Amidst a backdrop of fluctuating global markets, the Hong Kong stock market has shown resilience, reflecting broader economic dynamics and investor sentiment. In such an environment, growth companies with high insider ownership in Hong Kong can offer unique investment opportunities as these insiders often have a deep commitment to the company’s success and are likely to be well-aligned with other shareholders’ interests.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

|

Name |

Insider Ownership |

Earnings Growth |

|

iDreamSky Technology Holdings (SEHK:1119) |

20.1% |

104.1% |

|

New Horizon Health (SEHK:6606) |

16.6% |

62.3% |

|

Fenbi (SEHK:2469) |

32.1% |

43% |

|

Meitu (SEHK:1357) |

38% |

33.7% |

|

Adicon Holdings (SEHK:9860) |

22.3% |

29.6% |

|

Tian Tu Capital (SEHK:1973) |

34% |

70.5% |

|

Zhejiang Leapmotor Technology (SEHK:9863) |

14.2% |

73.8% |

|

Beijing Airdoc Technology (SEHK:2251) |

27.4% |

83.9% |

|

Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) |

13.9% |

100.1% |

|

Ocumension Therapeutics (SEHK:1477) |

17.7% |

93.7% |

Here we highlight a subset of our preferred stocks from the screener.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: BYD Company Limited operates in the automotive and battery sectors across China, Hong Kong, Macau, Taiwan, and internationally, with a market capitalization of approximately HK$725.48 billion.

Operations: The company’s revenue is primarily derived from its automotive and battery sectors.

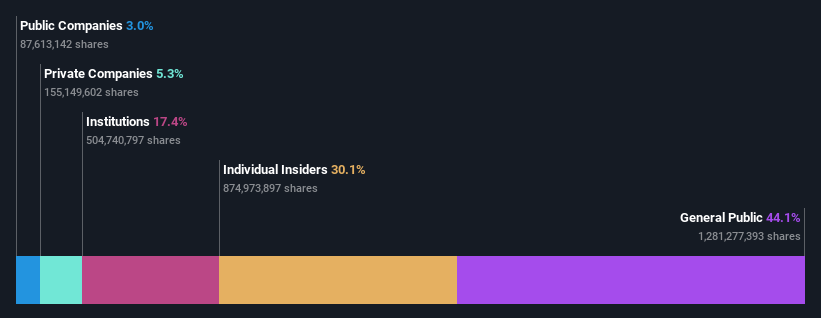

Insider Ownership: 30.1%

Earnings Growth Forecast: 14.7% p.a.

BYD, a growth company with significant insider ownership in Hong Kong, recently launched the BYD SHARK in Mexico, marking its first global product launch outside China. This move underlines BYD’s innovative edge and expansion strategy. Financially, BYD reported a robust increase in sales and production volumes year-over-year as of April 2024, reflecting strong market demand. Despite this growth, the stock is trading below its estimated fair value which might raise concerns about valuation perceptions. The company’s earnings are expected to continue growing at a rate faster than the local market average.

Simply Wall St Growth Rating: ★★★★☆☆

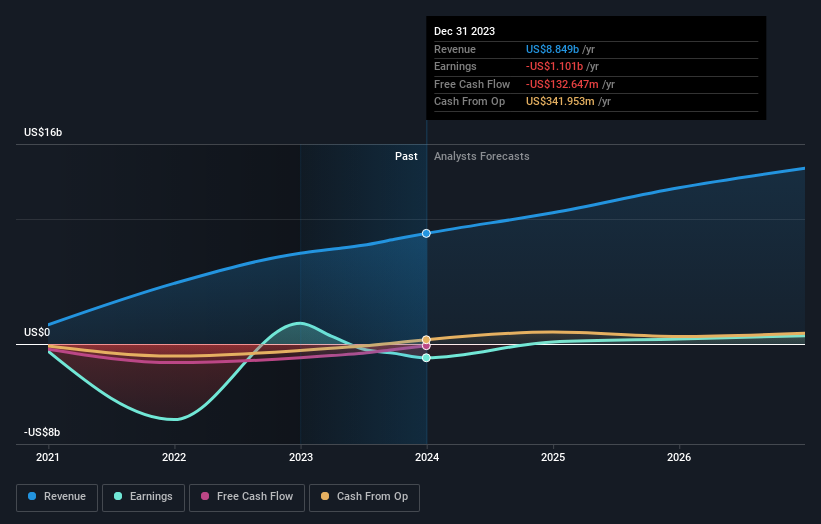

Overview: J&T Global Express Limited, an investment holding company, provides express delivery services and has a market capitalization of approximately HK$70.32 billion.

Operations: The firm primarily generates its income through express delivery services.

Insider Ownership: 20.2%

Earnings Growth Forecast: 104.1% p.a.

J&T Global Express is poised for significant growth with an expected profit surge and robust revenue increases in the coming years. Recent operational results showed a substantial rise in parcel volume, indicating strong business momentum. However, insider transactions have been minimal, and recent executive changes could impact corporate governance dynamics. Despite these challenges, J&T’s projected revenue growth outpaces the local market, positioning it as a promising but cautious pick among Hong Kong growth companies with high insider ownership.

Simply Wall St Growth Rating: ★★★★☆☆

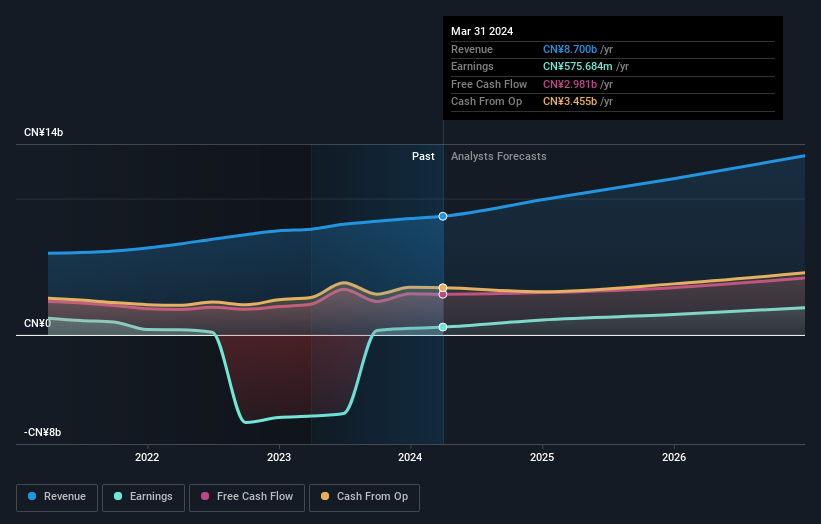

Overview: Kingsoft Corporation Limited operates in the entertainment and office software services sector across Mainland China, Hong, Kong, and globally, with a market capitalization of approximately HK$35.02 billion.

Operations: The company generates revenue through two primary segments: office software and services, which brought in CN¥4.73 billion, and entertainment software and others, accounting for CN¥3.97 billion.

Insider Ownership: 20.3%

Earnings Growth Forecast: 33.3% p.a.

Kingsoft, a company with high insider ownership in Hong Kong, is trading at 57.7% below its estimated fair value, indicating potential undervaluation. Its earnings are expected to grow by 33.27% annually over the next three years, outpacing the local market’s forecast of 11.9%. Despite this robust profit outlook and recent approval of a dividend increase at its AGM on May 23, 2024, Kingsoft’s return on equity is projected to remain low at 7.2%, suggesting some challenges in capital efficiency.

Seize The Opportunity

Searching for a Fresh Perspective?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SEHK:1211 SEHK:1519 and SEHK:3888.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com