As global markets continue to navigate a complex landscape marked by political uncertainties and fluctuating economic indicators, the Hong Kong market remains a focal point for investors looking for growth opportunities. High insider ownership in SEHK-listed companies often signals strong confidence in the company’s future prospects, making these stocks particularly interesting in the current environment.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

|

Name |

Insider Ownership |

Earnings Growth |

|

iDreamSky Technology Holdings (SEHK:1119) |

20.1% |

104.1% |

|

Fenbi (SEHK:2469) |

32.4% |

43% |

|

Joy Spreader Group (SEHK:6988) |

36.5% |

107.6% |

|

DPC Dash (SEHK:1405) |

38.2% |

89.7% |

|

Zylox-Tonbridge Medical Technology (SEHK:2190) |

18.5% |

79.3% |

|

Adicon Holdings (SEHK:9860) |

22.3% |

29.6% |

|

Tian Tu Capital (SEHK:1973) |

34% |

70.5% |

|

Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) |

13.9% |

100.1% |

|

Zhejiang Leapmotor Technology (SEHK:9863) |

15% |

76.5% |

|

Beijing Airdoc Technology (SEHK:2251) |

28.2% |

83.9% |

We’re going to check out a few of the best picks from our screener tool.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: BYD Company Limited operates in the automobile and battery sectors across China, including Hong Kong, Macau, Taiwan, and other international markets, with a market capitalization of approximately HK$756.33 billion.

Operations: The company generates revenue from its automobile and battery sectors across various regions including China, Hong Kong, Macau, Taiwan, and internationally.

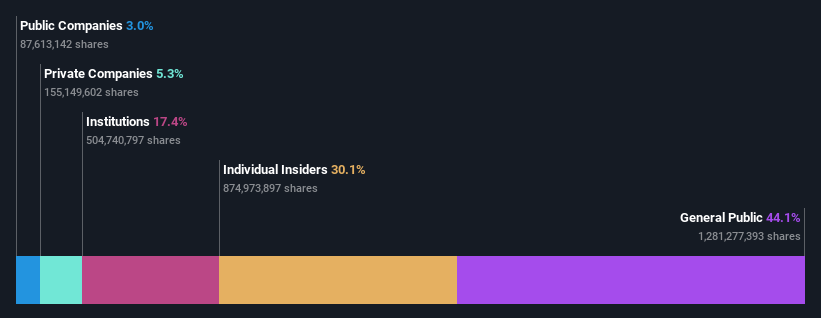

Insider Ownership: 30.1%

Revenue Growth Forecast: 14.2% p.a.

BYD Company Limited, a significant player in the electric vehicle industry, recently showcased robust growth with substantial increases in monthly and annual sales and production volumes. Noteworthy is the launch of BYD SHARK in Mexico, marking its first global product debut outside China, which could redefine the plug-in hybrid pickup market with advanced technology. Despite high insider ownership suggesting strong confidence from within, BYD’s revenue growth forecast at 14.2% per year outpaces the Hong Kong market’s 7.8%, yet falls short of more aggressive growth benchmarks. The company also maintains an appealing dividend policy with recent increases, reinforcing its shareholder value proposition amidst strategic expansions and technological advancements.

Simply Wall St Growth Rating: ★★★★☆☆

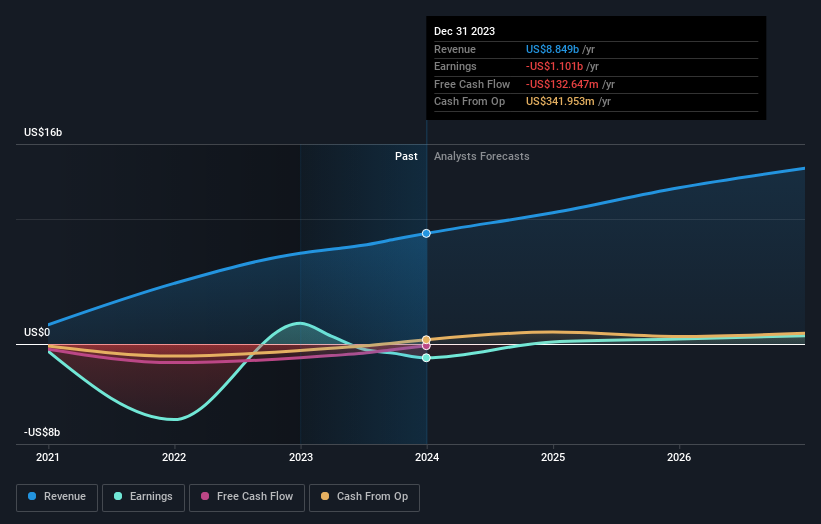

Overview: J&T Global Express Limited, primarily engaged in express delivery services as an investment holding company, has a market capitalization of approximately HK$73.41 billion.

Operations: The company generates HK$8.85 billion from its air freight transportation segment.

Insider Ownership: 20.2%

Revenue Growth Forecast: 15.5% p.a.

J&T Global Express Limited, despite recent board changes with Mr. Peter Lai Hock Meng stepping in as an independent non-executive director, is poised for notable growth. The company reported a significant increase in parcel volume this quarter and was recently added to the S&P Global BMI Index. With insider ownership aligning interests with shareholders, J&T is forecasted to become profitable within three years and expects revenue growth of 15.5% annually—outpacing the Hong Kong market average of 7.8%. However, its projected return on equity remains low at 17.6%.

Simply Wall St Growth Rating: ★★★★★☆

Overview: Meituan is a technology retail company based in the People’s Republic of China, with a market capitalization of approximately HK$720.96 billion.

Operations: The company’s revenue is derived from various technology retail activities in China.

Insider Ownership: 11.4%

Revenue Growth Forecast: 12.7% p.a.

Meituan, a prominent player in Hong Kong’s growth sector with high insider ownership, has demonstrated robust financial performance. In Q1 2024, the company reported a significant increase in sales to CNY 73.28 billion and net income to CNY 5.37 billion, reflecting substantial year-over-year growth. Despite no major insider purchases recently, Meituan is expected to maintain strong earnings growth at an annual rate of 31.5%, outstripping the Hong Kong market projection of 11.7%. However, concerns about substantial insider selling and large one-off items affecting its financial results persist.

Where To Now?

Ready To Venture Into Other Investment Styles?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SEHK:1211 SEHK:1519 and SEHK:3690.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com