Aptiv PLC’s APTV stock has gained 6.1% in the past three months, and we believe that it has the potential to sustain this momentum in the near term. Consequently, if you haven’t taken advantage of its share price appreciation yet, it’s time you add the stock to your portfolio.

What Makes APTV an Attractive Pick?

Solid Rank: APTV currently sports a Zacks Rank #1 (Strong Buy). Our research shows that stocks with a Zacks Rank #1 or 2 (Buy), offer attractive investment opportunities for investors. Thus, the company is a compelling investment proposition at the moment.

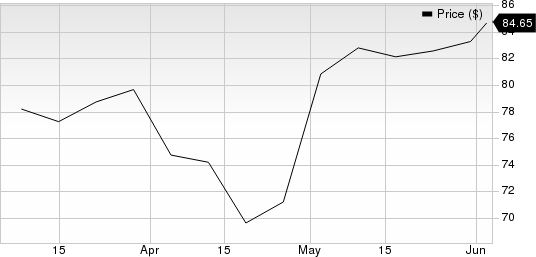

Aptiv PLC Price

Aptiv PLC price | Aptiv PLC Quote

Northward Estimate Revisions: Eight estimates for 2024 have moved north in the past 60 days versus no southward revision, reflecting analysts’ confidence in the company. The Zacks Consensus Estimate for HRB’s fiscal 2024 earnings has moved up 6% in the past 60 days.

Strong Growth Prospects: The company has an expected long-term (three to five years) earnings per share growth rate of 20.7%. Its 2024 and 2025 earnings are expected to improve 23.7% and 30%, respectively, year over year.

Positive Earnings Surprise History: APTV has an impressive earnings surprise history. The company outpaced the Zacks Consensus Estimate in all the trailing four quarters, delivering an average earnings surprise of 12.2%.

Growth Factors: Aptiv is exposed to the lucrative connected cars market. With security becoming a key selling point for connected cars, automakers are increasingly seeking related technologies. This is one of the reasons behind the quick advancement of the driver-assistance system market. Demand for personalization, infotainment connectivity and convenience are increasing rapidly. Added features require more wiring inside vehicles. We believe that with excellent system integration expertise, Aptiv is well-positioned to leverage the growing electrification, connectivity and autonomy trends in the automotive sector.

The company’s “smart architecture” provides a competitive advantage and should help it continue gaining market share. Decreasing environmental impact and increasing fuel economy are the key industry trends, and OEMs have increased their search for better engine management and lower power consumption. Aptiv intends to take advantage of this trend as its “smart architecture” reduces wiring requirements in cars, helping them become fuel-efficient and add features.

The 2023 acquisition of Höhle has strengthened the company’s Signal and Power Solutions segment. The 2022 acquisition of Wind River expanded Aptiv’s position in the automotive software solutions market.

Other Stocks to Consider

A couple of other top-ranked stocks from the broader Zacks Business Services sector are Deluxe DLX and Marvell Technology MRVL.

Deluxe currently carries a Zacks Rank of 2. It has a long-term earnings growth expectation of 12%. You can see the complete list of today’s Zacks #1 Rank stocks here.

DLX delivered a trailing four-quarter earnings surprise of 23.3%, on average.

Marvell Technology presently carries a Zacks Rank of 2. It has a long-term earnings growth expectation of 27.2%.

MRVL delivered a trailing four-quarter earnings surprise of 2.5%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Marvell Technology, Inc. (MRVL) : Free Stock Analysis Report

Deluxe Corporation (DLX) : Free Stock Analysis Report

Aptiv PLC (APTV) : Free Stock Analysis Report