Amidst a backdrop of fluctuating global markets, Hong Kong’s economy continues to navigate through its own unique challenges and opportunities. As investors seek stability and growth potential, companies with high insider ownership in Hong Kong can offer an intriguing avenue for those looking to align with the interests of management teams deeply invested in their companies’ success.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

|

Name |

Insider Ownership |

Earnings Growth |

|

iDreamSky Technology Holdings (SEHK:1119) |

20.1% |

104.1% |

|

New Horizon Health (SEHK:6606) |

16.6% |

62.3% |

|

Fenbi (SEHK:2469) |

32.1% |

43% |

|

Meitu (SEHK:1357) |

38% |

33.7% |

|

Zylox-Tonbridge Medical Technology (SEHK:2190) |

18.5% |

79.3% |

|

Adicon Holdings (SEHK:9860) |

22.3% |

29.6% |

|

Zhejiang Leapmotor Technology (SEHK:9863) |

14.2% |

73.8% |

|

Beijing Airdoc Technology (SEHK:2251) |

27.2% |

83.9% |

|

Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) |

15.7% |

100.1% |

|

Ocumension Therapeutics (SEHK:1477) |

17.7% |

93.7% |

We’ll examine a selection from our screener results.

Simply Wall St Growth Rating: ★★★★☆☆

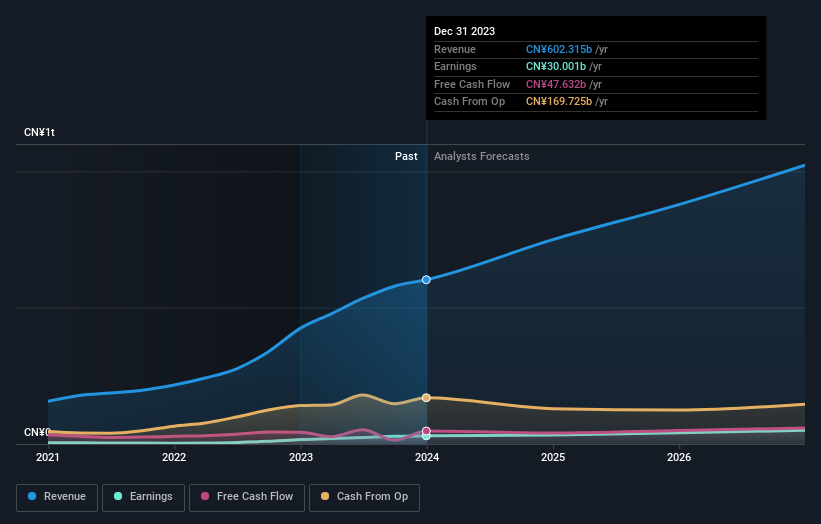

Overview: BYD Company Limited operates in the automobile and battery sectors across China, Hong Kong, Macau, Taiwan, and internationally, with a market capitalization of approximately HK$687.69 billion.

Operations: The company generates revenue primarily from its automobile and battery sectors.

Insider Ownership: 30.1%

BYD, a prominent player in the electric vehicle market, recently launched BYD SHARK, its first global pickup model outside China. This launch aligns with its robust sales growth, as evidenced by significant year-over-year increases in monthly and annual sales volumes. Despite recent insider selling not being substantial, BYD’s aggressive expansion and innovation underscore its commitment to maintaining a strong market presence. The company’s earnings are projected to grow 14.43% annually, outpacing the Hong Kong market forecast of 11.9%.

Simply Wall St Growth Rating: ★★★★☆☆

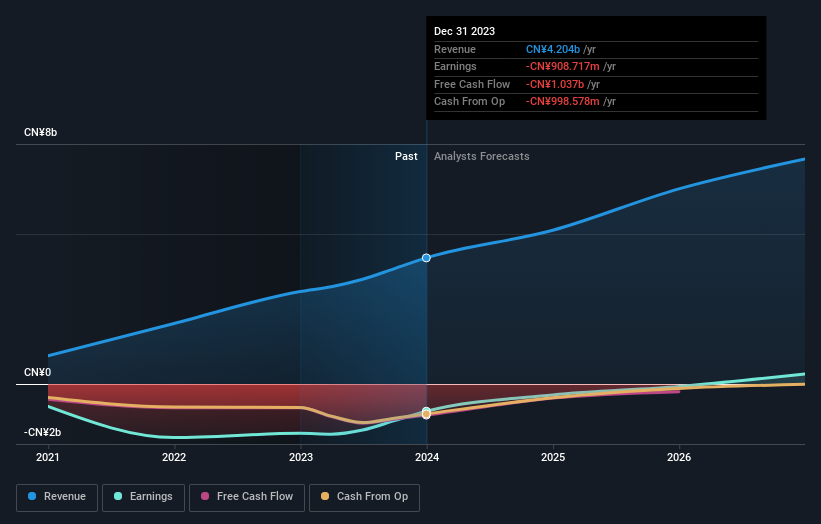

Overview: Alibaba Health Information Technology Limited operates in Mainland China and Hong Kong, focusing on pharmaceutical direct sales, e-commerce platforms, and healthcare digital services with a market capitalization of approximately HK$52.75 billion.

Operations: The company generates revenue primarily through its distribution and development of pharmaceutical and healthcare business, totaling CN¥27.03 billion.

Insider Ownership: 24.2%

Alibaba Health Information Technology Limited showcased a robust financial performance in its recent earnings, with a significant increase in both sales and net income for the fiscal year ended March 31, 2024. The company’s revenue and earnings growth are outpacing the Hong Kong market averages, with projected annual revenue growth of 12.2% and earnings growth of 23.1%. However, shareholder dilution over the past year and large one-off items have impacted its financial results. Despite these challenges, Alibaba Health remains positioned for strong future growth due to substantial insider ownership which aligns leadership interests with shareholder returns.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Beijing Fourth Paradigm Technology Co., Ltd. is an investment holding company specializing in AI solutions across various industries in China, with a market capitalization of approximately HK$25.61 billion.

Operations: The company generates revenue primarily through three segments: the Sage AI Platform (CN¥2.51 billion), Shift Intelligent Solutions (CN¥1.28 billion), and SageGPT AiGS Services (CN¥0.42 billion).

Insider Ownership: 22.8%

Beijing Fourth Paradigm Technology has initiated a share repurchase program, enhancing shareholder value by potentially increasing earnings per share. Despite its highly volatile stock price recently, the company’s revenue growth is expected to outpace the Hong Kong market average significantly at 19.3% annually. However, its forecasted return on equity remains low at 6%. This mixed financial outlook reflects both growth potential and challenges in achieving higher profitability and stability in shareholder equity.

Turning Ideas Into Actions

Ready For A Different Approach?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SEHK:1211 SEHK:6682 and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com