Amidst a backdrop of fluctuating global markets, Hong Kong’s Hang Seng Index has shown resilience with a modest gain, reflecting investor optimism and robust retail sales growth. In such an environment, stocks with high insider ownership in Hong Kong can be particularly compelling as they often signal strong confidence from those closest to the company’s operations.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

|

Name |

Insider Ownership |

Earnings Growth |

|

iDreamSky Technology Holdings (SEHK:1119) |

20.1% |

104.1% |

|

Fenbi (SEHK:2469) |

32.5% |

43% |

|

Zylox-Tonbridge Medical Technology (SEHK:2190) |

18.7% |

79.3% |

|

Adicon Holdings (SEHK:9860) |

22.3% |

29.6% |

|

Tian Tu Capital (SEHK:1973) |

33.9% |

70.5% |

|

DPC Dash (SEHK:1405) |

38.2% |

89.7% |

|

Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) |

13.9% |

100.1% |

|

Zhejiang Leapmotor Technology (SEHK:9863) |

15% |

76.5% |

|

Beijing Airdoc Technology (SEHK:2251) |

28.2% |

83.9% |

|

Ocumension Therapeutics (SEHK:1477) |

23.1% |

93.7% |

We’ll examine a selection from our screener results.

Simply Wall St Growth Rating: ★★★★☆☆

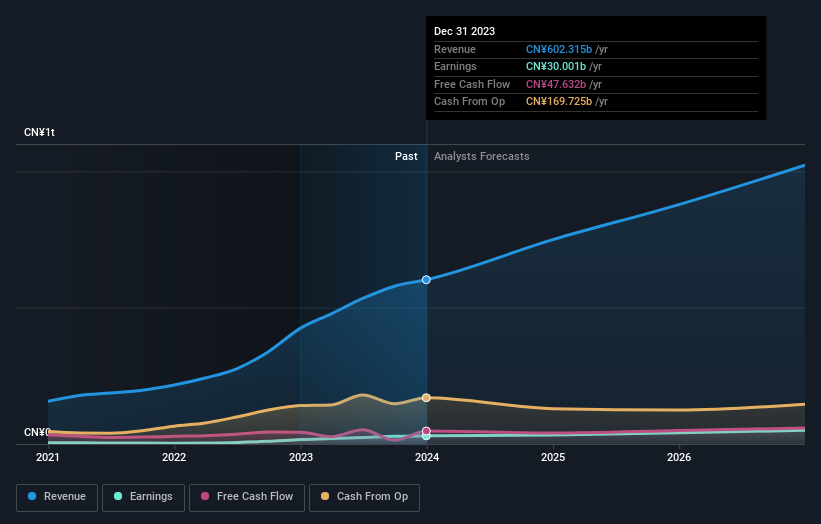

Overview: BYD Company Limited operates in the automobile and battery sectors across Mainland China, Hong Kong, Macau, Taiwan, and internationally, with a market capitalization of approximately HK$745.91 billion.

Operations: The company’s revenue is primarily generated from its automobile and battery sectors across various regions including Mainland China, Hong Kong, Macau, Taiwan, and internationally.

Insider Ownership: 30.1%

Earnings Growth Forecast: 14.9% p.a.

BYD, a notable growth company in Hong Kong, demonstrates robust insider ownership but shows mixed financial dynamics. Its earnings grew by 52.7% last year and are projected to increase at 14.9% annually, surpassing the local market’s average of 11.5%. However, its revenue growth forecast of 14.1% yearly slightly lags behind more aggressive benchmarks considered high growth. Despite trading below fair value by 14.4%, indicating potential undervaluation, the absence of significant insider buying over recent months might temper investor enthusiasm regarding governance and future prospects alignment.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Meitu, Inc. is an investment holding company that specializes in creating image, video, and design products aimed at enhancing digitalization in the beauty industry, operating both in the People’s Republic of China and internationally, with a market capitalization of HK$12.11 billion.

Operations: The company generates revenue primarily through its Internet Business segment, which amounted to CN¥2.70 billion.

Insider Ownership: 36.6%

Earnings Growth Forecast: 28.9% p.a.

Meitu, a growth-oriented company in Hong Kong, recently approved significant corporate governance changes and dividend payouts at its AGM. While Meitu’s revenue growth is expected to be robust at 17.7% annually, slightly below the high-growth benchmark of 20%, its earnings are projected to expand impressively by 28.9% per year, outpacing the local market’s average. Despite trading significantly below its estimated fair value, concerns about shareholder dilution and substantial insider selling could affect investor confidence in its governance alignment.

Simply Wall St Growth Rating: ★★★★★☆

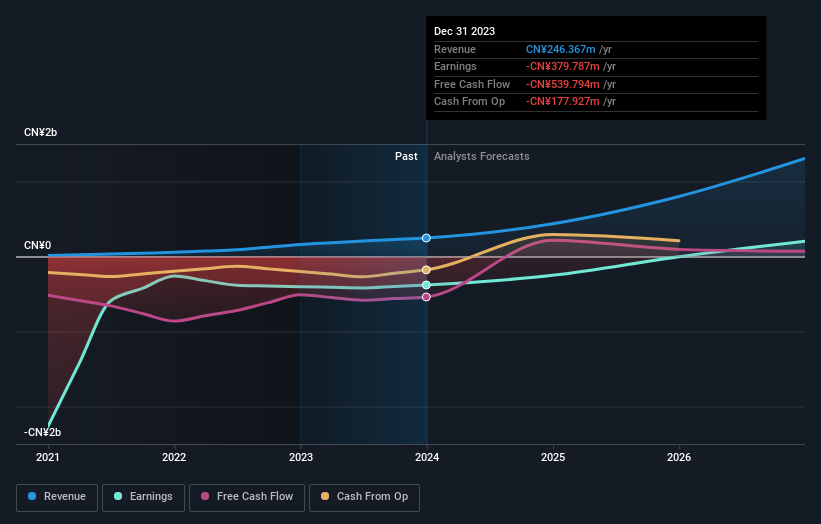

Overview: Ocumension Therapeutics operates as an ophthalmic pharmaceutical platform company in the People’s Republic of China, with a market capitalization of approximately HK$4.74 billion.

Operations: The company generates revenue primarily through the discovery, development, and commercialization of ophthalmic therapies, totaling CN¥246.37 million.

Insider Ownership: 23.1%

Earnings Growth Forecast: 93.7% p.a.

Ocumension Therapeutics, a Hong Kong-based growth company with high insider ownership, has shown promising developments in its pharmaceutical pipeline. Recent successful phase III trials of OT-502 and OT-702 highlight its innovation in ophthalmic treatments. Despite a low forecasted return on equity of 3.8% in three years, revenue and earnings are expected to grow by 35.2% and 93.7% annually. These factors position Ocumension as an emerging leader in its sector, although profitability is only anticipated within the next three years.

Taking Advantage

Seeking Other Investments?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SEHK:1211 SEHK:1357 and SEHK:1477.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com