NIO Inc. NIO incurred a loss per American Depositary Share of 36 cents in the first quarter of 2024, wider than the Zacks Consensus Estimate of a loss of 31 cents. The company had reported a loss of 42 cents in the year-ago quarter.

This China-based electric vehicle maker posted revenues of $1.37 billion, which missed the Zacks Consensus Estimate of $1.48 billion and fell 12.2% year over year due to lower delivery volumes.

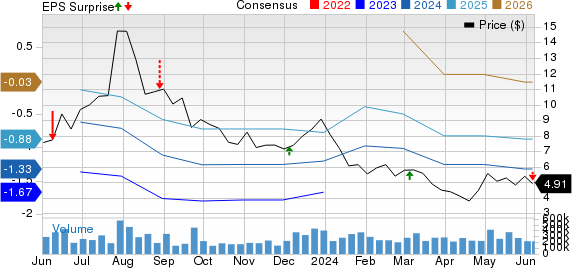

NIO Inc. Price, Consensus and EPS Surprise

NIO Inc. price-consensus-eps-surprise-chart | NIO Inc. Quote

Key Details

NIO delivered 30,053 vehicles in the first quarter, down 3.2% year over year, including 17,809 SUVs and 12,244 sedans.

Revenues generated from vehicle sales amounted to $1.16 billion, down 13.4% year over year. The drop in sales was mainly attributable to lower delivery volume. Other sales of $211.5 million remained flat on a year-over-year basis.

Gross profit came in at $67.6 million, up 186.4% year over year. Vehicle margin in the reported quarter climbed to 9.2% from 5.1% in first-quarter 2023 due to lower material cost per unit. Gross margin was 4.9%, up from 1.5% in the year-ago quarter.

Research & development costs amounted to $396.7 million, which declined 11.4% year over year. Selling, general & administrative costs were $415.1 million, up 16.5% year over year.

As of Mar 31, 2024, cash and cash equivalents totaled $3.30 billion and long-term debt amounted to $1.58 billion.

For second-quarter 2024, NIO projects deliveries in the range of 54,000-56,000 vehicles, implying a rise of 129.6-138.1% year over year. Revenues are estimated between $2,297 million and $2,373 million.

Zacks Rank & Key Picks

NIO currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the auto space are Blue Bird Corporation BLBD, Oshkosh Corporation OSK and Geely Automobile Holdings Limited GELYY. While BLBD and OSK sport a Zacks Rank #1 (Strong Buy) each, GELYY carries a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The consensus estimate for BLBD’s 2024 sales and earnings suggests year-over-year growth of 17.29% and 155.14%, respectively. The EPS estimates for 2024 and 2025 have improved 63 cents and 69 cents, respectively, in the past 30 days.

The Zacks Consensus Estimate for OSK’s 2024 sales and earnings suggests year-over-year growth of 9.86% and 11.92%, respectively. The EPS estimates for 2024 and 2025 have improved 12 cents and 10 cents, respectively, in the past 30 days.

The Zacks Consensus Estimate for GELYY’s 2024 sales suggests year-over-year growth of 36.6%. The EPS estimates for 2024 and 2025 have moved up 21 cents and 34 cents, respectively, in the past 60 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Oshkosh Corporation (OSK) : Free Stock Analysis Report

Geely Automobile Holdings Ltd. (GELYY) : Free Stock Analysis Report

Blue Bird Corporation (BLBD) : Free Stock Analysis Report

NIO Inc. (NIO) : Free Stock Analysis Report