Amid a backdrop of fluctuating global markets, with the Hang Seng Index recently experiencing significant declines, investors are keenly observing how different sectors and companies navigate these challenging conditions. In this context, growth companies in Hong Kong with high insider ownership present a compelling profile as they often exemplify a strong alignment between management’s interests and shareholder returns, particularly in environments where strategic agility is paramount to capitalize on emerging economic opportunities.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

|

Name |

Insider Ownership |

Earnings Growth |

|

iDreamSky Technology Holdings (SEHK:1119) |

20.1% |

104.1% |

|

New Horizon Health (SEHK:6606) |

16.6% |

61% |

|

Fenbi (SEHK:2469) |

32.1% |

43% |

|

Meitu (SEHK:1357) |

38% |

33.7% |

|

Adicon Holdings (SEHK:9860) |

22.3% |

29.6% |

|

Zylox-Tonbridge Medical Technology (SEHK:2190) |

18.5% |

79.3% |

|

Zhejiang Leapmotor Technology (SEHK:9863) |

14.2% |

73.8% |

|

Beijing Airdoc Technology (SEHK:2251) |

27.2% |

83.9% |

|

Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) |

15.7% |

100.1% |

|

Ocumension Therapeutics (SEHK:1477) |

17.7% |

93.7% |

Underneath we present a selection of stocks filtered out by our screen.

Simply Wall St Growth Rating: ★★★★☆☆

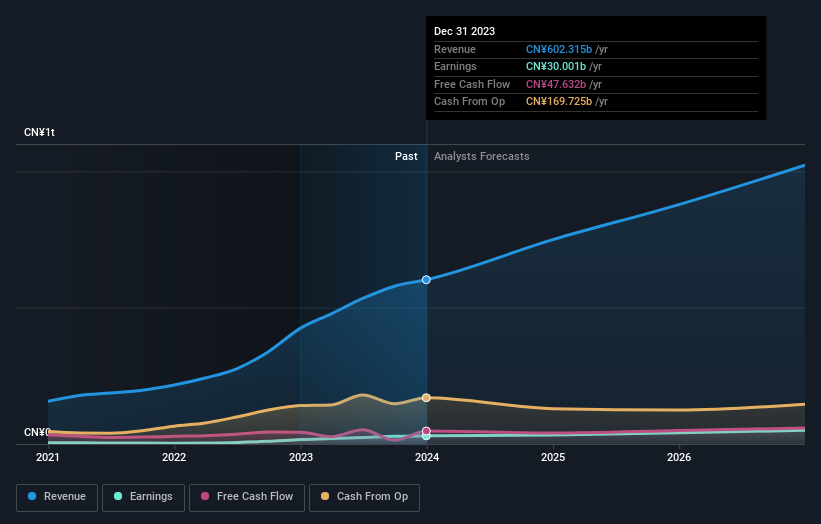

Overview: BYD Company Limited operates in the automobile and battery sectors across China, Hong Kong, Macau, Taiwan, and internationally, with a market capitalization of approximately HK$676.34 billion.

Operations: The company’s revenue is primarily derived from its automobile and battery sectors.

Insider Ownership: 30.1%

Earnings Growth Forecast: 14.4% p.a.

BYD, a notable Hong Kong growth company with substantial insider ownership, is trading at 33.8% below its estimated fair value, making it an attractive proposition despite its revenue and earnings growth forecasts (14.3% and 14.4% per year respectively) trailing the high-growth benchmark of 20%. The company’s earnings have surged by 52.7% over the past year, outpacing the local market’s average. Additionally, BYD’s recent global product launch in Mexico underlines its aggressive expansion strategy and innovation in new energy vehicles, potentially bolstering future performance despite no significant insider buying reported in the last three months.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Dongyue Group Limited operates as an investment holding company, primarily engaged in manufacturing and distributing polymers, organic silicone, refrigerants, and other chemical products across China and globally. The company has a market capitalization of approximately HK$16.93 billion.

Operations: Dongyue Group’s revenue segments include polymers generating CN¥4.55 billion, refrigerants at CN¥5.48 billion, organic silicone contributing CN¥4.86 billion, and dichloromethane PVC along with liquid alkali at CN¥1.21 billion.

Insider Ownership: 15.4%

Earnings Growth Forecast: 35.7% p.a.

Dongyue Group, despite its recent challenges including a significant profit decline and management changes, remains a key player in Hong Kong’s growth sectors with high insider ownership. The company’s earnings are expected to grow at 35.7% annually, outstripping the local market forecast of 11.9%. However, its profit margins have dipped from last year and it recently reduced its dividend payout, reflecting some operational pressures amidst leadership transitions which could impact short-term stability but potentially pave the way for strategic realignment under new executive leadership.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Alibaba Health Information Technology Limited operates in pharmaceutical direct sales, e-commerce platforms, and healthcare digital services across Mainland China and Hong Kong, with a market capitalization of approximately HK$57.09 billion.

Operations: The company generates revenue primarily from the distribution and development of pharmaceutical and healthcare products, totaling CN¥27.03 billion.

Insider Ownership: 24.2%

Earnings Growth Forecast: 23.2% p.a.

Alibaba Health Information Technology Limited has shown robust financial performance with a significant increase in net income and sales, reporting CNY 883.48 million and CNY 27.03 billion respectively for the fiscal year ended March 31, 2024. Despite shareholder dilution last year, the company’s earnings are expected to grow by 23.24% annually over the next three years, outpacing the Hong Kong market’s growth rate. However, its forecasted Return on Equity of 13.8% suggests potential challenges in achieving higher profitability levels moving forward.

Make It Happen

Seeking Other Investments?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SEHK:1211 SEHK:189 and SEHK:241.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com