The Western Union Company WU collaborated with Cuba’s popular online marketplace, Katapulk, to provide an additional money transfer channel for U.S. customers sending money to Cuba. Customers can send money either from the official website of Katapulk Marketplace or via its mobile app for iOS and Android users.

Funds can be transferred to only bank accounts and debit cards, and the service is restricted to consumer money transfers. U.S. customers will need to provide valid government-issued identification proof and can send up to $2,000 per transaction. Transfers are processed and received on the same day, even if it is a weekend or holiday.

However, the benefit of these seamless transfers can only be reaped by recipients holding Carnet de Identidad IDs and a bank or debit card account at three of Cuba’s government-operated banks, Banco Popular de Ahorro, Banco Metropolitano S.A., and Banco de Credito y Comercio (Bandec).

Consequent to sending money through the Katapulk Marketplace, customers with accounts at three of the abovementioned banks can further track their transactions, thereby assuring greater transparency and peace of mind. In addition to this, deposits into Freely Convertible Currency accounts can be made in U.S. dollars only.

The recent partnership bears testament to Western Union’s efforts to provide enhanced money transfer services across Cuba with the help of which individuals can send money to close ones residing in the island country. The suspension of WU’s money transfer services in 2020 due to sanctions imposed by the Trump administration was lifted and subsequently, its services of sending money from the United States to Cuba reintroduced in 2023.

However, due to a cybersecurity incident that impacted Cuba’s electronic payment system, services came to a temporary halt. Thereafter, in May 2024, Western Union announced its partnership with its processing partner Orbit S.A. WU’s services in Cuba were, therefore, made effective immediately.

Thus, the recent decision to provide an additional money transfer channel across Cuba seems prudent on the part of Western Union as it is expected to increase the consideration that WU receives from customers for transferring money. Money transfer revenues account for a significant chunk of WU’s top line.

A solid cross-border money transfer platform built on the back of several partnerships and significant investments enables Western Union to bring about seamless money transfers. The platform expands more than 200 countries and territories, further reinstating the belief that individuals from all across the globe put on WU while engaging in remittances.

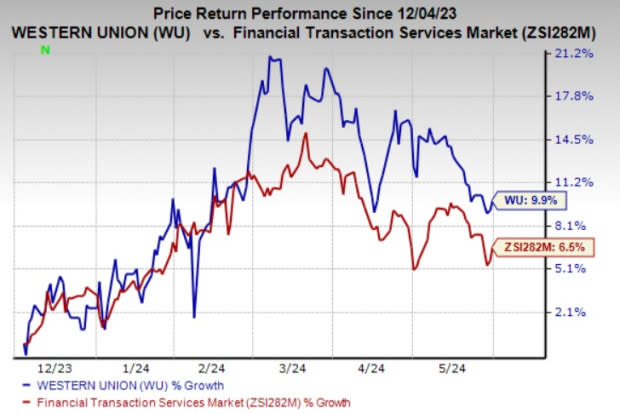

Shares of Western Union have gained 9.9% in the past six months compared with the industry’s 6.5% growth. WU currently sports a Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

Other Top-Tanked Stocks

Some other top-ranked stocks in the Business Services space are Aptiv PLC APTV, SPX Technologies, Inc. SPXC and Duolingo, Inc. DUOL, each currently flaunting a Zacks Rank of 1. You can see the complete list of today’s Zacks #1 Rank stocks here.

The bottom line of Aptiv outpaced the Zacks Consensus Estimate in each of the last four quarters, the average surprise being 12.18%. The consensus estimate for APTV’s 2024 earnings and revenues indicates an improvement of 23.7% and 5.2%, respectively, from the year-ago reported figure.

The consensus estimate for APTV’s 2024 earnings has moved 6.7% north in the past 30 days. Shares of the company have gained 1.5% in the past six months.

SPX Technologies’ earnings outpaced the Zacks Consensus Estimate in three of the trailing four quarters and matched the mark once, the average surprise being 13.92%. The consensus mark for SPXC’s 2024 earnings and revenues implies an improvement of 24.4% and 14.7%, respectively, from the year-ago reported figure.

The consensus estimate for SPXC’s 2024 earnings has moved 6.1% north in the past 30 days. Shares of the company have gained 51.5% in the past six months.

The bottom line of Duolingo outpaced the Zacks Consensus Estimate in each of the last four quarters, the average surprise being 115.22%. The consensus estimate for DUOL’s 2024 earnings is pegged at $1.74 per share, which indicates a nearly five-fold increase from the year-ago reported figure. The consensus mark for revenues implies a 37.8% increase from the year-ago reported figure.

The Zacks Consensus Estimate for DUOL’s 2024 earnings has moved 26.1% north in the past 30 days. Shares of the company have declined 11.6% in the past six months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Western Union Company (WU) : Free Stock Analysis Report

SPX Technologies, Inc. (SPXC) : Free Stock Analysis Report

Aptiv PLC (APTV) : Free Stock Analysis Report

Duolingo, Inc. (DUOL) : Free Stock Analysis Report