Less than three months after my generally upbeat visit to Workhorse Group’s refurbished plant near the Ohio-Indiana border, the electric truck maker’s situation appears dire.

Layoffs and furloughs

Workhorse has laid off 20% of its workforce. Much of the rest is on unpaid furlough and could be called back to work.

The company is choked with inventory. It has less than $7 million in cash on the books and accounts payable for more than twice that amount. At a projected burn rate less than Q1’s $5.5 million, Workhouse has enough money to get through the next quarter or two if nothing changes.

Shares trade around 20 cents and have been out of compliance with Nasdaq listing requirements since September. Workhorse has until this September to get its price above $1 to remain listed.

A reverse split — exchanging one new share for a multiple of existing shares — to artificially boost the stock price is an option to get there. But it is a cosmetic move and one the Nasdaq does not always support unless it sees a viable business inappropriately beaten down.

On Thursday, the Russell 3,000 Index dropped Workhorse, electric truck maker Nikola and battery maker Microvast among 144 deletions in its latest reconstitution of the companies that make up the index.

Workhorse drone business and manufacturing plant on the block

Workhorse’s drone business, a legacy of former CEO Steve Burns, was transitioning to an as-a-service entity. Now it is for sale, along with Workhorse’s plant, which it would lease back from a buyer. That’s a common tactic among financially struggling companies.

Workhorse has access to some borrowed money, but will it be enough to save the company that has spent most of its 17-year existence in jeopardy?

A little more than a year ago, CEO Rick Dauch candidly talked with me about Workhorse’s survival. Of its anemic stock price that touched $40 a share during the pandemic meme stock craze, he said, “If the stock goes to zero, it goes to zero. But I think we can turn it around and go the right direction.”

Workhorse squandered its first-mover advantage

After squandering a first-mover advantage in medium-duty electric trucks with an inexperienced leadership team and product missteps, the company brought in Dauch, a veteran automotive supplier executive, to turn things around. The situation was so bad, he determined it was better to start over than salvage what he had inherited.

But even the relatively quick 20-month development of a ground-up Class 5 electric step van cost Workhorse time it didn’t have against established competitors like General Motors, which launched its BrightDrop electric vans, and Ford, which offers an electrified Transit van. A host of startups — Motiv Electric Trucks, Ree Automotive and Xos — chase the same customers.

Other startups have failed. Some like XL Fleet and Electric Last Mile Solutions had their assets sold and absorbed into other companies.

Workhorse puts on a brave face at the ACT Expo

Workhorse featured its W56 truck at the Advanced Clean Transportation Expo in Las Vegas earlier this month. Dauch did his best to point to the positive during a first-quarter earnings call last Friday. The three analysts who participated brought tough questions.

Workhorse has pending orders for both the W4 CC [chassis cab] it purchases from Canada’s GreenPower Motor Co. and its purpose-built W56. But it had nearly $50 million in unsold inventory as of March 31. April and May were better but an overhang remains.

Kingsburg Truck Sales ordered 141 W4 CCs that will clear a yard of finished trucks at Union City, Indiana, Dauch said. Terms of that sale are unknown. But Workhorse’s cost of sales in Q1 ballooned to $7.4 million compared to $5.3 million a year ago.

Workhorse has 68 orders for W56 step vans to date. It is building about one per day in the plant, which could manufacture up to five a day with more demand.

‘Slower than expected’ transition

“The transition to EV technologies in the commercial truck and last-mile segment is starting to take place, slower than expected, but it’s starting,” Dauch told the analysts. “We’re focused on returning our team to work when additional truck orders are received.”

Workhorse’s barriers to success — overcoming resistance to the higher upfront cost of electric trucks and the availability and cost of installing charging infrastructure — are woes for the rest of the trucking industry. But Workhorse urgently needs to generate revenue.

Dauch is counting on California’s Advanced Clean Trucks rule that requires fleets with Class 4-6 trucks to have 9% zero-emission trucks by the end of the year to help that along.

“We don’t control the pace of EV adoption,” he said. “I’m starting to see the cracks in the dam where even the small fleets are starting to understand they have to register their fleet with the California officials. So, they understand and they have to show their plans to get to that 9% target.”

A green hydrogen boost for Plug Power — and Nikola?

The Biden administration is spending serious money to create a hydrogen economy. The biggest investment is the eight hydrogen hubs with a price tag of $1 billion each. But there is other money out there. Plug Power earlier this month received a conditional loan guarantee of $1.66 billion from the Department of Energy to finance the development, construction and ownership of up to six green hydrogen production facilities.

Green hydrogen made from renewable sources is the holy grail of hydrogen, most of which today is taken from petroleum-based natural gas, also known as gray hydrogen. While the hydrogen is clean, its source is anything but.

Other colors ascribed to hydrogen — blue from capturing carbon from methane in landfills; pink from nuclear energy; and others — are less prevalent.

Final details have yet to be worked out, but Plug sees at least some of the plants servicing fuel cell truck transportation. And Plug has a partnership with Nikola, which is trying to win national contracts for its fuel cell electric trucks.

Plug’s first commercial scale green hydrogen plant in Woodbine, Georgia, could help Nikola sell its Tre fuel cell electric vehicle (FCEV) as zero-emission drayage trucks at the Port of Savannah in Georgia.

It also could be a hydrogen source for Hyundai Motors, which is planning to use its Xcient fuel cell trucks for inbound and outbound logistics at its electric vehicle-dedicated Metaplant America in Bryan County, Georgia. The plant begins operations in Q4.

“Green hydrogen is an essential driver of industrial decarbonization in the United States,” Plug Power CEO Andy Marsh said. “This loan guarantee will help us build on that success with additional green hydrogen plants.”

