by $0.25 per share. Despite this, Dana saw improvements in operating cash flow, which was a use of $102 million compared to a use of $170 million in the same period last year, and free cash flow improved by $118 million.

Operational and Segment Performance

Dana Inc’s performance was bolstered by company-wide efficiency improvements and stable demand in key markets. The Light Vehicle segment led with sales of $1.098 billion, up from $962 million in the prior year. The Off-Highway and Power Technologies segments also showed robust performance contributing to the overall growth.

The company’s focus on operational excellence and customer satisfaction has enabled it to maintain a competitive edge and drive market share gains across its diverse portfolio, which spans traditional ICE, hybrid, and EV programs.

Strategic Moves and Market Positioning

Dana’s strategic divestitures and ongoing investment in electric vehicle (EV) product development highlight its commitment to aligning with industry shifts towards sustainable and innovative mobility solutions. Despite the short-term financial impacts, these moves position Dana well for future growth and market leadership.

Outlook and Guidance

Looking ahead, Dana Inc has raised its full-year guidance for free cash flow, reflecting confidence in its operational strategies and market position. The company continues to navigate market challenges adeptly, leveraging its technological leadership to drive long-term shareholder value.

Dana’s robust portfolio and strategic initiatives, particularly in electrification and sustainable technologies, underscore its potential for sustained growth in a rapidly evolving automotive industry.

For detailed insights and ongoing updates, investors and stakeholders are encouraged to follow Dana Inc’s developments closely as it continues to innovate and expand its market presence.

Explore the complete 8-K earnings release (here) from Dana Inc for further details.

This article first appeared on GuruFocus.