-

Earnings Per Share (EPS): Reported at $2.04, up 28% from Q1 2023, falling short of the estimated $2.29.

-

Adjusted EPS: Achieved $2.40, marking a 28% increase year-over-year and aligning closely with the estimate of $2.40.

-

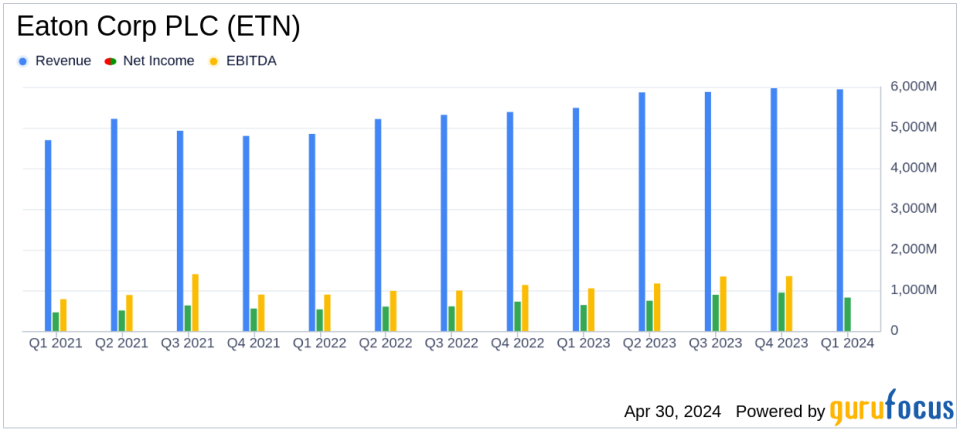

Revenue: Reached $5.943 billion, an 8% increase from the previous year, surpassing the estimated $5.905 billion.

-

Net Income: Posted at $821 million, up from $638 million in Q1 2023, exceeding the estimated $904.95 million.

-

Segment Margins: Improved to 23.1%, a significant increase of 340 basis points from Q1 2023.

-

Free Cash Flow: Increased by 40% to $292 million, reflecting strong operational efficiency.

-

Full-Year Guidance: Raised for organic sales growth, segment margins, and EPS, indicating positive outlook for 2024.

Eaton Corp PLC (NYSE:ETN) released its 8-K filing on April 30, 2024, revealing a robust start to the year with record-breaking first quarter results. The company reported earnings per share (EPS) of $2.04 and adjusted EPS of $2.40, both marking a significant 28% increase from the previous year and surpassing the analyst’s estimated EPS of $2.29. With a net income of $821 million, Eaton also exceeded the expected $904.95 million, showcasing a strong financial performance.

Company Overview

Eaton, a global power management company, has been operational for over a century. Based in Ireland for favorable tax treatment, the majority of its operations are in the U.S. Eaton operates through various segments including Electrical Americas, Electrical Global, Aerospace, Vehicle, and eMobility, serving a diverse range of markets from data centers and utilities to residential and commercial vehicles.

Financial Highlights and Segment Performance

The company’s revenue reached a first quarter record of $5.9 billion, an 8% increase driven by organic sales growth, aligning closely with the estimated revenue of $5905.44 million. The segment margins impressively grew to 23.1%, a 340-basis point improvement compared to the first quarter of 2023. This margin expansion underscores Eaton’s efficient operations and strong market positioning.

The Electrical Americas and Aerospace segments notably demonstrated robust performance with significant increases in both sales and operating profits. The Electrical Americas segment saw a 17% rise in sales to $2.7 billion, while the Aerospace segment’s sales grew by 9% to $871 million. Both segments achieved record operating profits and margins, highlighting Eaton’s strong execution and favorable market conditions.

Challenges and Strategic Initiatives

Despite the positive outcomes, Eaton faces challenges such as potential supply chain disruptions and competitive market pressures. However, the company is strategically positioned to navigate these challenges, evidenced by its proactive management strategies including a new multi-year restructuring program aimed at optimizing operations.

Future Outlook and Investor Insights

Looking ahead, Eaton has raised its full-year 2024 guidance, reflecting confidence in sustained growth. The company now expects organic sales growth between 7-9% and has increased its EPS forecast to $8.95-$9.35. Adjusted EPS is also projected to rise, with new estimates ranging from $10.20 to $10.60.

This optimistic outlook, combined with strong first quarter results, positions Eaton as a compelling entity within the industrial products sector. Investors and stakeholders may find Eaton’s strategic initiatives and robust financial health indicative of potential long-term value, making it a noteworthy consideration for portfolios focused on industrial and technological growth.

Conclusion

Eaton’s record-setting start to 2024, characterized by substantial growth in earnings, robust segment performance, and upwardly revised financial projections, sets a positive tone for the year. With strategic plans well-aligned to capitalize on global industrial and technological trends, Eaton continues to demonstrate its resilience and capacity for sustained growth.

For detailed financial figures and further information, please refer to Eaton’s full earnings release available on their website.

Explore the complete 8-K earnings release (here) from Eaton Corp PLC for further details.

This article first appeared on GuruFocus.