Shares of Magna International MGA have declined 4.2% since the company reported first-quarter 2024 results. The auto equipment provider reported adjusted earnings of $1.08 per share, which declined from the year-ago quarter’s $1.11 per share and also missed the Zacks Consensus Estimate of $1.28. The underperformance is attributed to lower-than-expected adjusted EBIT from Body Exteriors & Structures and Power & Vision segments.

Net sales increased 2.7% from the prior-year quarter to $10.97 billion but fell short of the Zacks Consensus Estimate of $11.02 billion.

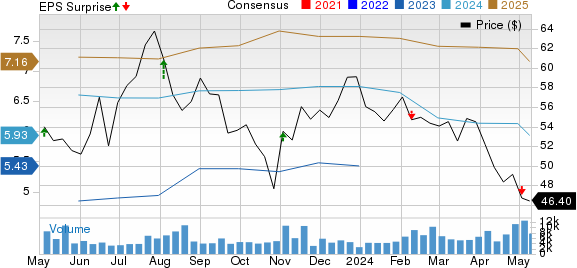

Magna International Inc. Price, Consensus and EPS Surprise

Magna International Inc. price-consensus-eps-surprise-chart | Magna International Inc. Quote

Segmental Performance

The Body Exteriors & Structures segment’s revenues were $4.43 billion, down 0.2% year over year. This can be attributed to the end of production of certain programs and lower customer recoveries related to high input costs, partly offset by higher global light vehicle production and the launch of new programs. Revenues lagged the Zacks Consensus Estimate of $4.48 billion. The segment reported an adjusted EBIT of $298 million, up from $272 million recorded in the year-ago period. The metric, however, missed the Zacks Consensus Estimate of $300 million because of higher production input costs net of customer recoveries, including for labor.

The Power & Vision segment’s revenues increased 16% year over year to $3.84 billion, outpacing the Zacks Consensus Estimate of $3.77 billion on higher production on certain programs, smart pricing, launch of new programs and benefits from acquisitions, net of divestitures. Segmental adjusted EBIT rose from $92 million to $98 million but missed the Zacks Consensus Estimate of $159 million. This can be attributed to high launch costs and lower equity income.

Revenues from the Seating Systems segment inched down 2% year over year to $1.45 million on customer price concessions, the end of production of certain programs and net weakening of foreign currencies against the U.S. dollar. However, the metric came ahead of the Zacks Consensus Estimate of $1.43 billion. Segmental adjusted EBIT grew from $37 million to $52 million and outpaced the Zacks Consensus Estimate of $45.6 million on lower launch costs.

The Complete Vehicles segment’s revenues decreased 15% year over year to $1.38 million and missed the Zacks Consensus Estimate of $1.49 billion due to lower assembly volumes. The segment reported an adjusted EBIT of $27 million. It fell 48% year over year but outpaced the Zacks Consensus Estimate of $20 million.

Financials

Magna had $1.5 billion in cash and cash equivalents as of Mar 31, 2024, up from $1.2 billion as of Dec 31, 2023. Long-term debt, as of Mar 31, 2024, was $4.55 billion, up from $4.17 billion as of Dec 31, 2023.

In the reported quarter, cash provided from operating activities totaled $261 million, up from the year-ago figure of $227 million.

The company declared a first-quarter dividend of 47.5 cents per common share. The dividend will be paid on May 31, 2024, to shareholders of record as of Mar 17, 2024.

2024 View

Magna has revised its full-year projections. It now expects 2024 revenues in the band of $42.6-$44.2 billion, down from $43.8-$45.4 billion guided earlier. Adjusted EBIT margin forecast remains unchanged at 5.4-6%. Adjusted net income is envisioned to be between $1.5 billion and $1.7 billion, compared with the prior guided range of $1.6-$1.8 billion. Capex is estimated in the band of $2.4-$2.5 billion.

Magna currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Peer Releases

Oshkosh Corporation OSK reported first-quarter 2024 adjusted earnings of $2.89 per share, beating the Zacks Consensus Estimate of $2.26. The bottom line also rose from $1.59 per share recorded in the year-ago period. Consolidated net sales climbed 12.2% year over year to $2.54 billion. The top line also surpassed the Zacks Consensus Estimate of $2.51 billion. OSK had cash and cash equivalents of $69.9 million as of Mar 31, 2024, compared with $125.4 million as of Dec 31, 2023. The company had a long-term debt of $598.9 million, up from $597.5 million as of Dec 31, 2023.

BorgWarner BWA reported adjusted earnings of $1.03 per share for first-quarter 2024, down from $1.09 per share recorded in the prior-year quarter. The bottom line, however, surpassed the Zacks Consensus Estimate of 87 cents. It reported net sales of $3.6 billion, beating the Zacks Consensus Estimate of $3.52 billion. The top line, however, declined 13.9% year over year. As of Mar 31, 2024, BWA had $1.03 billion in cash/cash equivalents/restricted cash compared with $1.53 billion as of Dec 31, 2023. As of Mar 31, long-term debt was $3.3 billion, down from $3.7 billion recorded on Dec 31, 2023.

Gentex Corp. GNTX reported first-quarter 2024 adjusted EPS of 47 cents, which came in line with the Zacks Consensus Estimate and grew 12% year over year. It reported net sales of $590.2 million, which missed the Zacks Consensus Estimate of $600 million but increased 7% from the year-ago period. Gentex had cash and cash equivalents of about $249 million as of Mar 31, 2024. The company had nearly 14.7 million shares remaining for buyback as of Mar 31.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BorgWarner Inc. (BWA) : Free Stock Analysis Report

Magna International Inc. (MGA) : Free Stock Analysis Report

Oshkosh Corporation (OSK) : Free Stock Analysis Report

Gentex Corporation (GNTX) : Free Stock Analysis Report