NIO Inc. NIO is slated to release first-quarter 2024 results on Jun 6, before market open. The Zacks Consensus Estimate for the to-be-reported quarter’s loss per share and revenues is pegged at 31 cents and $1.48 billion, respectively.

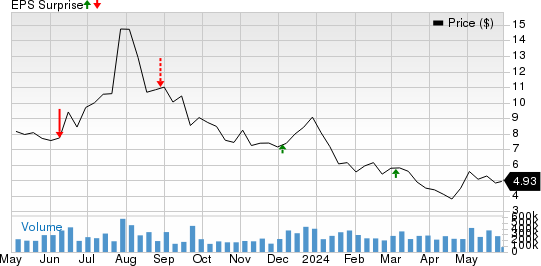

The consensus estimate for NIO’s loss per share has widened by 3 cents in the past 90 days. Its bottom-line estimates imply an increase of 26.19% from the year-ago reported number. Revenues indicate a year-over-year decline of 4.65%. Over the trailing four quarters, it surpassed earnings estimates on two occasions and missed twice, the average negative surprise being 26.72%. This is depicted in the graph below:

NIO Inc. Price and EPS Surprise

NIO Inc. price-eps-surprise | NIO Inc. Quote

In the last reported quarter, the company incurred a loss of 45 cents per share, narrower than the Zacks Consensus Estimate of a loss of 51 cents. The company had incurred a loss of 51 cents in the year-ago period. This China-based electric vehicle maker posted revenues of $2.41 billion, which beat the Zacks Consensus Estimate of $2.29 billion and rose 3.4% year over year due to higher delivery volumes.

Factors at Play

In the first quarter of 2024, NIO delivered 30,053 vehicles, which declined 3.2% year over year. We forecast first-quarter revenues from vehicle sales to be RMB8,826 million, implying a decline of 4.3% on lower year-over-year deliveries. Also, the China-based EV maker has been bearing the brunt of high SG&A expenses for the past several quarters and the trend is expected to have continued amid increasing personnel costs related to sales functions and a rise in sales and marketing activities. Lower year-over-year deliveries and high SG&A expenses are likely to have hurt the company’s performance in the to-be-reported quarter.

On a somewhat positive note, NIO’s gross margins have been improving from past few quarters. In the last reported quarter, NIO’s gross margin increased to 7.5% from 3.9% reported in the year-ago quarter due to lower material cost per unit. In March 2024, the China-based EV maker commenced the deliveries of its 2024 ES8, ES6, EC7, EC6 and ET5T models. The newly launched products are expected to have been more gross margin-oriented and are likely to have maintained the margin at an elevated level in the first quarter, boosting the company’s performance.

Earnings Whispers

Our proven model does not conclusively predict an earnings beat for NIO for the quarter to be reported, as it does not have the right combination of the two key ingredients. A combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. That is not the case here, as elaborated below.

Earnings ESP: NIO has an Earnings ESP of 0.00%. This is because the Most Accurate Estimate is on par with the Zacks Consensus Estimate. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: It currently carries a Zacks Rank #3.

Earnings Whispers for Other Auto Stocks

Thor Industries, Inc. THO has an Earnings ESP of -4.17% and carries a Zacks Rank #4 (Sell) at present. It is slated to release third-quarter fiscal 2024 results on Jun 5. The Zacks Consensus Estimate for THO’s earnings per share is pegged at $1.92. You can see the complete list of today’s Zacks #1 Rank stocks here.

Thor surpassed earnings estimates in three of the trailing four quarters and missed once, delivering an average surprise of 35.80%.

ChargePoint Holdings, Inc. CHPT has an Earnings ESP of 0.00% and carries a Zacks Rank #3 at present. It is slated to release first-quarter fiscal 2025 results on Jun 5. The Zacks Consensus Estimate for CHPT’s loss per share is pegged at 12 cents.

ChargePoint has surpassed earnings estimates in one of the trailing four quarters and missed thrice, delivering an average negative surprise of 26.33%.

REV Group, Inc. REVG has an Earnings ESP of 0.00% and carries a Zacks Rank #3 at present. It is slated to release second-quarter fiscal 2024 results on Jun 5. The Zacks Consensus Estimate for REVG’s earnings per is pegged at 28 cents.

REVG surpassed earnings estimates in each of the trailing four quarters, delivering an average surprise of 85.08%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Thor Industries, Inc. (THO) : Free Stock Analysis Report

REV Group, Inc. (REVG) : Free Stock Analysis Report

NIO Inc. (NIO) : Free Stock Analysis Report

ChargePoint Holdings, Inc. (CHPT) : Free Stock Analysis Report