Adient ADNT reported adjusted earnings per share (EPS) of 54 cents for the second quarter of fiscal 2024. Earnings rose from 32 cents recorded in the year-ago period and outpaced the Zacks Consensus Estimate of 39 cents.

The company generated net sales of $3.75 billion, which decreased 4.1% year over year and missed the Zacks Consensus Estimate of $3.83 billion.

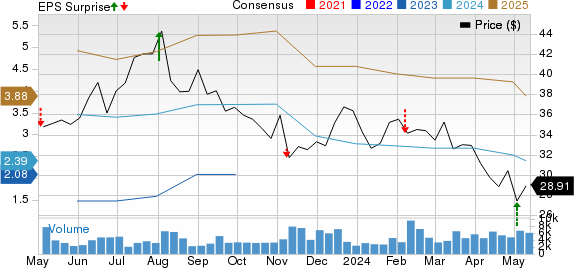

Adient Price, Consensus and EPS Surprise

Adient price-consensus-eps-surprise-chart | Adient Quote

Segmental Performance

Adient currently operates through three reportable segments — Americas, including North America and South America; Europe, which includes the Middle East and Africa (EMEA); and Asia Pacific/China (Asia).

In the reported quarter, the Americas segment recorded revenues of $1.66 billion, which declined 5.7% from the year-ago period and missed the Zacks Consensus Estimate of $1.80 billion. The segment recorded an adjusted EBITDA of $80 million, which increased from $72 million recorded in the prior-year quarter and beat the Zacks Consensus Estimate of $75 million, driven by improved business performance and commodity tailwind.

The EMEA segment registered revenues of $1.37 billion, which declined 2.2% year over year and missed the Zacks Consensus Estimate of $1.38 billion. The segment recorded EBITDA of $57 million, which was higher than the $53 million generated in the year-ago period. It also outpaced the Zacks Consensus Estimate of $53 million on the back of improved business performance and net commodity benefits.

In the fiscal second quarter, revenues in the Asia segment came in at $742 million, which declined 4.1% year over year and missed the Zacks Consensus Estimate of $774 million. The segment’s adjusted EBITDA fell 0.8% year over year to $112 million due to unfavorable volume and product mix.

Financial Position

Adient had cash and cash equivalents of $905 million as of Mar 31, 2024, compared with $1.11 billion as of Sep 30, 2023.

As of Mar 31, 2024, long-term debt amounted to $2.4 billion.

Capital expenditures totaled $69 million compared with $56 million in the prior-year quarter.

During the quarter under review, ADNT repurchased nearly 1.5 million shares for $50 million.

Revised Guidance 2024

Adient envisions fiscal 2024 revenues in the range of $14.8-$14.9 billion, down from the previous guidance of $15.40-$15.50 billion. Adjusted EBITDA is estimated in the range of $900-$920 million, down from the prior guidance of $985 million. Equity income is projected to be $80 million, up from the previous guidance of $70 million.

Free cash flow is anticipated to be $250 million, down from the previous guidance of $300 million. Capex and cash tax are estimated between $310 million and $105 million, respectively. The company expects interest expenses to be $185 million.

Zacks Rank & Key Picks

ADNT currently carries a Zacks Rank #5 (Strong Sell).

Some better-ranked players in the auto space are Geely Automobile Holdings Limited GELYY and Oshkosh Corporation OSK, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for GELYY’s 2024 sales suggests year-over-year growth of 36.6%. The EPS estimates for 2024 and 2025 have moved up 34 cents and 54 cents, respectively, in the past 60 days.

The Zacks Consensus Estimate for OSK’s 2024 sales and earnings suggests year-over-year growth of 9.86% and 10.72%, respectively. The EPS estimates for 2024 and 2025 have improved 73 cents and 70 cents, respectively, in the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Oshkosh Corporation (OSK) : Free Stock Analysis Report

Geely Automobile Holdings Ltd. (GELYY) : Free Stock Analysis Report

Adient (ADNT) : Free Stock Analysis Report