-

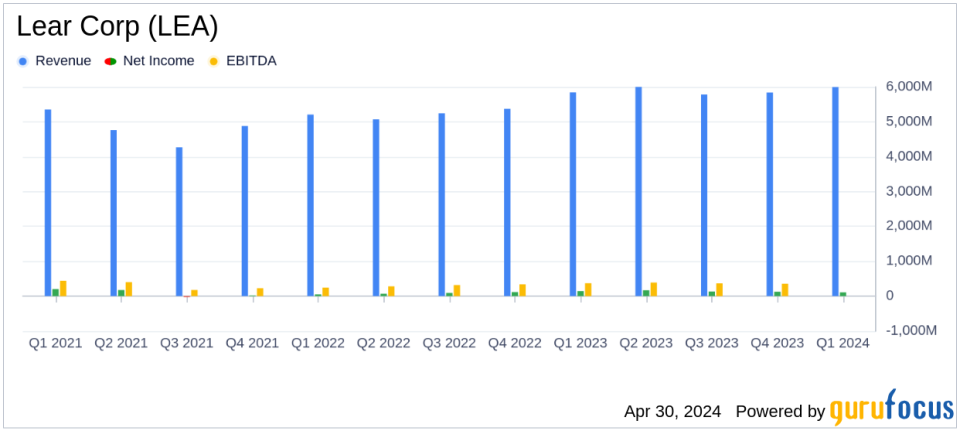

Reported Revenue: $6.0 billion, a 3% increase from $5.8 billion in Q1 2023, meeting the estimate of $6005.84 million.

-

Net Income: Reported at $110 million, down from $144 million in the previous year, falling short of the estimated $176.89 million.

-

Earnings Per Share (EPS): Reported at $1.90, decreased from $2.41 year-over-year, below the estimated $3.02.

-

Adjusted Earnings Per Share: $3.18, a 14% increase from $2.78 in Q1 2023, exceeding the estimate of $3.02.

-

Free Cash Flow: Negative $148 million, compared to negative $147 million in the previous year.

-

Core Operating Earnings: Increased to $280 million from $263 million in Q1 2023, indicating a margin improvement.

-

Global Vehicle Production: Declined by 1% overall, with regional variations showing North America up by 1%, Europe down by 2%, and China up by 5%.

Lear Corporation (NYSE:LEA), a leader in automotive seating and electrical systems, disclosed its first quarter results for 2024 on April 30, 2024, revealing a mixed financial performance. The company announced these results in its 8-K filing. Despite surpassing revenue expectations with a record first quarter revenue of $6.0 billion, Lear’s earnings per share (EPS) of $1.90 fell short of analyst estimates of $3.02. Adjusted EPS, however, stood at $3.18, slightly above the forecast.

Lear Corp specializes in the design, development, and manufacturing of automotive seating and electrical systems. Their products range from seat frames and mechanisms to high-voltage power distribution systems and software for automated driving. Lear’s primary market is North America, which constitutes 44% of its revenue, with General Motors being its largest customer.

Financial Performance Overview

The company’s revenue of $6.0 billion represents a 3% increase year-over-year, driven by a 10 percentage point growth in E-Systems over the market. This growth comes despite a 1% decline in global vehicle production, showcasing Lear’s ability to outperform market trends. However, net income decreased to $110 million from $144 million in the same quarter last year, impacted by various restructuring charges and other special items totaling $74 million.

Operational Highlights and Strategic Moves

Lear reported its seventh consecutive quarter of margin improvement in its E-Systems segment and highlighted several strategic initiatives, including the acquisition of WIP Industrial Automation and the launch of IDEA by Lear to enhance product innovation and operational excellence. The company also secured its first JIT seat program with FAW Toyota in China and was recognized as a GM Supplier of the Year for the seventh consecutive year.

Challenges and Forward-Looking Statements

Despite the positive revenue growth, Lear faces challenges, including a lower production environment in Europe, which has necessitated restructuring actions including future plant closures. The company’s free cash flow was also negative at $(148) million, slightly worse than the previous year, reflecting ongoing capital expenditures and operational challenges.

Financial Health and Future Outlook

Lear ended the quarter with $930 million in cash and cash equivalents and maintained strong liquidity of $2.9 billion. For the full year 2024, Lear expects net sales between $24,000 million and $24,600 million, with core operating earnings projected between $1,155 million and $1,305 million. This outlook assumes a stable exchange rate and does not account for potential disruptions that could impact financial performance.

The company’s ability to navigate through market fluctuations, combined with strategic acquisitions and innovation, positions it to potentially enhance shareholder value over the long term. However, investors should consider the ongoing challenges and the impact of external economic factors on Lear’s future performance.

For more detailed information and to access the complete filing, please visit the SEC’s official website or Lear Corp’s investor relations page.

Explore the complete 8-K earnings release (here) from Lear Corp for further details.

This article first appeared on GuruFocus.