-

Reported Net Sales: $3,750 million for the quarter, down from $3,912 million in the same period last year.

-

Net Income: Reported a net loss of $70 million, compared to a net loss of $15 million in the previous year, significantly below the estimated net income of $44.15 million.

-

Earnings Per Share (EPS): Reported a loss of $0.77 per share, falling short of the estimated earnings of $0.42 per share.

-

Gross Profit: Decreased to $230 million from $250 million year-over-year.

-

Operating Cash Flow: Generated $81 million, down from $126 million in the same quarter last year.

-

Adjusted EBITDA: Totalled $227 million with a margin of 6.1%, compared to $215 million and a margin of 5.5% last year.

-

Restructuring and Impairment Costs: Increased significantly to $125 million from $17 million in the prior year’s comparable quarter.

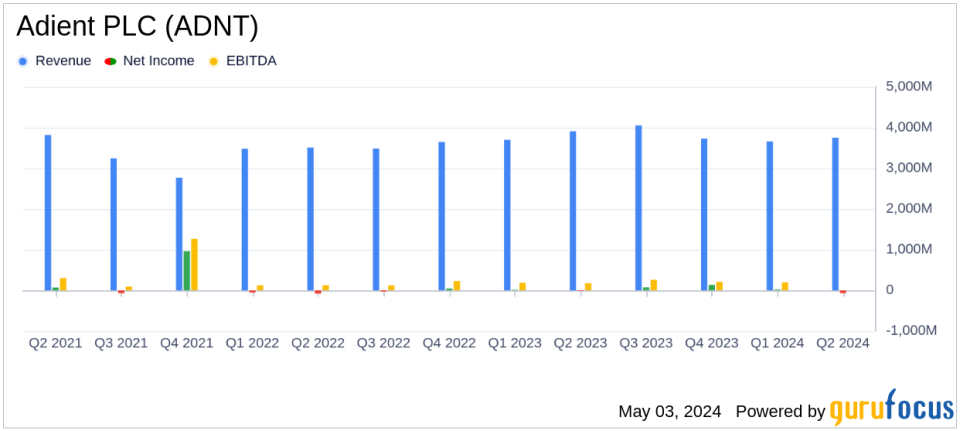

On May 3, 2024, Adient PLC (NYSE:ADNT) released its latest earnings report, revealing a challenging fiscal second quarter. The company disclosed these figures in its 8-K filing, which showed a decline in net sales and a significant net loss, contrasting sharply with analyst expectations.

Company Overview

Adient began operations on October 31, 2016, after being spun off from Johnson Controls’ automotive experience segment. As a global leader in automotive seating, Adient holds approximately one-third of the market share worldwide. The company’s presence in China has adjusted to nearly 20% following the divestiture of its main joint venture there at the end of fiscal 2021. Headquartered in Ireland, with significant operations in the Detroit area, Adient reported a consolidated revenue of $15.4 billion for fiscal 2023.

Q2 Financial Performance

For the quarter ended March 31, 2024, Adient reported net sales of $3.75 billion, down from $3.91 billion in the same quarter the previous year, falling short of the estimated $3.79 billion. The company’s net loss widened to $70 million, or $0.77 per diluted share, compared to a loss of $15 million, or $0.16 per diluted share, year-over-year. This performance was significantly below the expected earnings per share of $0.42.

Analysis of Income Statement and Balance Sheet

The income statement revealed a decrease in gross profit from $250 million to $230 million year-over-year, impacted by higher cost of sales which stood at $3.52 billion. Selling, general, and administrative expenses decreased to $115 million from $141 million, providing some relief. However, restructuring and impairment costs showed a substantial increase to $125 million from $17 million, reflecting ongoing operational adjustments.

The balance sheet showed a decrease in total assets from $9.42 billion to $9.28 billion. Notably, cash and cash equivalents decreased from $1.11 billion to $905 million. This reduction in liquidity could impact the company’s flexibility in managing future financial challenges.

Cash Flow and Segment Performance

Cash flow from operations was $81 million, down from $126 million in the prior year’s quarter. This decline is partly due to significant changes in receivables and inventories. Segment-wise, the Americas and EMEA regions showed slight improvements in adjusted EBITDA, while Asia’s performance remained robust with an adjusted EBITDA of $112 million, slightly down from $113 million.

Strategic and Operational Challenges

Adient’s current financial health poses challenges, particularly in its restructuring efforts which have led to significant impairment costs. The automotive industry’s cyclical nature and economic uncertainties also add to the operational challenges, potentially impacting future profitability and market position.

Conclusion

Adient PLC’s fiscal Q2 2024 results highlight the difficulties it faces in a competitive and changing market. Despite a strong market presence and global reach, the company must navigate through its financial and operational challenges to stabilize and improve its financial standing. Investors and stakeholders will likely watch closely how Adient addresses these challenges in upcoming quarters.

Explore the complete 8-K earnings release (here) from Adient PLC for further details.

This article first appeared on GuruFocus.