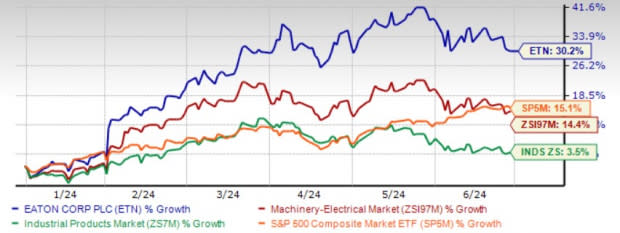

Shares of Eaton Corporation ETN have gained 30.2% year to date compared to its industry’s growth of 14.2%. The power management company operates in more than 175 countries across the globe, and an ongoing improvement in the end market conditions is boosting orders and revenues.

Organic growth, and continued investment in research and development of new products are assisting the company in providing efficient power management solutions to its clients. Strategic acquisitions are further expanding its market reach.

Courtesy of strong contributions from its segments, Eaton has outperformed its sector and the S&P 500 in the year-to-date period.

Price Performance (Year to Date)

Image Source: Zacks Investment Research

Global Reach and Wide Products Base

Eaton supplies energy-efficient solutions to a broad customer base globally across various markets. This leads to stability in revenue generation, and the loss of a customer should not have any significant impact on revenues and margins.

Demand for electric vehicle (EV) charging infrastructure is growing globally and Eaton, with its expertise, is working to grab a larger market share in this fast-expanding business. Eaton provides flexible, convenient and sustainable EV charging solutions, including a wide range of AC and DC chargers, power management systems and software services.

Reindustrialization and megatrends worldwide, with $1.2 trillion in cumulative mega projects announced in North America since January 2021, have also favored Eaton. The company has already won over $1 billion in new orders and is in active negotiation on another $1 billion of electrical content on a small subset of these total projects. Only a tiny portion of the orders have been reflected in total revenues. So, the impact and benefit of the step-up in mega projects will be reflected in total revenues over the long term.

The new AI training data centers, which require both high power and density, are creating a new opportunity for growth for this power management company. Eaton is strengthening its participation across the entire electrical power value chain and benefiting from momentum in data center and utility end markets as well as a growth cycle in the commercial aerospace and defense markets.

Free Cash Flow & Shareholders’ Value

Eaton continues to generate stable free cash flow from its operations and rewards its shareholders through share buybacks and dividend payments. The company expects to generate free cash flow in the $3.2-$3.6 billion range in 2024.

As of Mar 31, 2024, there was $3.94 billion available for share repurchases under the 2022 Program. The company will continue to pursue share repurchases this year, depending on market conditions and capital levels, and plans to repurchase shares in the range of $1.5-$2.5 billion this year. During the first quarter, Eaton’s board of directors approved a 9% increase to the dividend paid in the fourth quarter of 2023 to 94 cents per share, with a dividend yield of 1.2%. Eaton’s management has raised dividends for 15 consecutive years. Another operator in this space, Emerson Electric Company EMR has increased its dividend for 28 years consecutively and currently has a dividend yield of 1.91%.

Return on Capital

Return on invested capital (ROIC) has hovered around 8% over the last few years and outperformed the industry average in the trailing 12 months. ROIC of ETN was 8.31% compared with the industry average of 3.44%. The company has been investing effectively in profitable projects, which is evident from its ROIC.

ETN’s trailing 12-month return on equity is 20.7%, ahead of the industry average of 9.9%. Return on equity, a profitability measure, reflects how effectively a company is utilizing its shareholders’ funds in its operations to generate income.

Estimates Moving North

Riding on the back of strong performance in the first quarter, the company now projects adjusted earnings per share (EPS) in the range of $10.20-$10.60 for 2024, indicating an increase of 14% at the midpoint from the prior-year levels. The company raised its organic sales guidance for 2024 from 6.5-8.5% to 7-9%. Eaton also raised its segment margin guidance from 22.4-22.8% to 22.8-23.2%.

The Zacks Consensus Estimate for ETN’s 2024 and 2025 earnings per share has moved up 2.7% and 2.3% in the last 60 days. The Zacks Consensus Estimate of 2024 earnings per share of Illinois Tool Works ITW, another operator in this space, moved up by 0.9% in the last 60 days. The estimates for ITW’s 2025 (EPS) fell by 0.4% in the same frame.

EPS Movement Chart

Image Source: Zacks Investment Research

Stock Valuation

Eaton’s stock is currently overvalued compared to its industry, as shown in the chart below. Given Eaton’s strong product offering, rising earnings estimates and strong return on capital, a premium valuation is quite justified for this stock.

Valuation Chart

Image Source: Zacks Investment Research

To Sum Up

Eaton continues to benefit from the strong contribution of its organic assets. The company is upgrading the quality of its products through research and development work. Proper power management is essential for the successful performance of a project and Eaton continues to provide the required solution to its customers.

Given the positive movement in earnings estimates, strong return on capital and stable free cash flow generation capacity, Zacks Rank#2 (Buy) Eaton is currently an ideal candidate to add to your portfolio.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Illinois Tool Works Inc. (ITW) : Free Stock Analysis Report

Emerson Electric Co. (EMR) : Free Stock Analysis Report

Eaton Corporation, PLC (ETN) : Free Stock Analysis Report