Investment fund to TuSimple: Give us our money back

TuSimple may be focusing on operating in Asia, but one large U.S. investor has a message for the autonomous trucking startup: Give us our money back.Camac Partners, which owns 11.4 million shares, or about 5.6%, of TuSimple Holdings, sent a letter to the TuSimple board “maintaining the company’s status quo is both unsustainable and unacceptable from a corporate governance perspective.”

It is calling for the autonomous trucking company to return excess cash to shareholders — which it estimates to be about $2.50 a share based on the company’s last report of cash on hand before voluntarily delisting from the Nasdaq in January.

Camac’s stake is worth about $3.9 million, according to a filing Thursday with the Securities and Exchange Commission. It has purchased nearly 700,000 shares in the last 60 days at prices ranging from 27 cents to 40 cents a share. The filing indicated Camac saw the cheap price of the shares as having potential to turn a profit.

Its best hope for a payday is for TuSimple to follow its recommendation to monetize and wind-down its remaining operations and make the most of the company’s $1.8 billion in operating losses in the three years since it went public.

“Trading 88% below the value of its excess cash, it is highly unlikely TuSimple can do anything remotely as sensible as returning excess capital to shareholders,” the letter said. “This is a simple way to create value for long-suffering shareholders.”

TuSimple and CFIUS reach an agreement

Separately, TuSimple said in a press release Wednesday that it has resolved its latest issues with the Committee on Foreign Investment in the United States (CFIUS).

At issue was a gap in TuSimple having a security director as required in an earlier national security settlement with the CFIUS and whether certain covered intellectual property was transferred contrary to the national security agreement. TuSimple admitted no fault in either instance.

Briefly noted …

Einride has placed an order for 150 Peterbilt Model 579EVs. It is the largest electric truck order to date for the Paccar brand.

Kodiak Robotics will integrate its autonomous driving system into a Textron Systems prototype, purpose-built uncrewed military vehicle. It follows the installation of the Kodiak Driver into a Ford F-150 for the U.S. military.

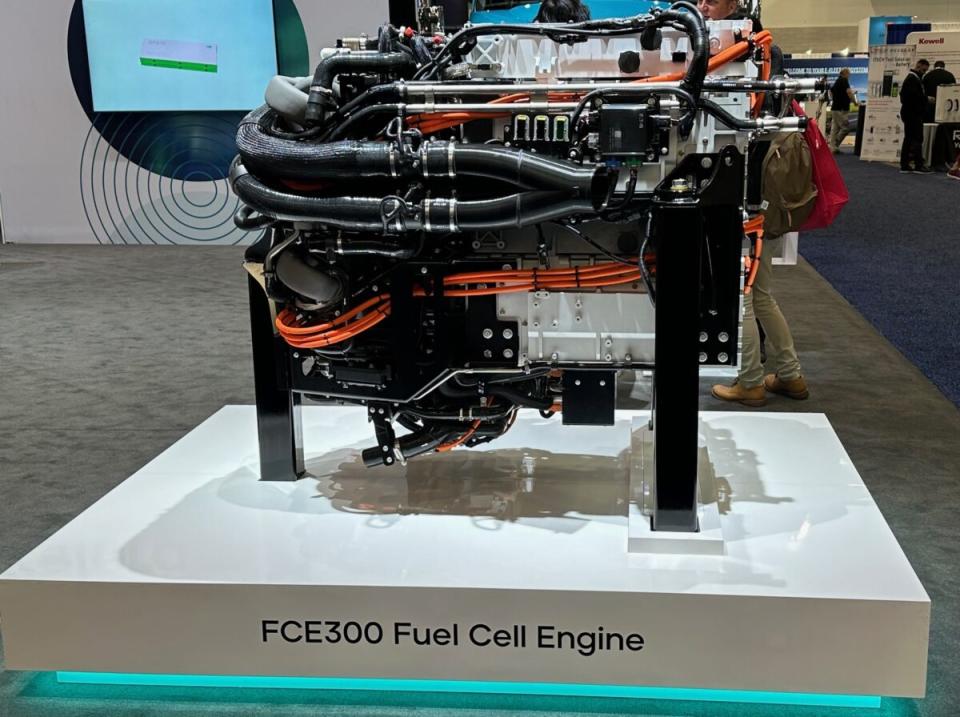

Hydrogen-powered fuel cell stacks just keep getting bigger. Ballard Power Systems showed its ninth-generation fuel cell system at the ACT Expo last week Three of the 120-kilowatt units can be combined for a whopping 360kW of power. Cummins Inc. showed its 300kW system, made up of two 150kW stacks.

Separately, Cummins said former president and chief operating officer Tony Satterhwaite will retire in September after a 36-year career at the company.

Hyliion gave up on its natural gas-electric Hypertruck ERX because it could not successfully scale it. Now, Hexagon Agility and Norwegian electric transmission technology company Brudelli Green Mobility are trying a similar approach to low-carbon transport.

Autonomous truck platooning is another technology that has all but disappeared in the U.S. Not so in China, where Pony.ai received approval to test its 1+N system in Beijing.

Truck Tech episode No. 68: WattEV says lagging infrastructure no longer an excuse for foot-dragging on electric trucks

There’s no minute like the last minute. Today is the last chance to use this special discount code to save on tickets to the FreightWaves Future of Supply Chain event in Atlanta next week.

That’s it for this week. Thanks for reading and watching. Click here to get Truck Tech via email on Fridays. And catch the latest in major events and hear from the top players on “Truck Tech” at 3 p.m. Wednesdays on the FreightWaves YouTube channel.Your feedback and suggestions are always welcome. Write to aadler@freightwaves.com.

The post Workhorse on the bubble, or is it worse? appeared first on FreightWaves.