Insights into Pzena’s Latest 13F Filing and Its Impact on the Portfolio

Richard Pzena (Trades, Portfolio), the founder and Co-Chief Investment Officer of Pzena Investment Management, LLC, has made notable changes to his investment portfolio in the first quarter of 2024. Since founding his firm in 1995, Pzena has adhered to a value investing philosophy, focusing on acquiring shares of commendable businesses at low prices, typically influenced by temporary setbacks. His latest 13F filing reveals strategic buys, significant position increases, and some exits, providing a clear view of his current investment strategy.

Summary of New Buys

Richard Pzena (Trades, Portfolio) added a total of 8 stocks to his portfolio this quarter. Noteworthy new acquisitions include:

-

Dollar General Corp (NYSE:DG), with 1,933,475 shares, making up 1.04% of the portfolio and valued at $301.74 million.

-

C.H. Robinson Worldwide Inc (NASDAQ:CHRW), comprising 873,048 shares or approximately 0.23% of the portfolio, valued at $66.47 million.

-

The Shyft Group Inc (NASDAQ:SHYF), with 327,733 shares, accounting for 0.01% of the portfolio and valued at $4.07 million.

Key Position Increases

Richard Pzena (Trades, Portfolio) also increased his stakes in 51 stocks. Significant increases include:

-

Charter Communications Inc (NASDAQ:CHTR), with an additional 1,399,034 shares, bringing the total to 2,848,459 shares. This adjustment represents a 96.52% increase in share count and a 1.39% impact on the current portfolio, valued at $827.85 million.

-

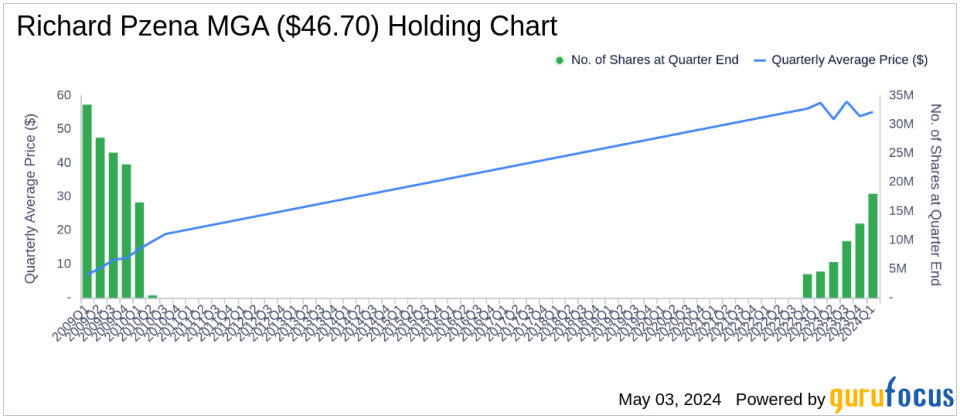

Magna International Inc (NYSE:MGA), with an additional 5,166,536 shares, bringing the total to 18,043,349 shares. This adjustment represents a 40.12% increase in share count, valued at $1.33 billion.

Summary of Sold Out Positions

During the first quarter of 2024, Richard Pzena (Trades, Portfolio) completely exited 14 holdings, including:

-

Juniper Networks Inc (NYSE:JNPR), where all 1,232,131 shares were sold, impacting the portfolio by -0.14%.

-

American Equity Investment Life Holding Co (NYSE:AEL), with all 503,490 shares liquidated, causing a -0.11% impact on the portfolio.

Key Position Reductions

Pzena also reduced his positions in 93 stocks. The most significant reductions include:

-

Westinghouse Air Brake Technologies Corp (NYSE:WAB), reduced by 2,700,906 shares, resulting in a -59.34% decrease in shares and a -1.29% impact on the portfolio. The stock traded at an average price of $135.45 during the quarter and has returned 20.99% over the past 3 months and 28.01% year-to-date.

-

GE Aerospace (NYSE:GE), reduced by 1,262,948 shares, resulting in a -99.75% reduction in shares and a -0.61% impact on the portfolio. The stock traded at an average price of $117.76 during the quarter and has returned 50.93% over the past 3 months and 61.47% year-to-date.

Portfolio Overview

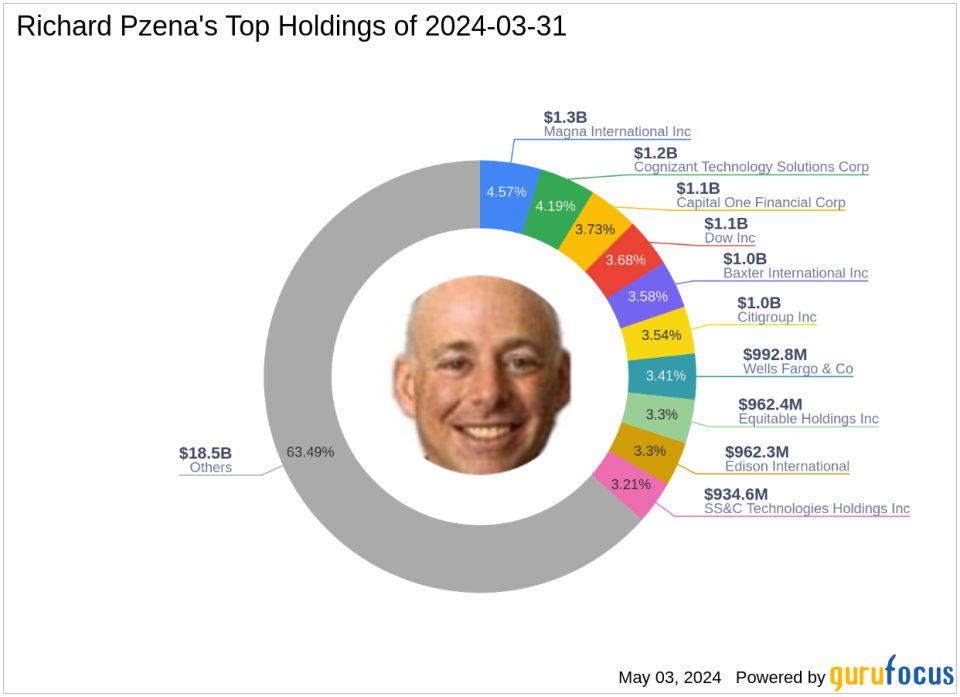

As of the first quarter of 2024, Richard Pzena (Trades, Portfolio)’s portfolio included 160 stocks. The top holdings were 4.57% in Magna International Inc (NYSE:MGA), 4.19% in Cognizant Technology Solutions Corp (NASDAQ:CTSH), 3.73% in Capital One Financial Corp (NYSE:COF), 3.68% in Dow Inc (NYSE:DOW), and 3.58% in Baxter International Inc (NYSE:BAX). The holdings are mainly concentrated across all 11 industries, including Financial Services, Technology, Healthcare, and more.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.