As global markets navigate through a landscape marked by fluctuating inflation rates and cautious monetary policies, the Hong Kong market has mirrored this volatility, particularly impacted by recent downturns in key indices like the Hang Seng. In such an environment, growth companies with high insider ownership in Hong Kong stand out as potentially resilient investments, given that high insider stakes often align leadership interests closely with shareholder value creation.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

|

Name |

Insider Ownership |

Earnings Growth |

|

iDreamSky Technology Holdings (SEHK:1119) |

20.1% |

104.1% |

|

New Horizon Health (SEHK:6606) |

16.6% |

62.3% |

|

Fenbi (SEHK:2469) |

32.1% |

43% |

|

Meitu (SEHK:1357) |

38% |

33.7% |

|

DPC Dash (SEHK:1405) |

38.2% |

89.7% |

|

Adicon Holdings (SEHK:9860) |

22.3% |

29.6% |

|

Zylox-Tonbridge Medical Technology (SEHK:2190) |

18.5% |

79.3% |

|

Beijing Airdoc Technology (SEHK:2251) |

27.4% |

83.9% |

|

Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) |

13.9% |

100.1% |

|

Ocumension Therapeutics (SEHK:1477) |

17.7% |

93.7% |

We’re going to check out a few of the best picks from our screener tool.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: BYD Company Limited operates in the automobile and battery sectors across China, Hong Kong, Macau, Taiwan, and internationally, with a market capitalization of approximately HK$717.78 billion.

Operations: The company generates revenue primarily from its automobile and battery sectors across various regions.

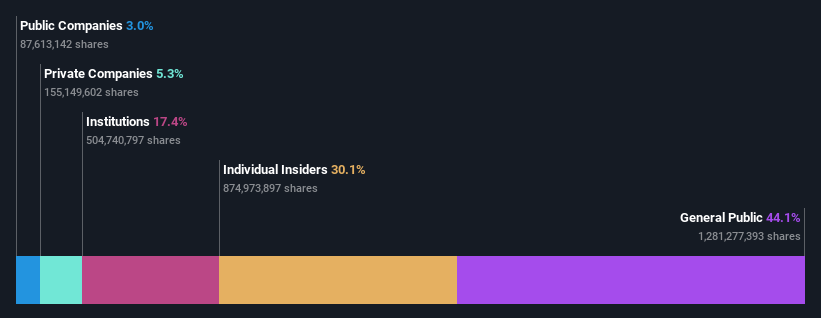

Insider Ownership: 30.1%

Revenue Growth Forecast: 14.5% p.a.

BYD, a growth company with high insider ownership in Hong Kong, is trading at 30.3% below its estimated fair value. While its earnings and revenue growth forecasts of 14.7% and 14.5% per year respectively outpace the Hong Kong market averages, these figures do not meet the significant growth threshold of over 20%. However, BYD’s Return on Equity is expected to be robust at 22.2% in three years, indicating strong profitability relative to equity levels. Recent strategic moves include launching the BYD SHARK pickup in Mexico and substantial sales volume increases year-over-year as of April 2024, showcasing operational expansion and market penetration efforts.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: China Ruyi Holdings Limited operates as an investment holding company, focusing on content production and online streaming in the People’s Republic of China, Hong Kong, Europe, and other international markets, with a market capitalization of approximately HK$25.74 billion.

Operations: The company’s revenue is primarily generated from its content production business, which earned CN¥2.23 billion, and its online streaming and gaming segments, which contributed CN¥1.38 billion.

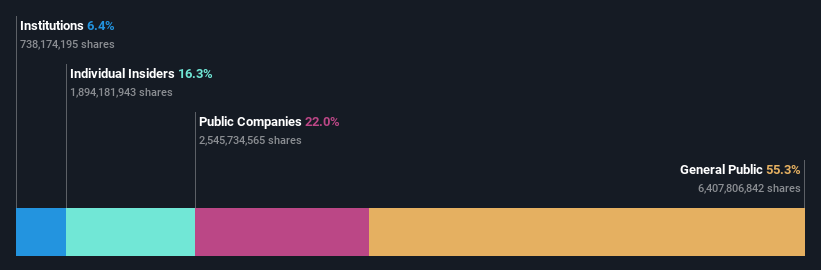

Insider Ownership: 15.3%

Revenue Growth Forecast: 27.7% p.a.

China Ruyi Holdings, a Hong Kong-based company with high insider ownership, recently reported a decline in net income and earnings per share for the full year ended December 31, 2023. Despite this, the company’s revenue saw substantial growth from CNY 1.32 billion to CNY 3.63 billion year-over-year. The firm is trading at a significant discount to its fair value and has forecasted revenue growth of 27.7% per year, outpacing the Hong Kong market average of 7.9%. Recent corporate changes include bylaw amendments and an office relocation to Causeway Bay, aiming to streamline operations ahead of its annual general meeting on June 18, 2024.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Alibaba Health Information Technology Limited operates as an investment holding company, focusing on pharmaceutical direct sales, e-commerce platforms, and healthcare and digital services in Mainland China and Hong Kong, with a market cap of HK$55.64 billion.

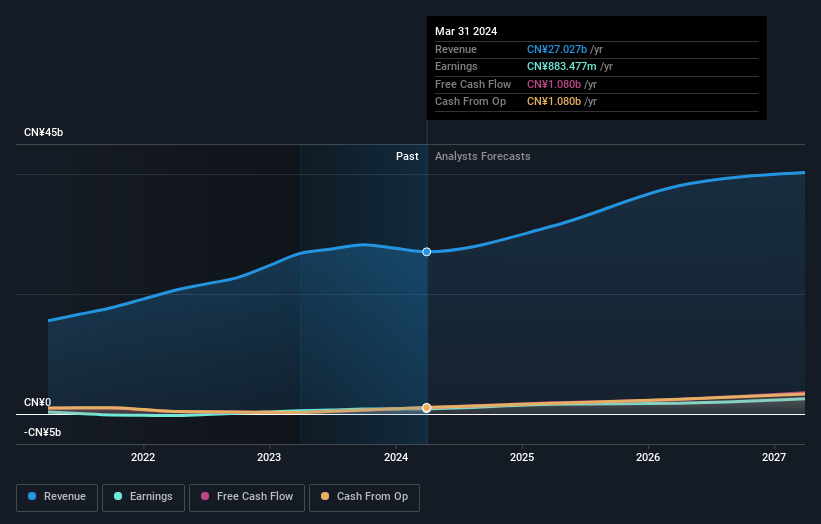

Operations: The company’s revenue primarily stems from the distribution and development of pharmaceutical and healthcare products, amounting to CN¥27.03 billion.

Insider Ownership: 24.2%

Revenue Growth Forecast: 11.2% p.a.

Alibaba Health Information Technology, despite a substantial year-over-year net income increase from CNY 535.65 million to CNY 883.48 million and a slight sales rise to CNY 27.03 billion, trades at about 61.3% below its estimated fair value, presenting a potential growth opportunity in Hong Kong’s health tech sector. The company’s earnings are expected to grow by 23.1% annually, outperforming the Hong Kong market forecast of 11.8%. However, shareholder dilution occurred over the past year, and one-off items have impacted financial results significantly.

Next Steps

Ready For A Different Approach?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SEHK:1211 SEHK:136 and SEHK:241.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com