Amidst a generally quiet period in global markets, with major U.S. stock indexes posting modest gains and anticipation building ahead of key economic updates, investors continue to seek opportunities that might be overlooked. In such an environment, identifying undervalued stocks becomes crucial as they may offer intrinsic discounts that could align well with strategic investment considerations during uncertain times.

Top 10 Undervalued Stocks Based On Cash Flows

|

Name |

Current Price |

Fair Value (Est) |

Discount (Est) |

|

Sparebanken Vest (OB:SVEG) |

NOK130.88 |

NOK262.26 |

50.1% |

|

Medley (TSE:4480) |

¥3560.00 |

¥7128.75 |

50.1% |

|

Calibre Mining (TSX:CXB) |

CA$1.94 |

CA$3.58 |

45.8% |

|

Arcadis (ENXTAM:ARCAD) |

€59.00 |

€118.18 |

50.1% |

|

Elkem (OB:ELK) |

NOK20.48 |

NOK40.95 |

50% |

|

Beijing Aosaikang Pharmaceutical (SZSE:002755) |

CN¥9.13 |

CN¥18.84 |

51.5% |

|

Zylox-Tonbridge Medical Technology (SEHK:2190) |

HK$10.80 |

HK$21.67 |

50.2% |

|

Levima Advanced Materials (SZSE:003022) |

CN¥13.38 |

CN¥27.43 |

51.2% |

|

Lumi Gruppen (OB:LUMI) |

NOK13.00 |

NOK26.27 |

50.5% |

|

Alnylam Pharmaceuticals (NasdaqGS:ALNY) |

US$248.68 |

US$495.29 |

49.8% |

Let’s review some notable picks from our screened stocks

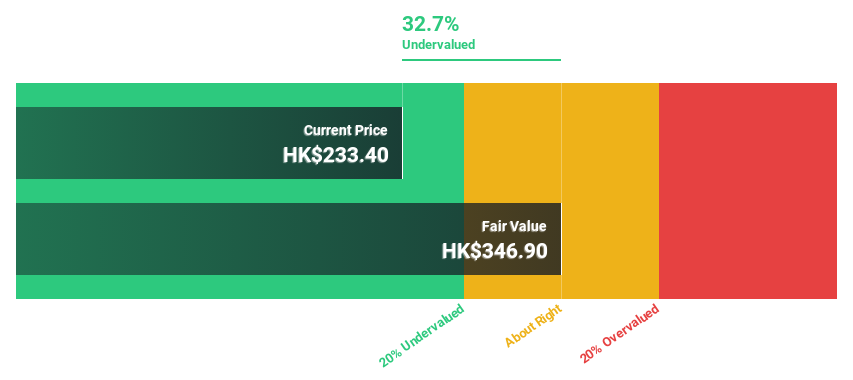

Overview: BYD Company Limited operates in the automobile and battery sectors across China, Hong Kong, Macau, Taiwan, and internationally, with a market capitalization of approximately HK$724.46 billion.

Operations: The company’s revenue is generated primarily from its automobile and battery sectors.

Estimated Discount To Fair Value: 33.2%

BYD, despite recent robust sales and production growth, is trading at HK$230.2, significantly below the estimated fair value of HK$353.75, indicating a potential undervaluation based on discounted cash flow analysis. This undervaluation persists even as BYD’s revenue and earnings are expected to outpace the Hong Kong market with forecasts of 13.7% and 14.8% annual growth respectively. However, it’s crucial to consider that while profit increased by over 50% last year, future earnings growth isn’t projected to be extraordinarily high, tempering some expectations for long-term performance acceleration.

