Sales of passenger cars registered 95,158 units in May, 3.4% more than a year ago

The market for electric and plug-in hybrid passenger cars decreased by 11.9% in May, with 9,180 sales and a 9.6% share, two points less than a year ago

Registrations of light commercial vehicles grow by 29.1%, with 15,565 sales

Sales of commercial vehicles, buses, coaches and minibuses increase 19.7% in May with 2,978 units

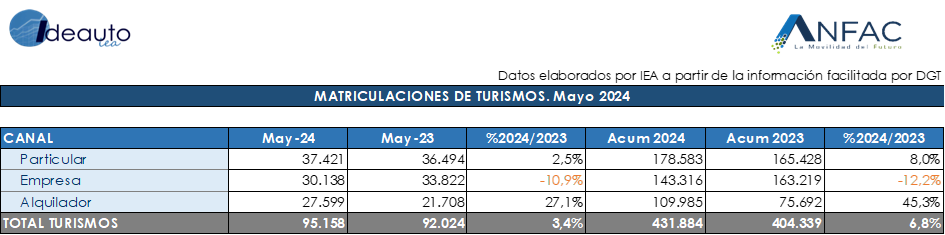

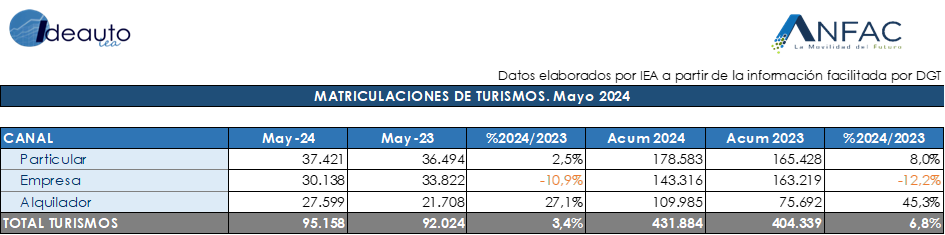

Madrid, June 3, 2024. The passenger car market increases 3.4% in the fifth month of the year, with 95,158 units. An improvement driven, mainly, by the push of the rent-a-car channel in the past month, which allows maintaining the positive pace that has been registered in previous months. In the first five months, the market has grown by 6.8%, with 431,884 new registrations. Even so, the market still remains 23% below 2019 volumes.

Despite the growth of the overall passenger car market, electrified sales have stagnated. In May, 9,180 electrified passenger cars (pure electric and plug-in hybrids) were registered, which represents a drop of 11.9% compared to May 2023. This figure places the electrified market at 9.65% of the total share, close to two percentage points less than a year ago and worsening the record. In the total for the year, the market grows by 3.5%, with 45,154 units, but only with 10.45% of the total market, a figure that is below that registered in 2023, which was 10.79%

The average CO2 emissions of passenger cars sold in May remain at 119.1 grams of CO2 per kilometer traveled, 1.4% higher than the average emissions of new passenger cars sold in the same month of 2023. In total of the year, an average of 117.8 grams of CO2 per kilometer traveled is recorded, 0.78% lower.

Regarding sales by channels, with the exception of companies, increases were recorded. Mainly from the rental channel, which registered a growth of 27.1%, with 27,599 units. Likewise, private sales grew by 2.5%, with 37,421 sales. On the contrary, the business channel registered a decrease of 10.9% and 30,138 sales in May.

LIGHT COMMERCIAL VEHICLES

Registrations of light commercial vehicles achieved strong growth of 29.1%, with 15,565 units in May. In the first five months of the year, a total of 69,096 new registrations were accumulated, which is 21.5% more than the same period of the previous year. Regarding sales by channels, all register growth. Rental companies with 3,104 sales are the ones that increased the most, with 99.2% more registrations compared to a year ago. Similarly, companies with 12.6% more and 9,841 units and the self-employed with an increase of 48.8% and 2,620 sales, maintain a path of improvement in the month.

INDUSTRIAL AND BUSES

In May, registrations of commercial vehicles, buses, coaches and minibuses significantly increase sales. In the fifth month, a growth of 19.7% was achieved, with 2,978 units. In the total for the year, there are 15,465 units, with an increase of 22.4%. By type of vehicle, both industrial vehicles and buses and coaches managed to grow, with an improvement of 14.2% and 65.9%, respectively, in the month. Where industrial companies register 2,535 new units and buses and coaches register 443 new registrations.

STATEMENTS

Félix García, director of communication and marketing at ANFAC, explained that “the passenger car market has slowed down during the month of May. It grows, but only at 3.4%. If we stay with the positive data, it is that in the accumulated growth of the year the path of growth continues up to almost 7%. More worrying is the stagnation suffered by sales of electric and plug-in hybrid passenger cars, which fell by 11.9% in May. The sales figures for this type of vehicle are below those of last year and the noise against the electric vehicle does not benefit sales. From the sector we are concerned that with this level of sales of zero-emission vehicles we will not meet the decarbonization objectives. The sector does not stop launching models with plugs to the market, but alone we cannot push the cart any further. Greater involvement and speed from the administration would be necessary to help citizens opt for new technologies.”

Raúl Morales, communication director of FACONAUTO, indicated that “vehicle registrations in the month of May confirm the upward trend that we already saw in the month of April and leaves us with a stable market with the individual channel, that one-to-one sale. what the dealer does, and the channel of vehicle rental companies supporting the market. The business channel still shows no signs of recovery compared to last year’s figures. A positive fact about these registrations in the month of May is that we are once again approaching those 100,000 sales that, psychologically, are positive for the sector and that mark a favorable trend that, we hope, will be confirmed in the coming summer months where the activity Dealer sales are usually better. From the statistics for the month of May, it is worth pausing with respect to Galicia, since its “Renew your Vehicle” plan continues to have a positive impact on registrations. Since January, vehicle sales in Galicia have grown at double the speed compared to those in Spain, and this means that when a well-thought-out fleet renewal plan is established, citizens stop having doubts and end up changing. your vehicle towards more efficient and safer models.

GANVAM’s communications director, Tania Puche, pointed out that “registrations in May are close to 100,000 units, which we can consider the natural volume of our market, taking into account our level of population, motorization and per capita income. However, we are still at volumes more than 20% lower than pre-pandemic levels. The market is driven, above all, by the purchases of rental companies, which are preparing for the summer tourist campaign; while business registrations remain negative, showing the weakness of business investment. This has a clear impact on the speed of fleet electrification, given that large corporate fleets are the ones that should drive the transition towards zero-emission vehicles. That is why, with our eyes set on the European elections this Sunday, it is so important to have a framework that guarantees stability and adequate incentives to stimulate investments.”