Amid a backdrop of mixed global economic signals, with the Hang Seng Index showing resilience by rising 1.59%, investors in Hong Kong are increasingly focusing on growth companies that exhibit high insider ownership. Such stocks often suggest a commitment from management and major stakeholders to the company’s long-term success, which can be particularly appealing in uncertain market conditions.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

|

Name |

Insider Ownership |

Earnings Growth |

|

iDreamSky Technology Holdings (SEHK:1119) |

20.1% |

104.1% |

|

New Horizon Health (SEHK:6606) |

16.6% |

62.3% |

|

Meitu (SEHK:1357) |

38% |

33.7% |

|

DPC Dash (SEHK:1405) |

38.2% |

89.7% |

|

Zylox-Tonbridge Medical Technology (SEHK:2190) |

18.5% |

79.3% |

|

Adicon Holdings (SEHK:9860) |

22.3% |

29.6% |

|

Tian Tu Capital (SEHK:1973) |

34% |

70.5% |

|

Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) |

13.9% |

100.1% |

|

Zhejiang Leapmotor Technology (SEHK:9863) |

15% |

73.8% |

|

Beijing Airdoc Technology (SEHK:2251) |

27.8% |

83.9% |

Underneath we present a selection of stocks filtered out by our screen.

Simply Wall St Growth Rating: ★★★★☆☆

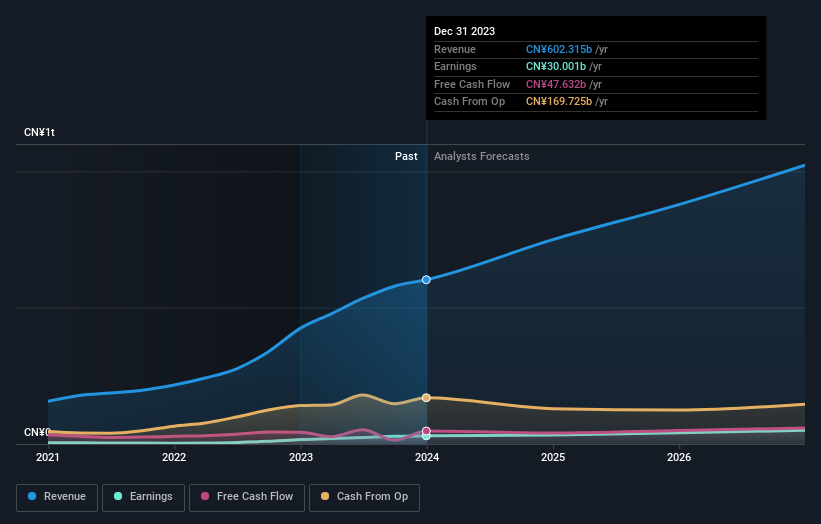

Overview: BYD Company Limited operates in the automotive and battery sectors across China, Hong Kong, Macau, Taiwan, and globally, with a market capitalization of approximately HK$708.77 billion.

Operations: The company generates revenue primarily from its automotive and battery sectors.

Insider Ownership: 30.1%

BYD, a growth company with significant insider ownership in Hong Kong, recently approved amendments to its bylaws and declared a dividend of RMB 3.096 per share. The firm reported substantial year-over-year increases in monthly and annual production and sales volumes, indicating robust operational growth. Additionally, BYD’s launch of the SHARK pickup in Mexico marks its first global product introduction outside China, potentially expanding its market footprint. These developments suggest a positive outlook, aligning with forecasts that BYD’s earnings will grow faster than the Hong Kong market average.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Alibaba Health Information Technology Limited operates in pharmaceutical direct sales, e-commerce platforms, and healthcare digital services in Mainland China and Hong Kong, with a market capitalization of approximately HK$62.07 billion.

Operations: The company generates revenue primarily through the distribution and development of pharmaceutical and healthcare products, totaling CN¥27.03 billion.

Insider Ownership: 24.2%

Alibaba Health Information Technology, a company with high insider ownership in Hong Kong, reported a significant increase in net income and sales for the fiscal year ending March 31, 2024. The company’s earnings per share also saw substantial growth from the previous year. Despite some shareholder dilution over the past year, Alibaba Health is poised for robust future earnings growth, significantly outpacing the Hong Kong market average. Recent agreements to provide software services to Taobao China Companies underline its strategic expansion efforts and potential revenue streams.

Simply Wall St Growth Rating: ★★★★★☆

Overview: Meituan is a technology retail company based in the People’s Republic of China, with a market capitalization of approximately HK$683.48 billion.

Operations: The company’s revenue streams are derived from various technology retail activities in China.

Insider Ownership: 12.2%

Meituan, demonstrating strong growth with high insider ownership, reported a substantial increase in quarterly sales to CNY 73.28 billion and net income to CNY 5.37 billion as of Q1 2024. This performance underscores a robust year-on-year growth trajectory. Despite some volatility in earnings due to one-off items, the company’s revenue and earnings are forecasted to grow faster than the market average, with insiders actively increasing their holdings recently, signaling confidence in its strategic direction and governance enhancements.

Make It Happen

Looking For Alternative Opportunities?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SEHK:1211 SEHK:241 and SEHK:3690.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com