Amid a backdrop of fluctuating global markets, with notable downturns in major indices including Hong Kong’s Hang Seng Index, investors are increasingly attentive to stability and growth potential in their equity selections. In this context, companies with high insider ownership can be particularly appealing as they often signal strong confidence from those closest to the business in its growth prospects and resilience.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

|

Name |

Insider Ownership |

Earnings Growth |

|

iDreamSky Technology Holdings (SEHK:1119) |

20.1% |

104.1% |

|

New Horizon Health (SEHK:6606) |

16.6% |

62.3% |

|

Meitu (SEHK:1357) |

38% |

33.7% |

|

Adicon Holdings (SEHK:9860) |

22.3% |

29.6% |

|

DPC Dash (SEHK:1405) |

38.2% |

89.7% |

|

Zylox-Tonbridge Medical Technology (SEHK:2190) |

18.5% |

79.3% |

|

Tian Tu Capital (SEHK:1973) |

34% |

70.5% |

|

Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) |

15.7% |

100.1% |

|

Beijing Airdoc Technology (SEHK:2251) |

27.2% |

83.9% |

|

Ocumension Therapeutics (SEHK:1477) |

17.7% |

93.7% |

Let’s explore several standout options from the results in the screener.

Simply Wall St Growth Rating: ★★★★☆☆

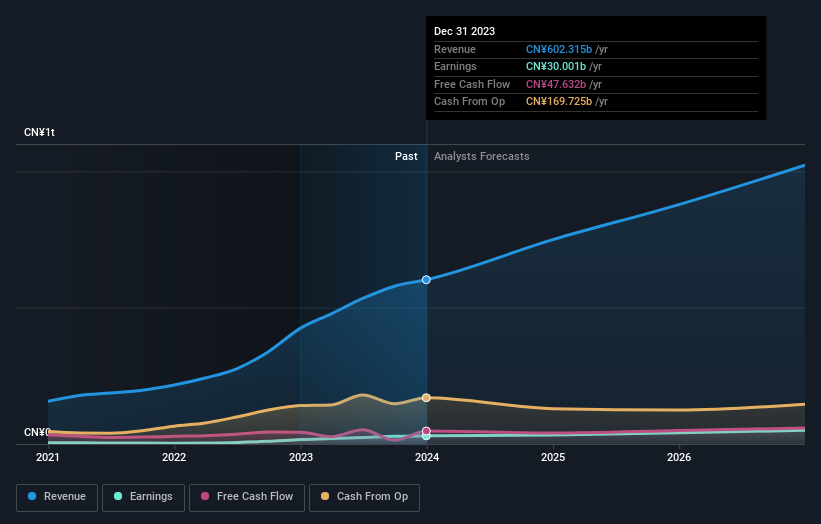

Overview: BYD Company Limited operates in the automobile and battery sectors across Mainland China, Hong Kong, Macao, Taiwan, and internationally, with a market capitalization of approximately HK$715.52 billion.

Operations: The company’s revenue is generated primarily from the automobile and battery sectors across various regions including Mainland China, Hong Kong, Macao, Taiwan, and internationally.

Insider Ownership: 30.1%

Earnings Growth Forecast: 14.7% p.a.

BYD, a prominent player in the electric vehicle market, recently extended its innovative reach by launching BYD SHARK, its first pickup truck model outside China. This launch not only diversifies BYD’s product line but also enhances its global footprint, particularly in the luxury hybrid sector. Despite robust sales growth with significant year-over-year increases and an aggressive expansion into new markets, insider ownership trends remain stable without substantial buying or selling over recent months. The company’s strategic moves and consistent revenue growth position it as a notable entity within Hong Kong’s high insider ownership landscape, although it shows moderate profit forecasts compared to very high-growth peers.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Alibaba Health Information Technology Limited operates in Mainland China and Hong Kong, focusing on pharmaceutical direct sales, e-commerce platforms, and healthcare digital services, with a market capitalization of HK$54.19 billion.

Operations: The company generates revenue primarily through its distribution and development of pharmaceutical and healthcare business, totaling CN¥27.03 billion.

Insider Ownership: 24.2%

Earnings Growth Forecast: 23.1% p.a.

Alibaba Health Information Technology has demonstrated robust financial performance with a significant increase in net income and earnings per share, as shown in its latest annual report. The company’s earnings are expected to grow by 23.1% annually, outpacing the Hong Kong market’s average. Despite trading at a substantial discount to its estimated fair value, concerns include shareholder dilution over the past year and forecasted low return on equity in three years. Recent agreements underline a commitment to expanding service offerings and maintaining competitive terms, supporting sustained growth potential within its sector.

Simply Wall St Growth Rating: ★★★★☆☆

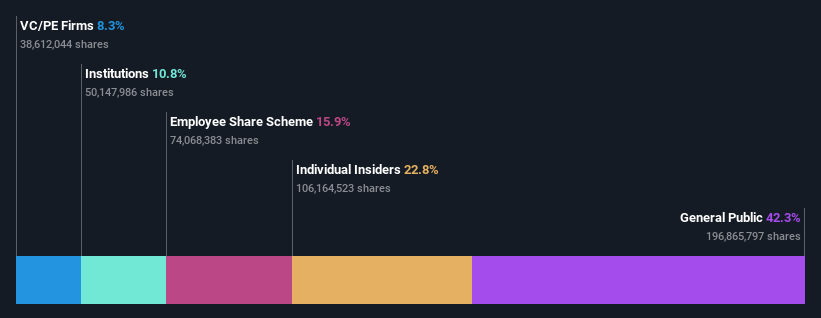

Overview: Beijing Fourth Paradigm Technology Co., Ltd. is an investment holding company that offers platform-centric artificial intelligence solutions in the People’s Republic of China, with a market capitalization of approximately HK$24.59 billion.

Operations: The company generates revenue through three primary segments: the Sage AI Platform (CN¥2.51 billion), SageGPT AiGS Services (CN¥0.42 billion), and Shift Intelligent Solutions (CN¥1.28 billion).

Insider Ownership: 22.8%

Earnings Growth Forecast: 96% p.a.

Beijing Fourth Paradigm Technology is set to become profitable within the next three years, with expected revenue growth outpacing the Hong Kong market average at 19.3% annually. Despite its highly volatile share price recently, insider ownership remains stable with no significant selling reported. The company’s recent initiation of a share repurchase program underlines confidence in its financial health, potentially boosting earnings per share by reducing outstanding shares. However, forecasted return on equity remains low at 6%.

Key Takeaways

Seeking Other Investments?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SEHK:1211SEHK:241.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com