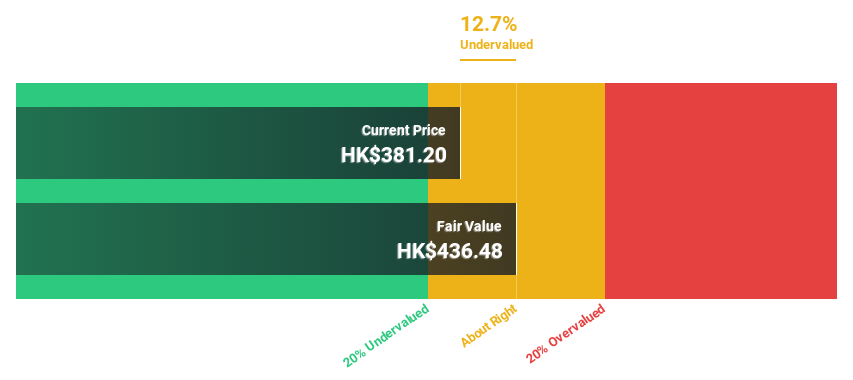

Overview: Tencent Holdings Limited operates as an investment holding company, providing value-added services, online advertising, fintech, and business services both in the People’s Republic of China and globally, with a market cap of approximately HK$3.49 trillion.

Operations: Tencent’s revenue is derived primarily from value-added services (CN¥297.67 billion), fintech and business services (CN¥207.36 billion), and online advertising (CN¥107.02 billion).

Estimated Discount To Fair Value: 39.6%

Tencent Holdings, with a current trading price of HK$379.4, appears undervalued based on a discounted cash flow valuation estimating its fair value at HK$632.69. Despite lower profit margins year-over-year (21.2% from 33.5%), the company’s earnings are expected to grow by 14.6% annually, outpacing the Hong Kong market’s 11.2%. Additionally, recent share buyback programs could enhance shareholder value by potentially increasing net asset value and earnings per share, reflecting positive management actions to utilize capital effectively.

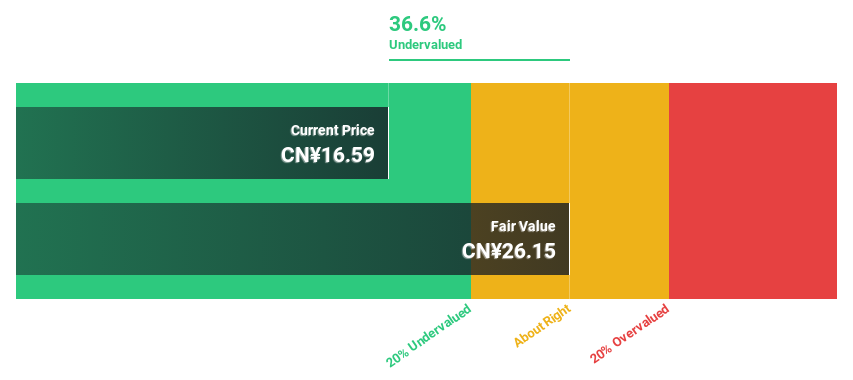

Overview: Ningxia Baofeng Energy Group Co., Ltd. is involved in the production and sale of a range of products including coal mining, washing, coking, coal tar, crude benzene, C4 deep-processed products, methanol, and olefins, with a market capitalization of approximately CN¥126.82 billion.

Operations: The company generates revenue from the production and sale of products such as coal mining, washing, coking, coal tar, crude benzene, C4 deep-processed products, methanol, and olefins.

Estimated Discount To Fair Value: 38.4%

Ningxia Baofeng Energy Group is priced at CN¥17.34, significantly below the estimated fair value of CN¥28.16, indicating potential undervaluation based on cash flows. Despite a dividend coverage issue, with a yield of 1.61% not well supported by cash flow, the company’s financials show promise with earnings expected to grow by 33.1% annually and revenue growth forecasted at 26.4% per year—both exceeding market averages significantly. However, high debt levels pose a financial risk that needs consideration.

Make It Happen

-

Click through to start exploring the rest of the 960 Undervalued Stocks Based On Cash Flows now.

-

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio’s performance.

-

Simply Wall St is a revolutionary app designed for long-term stock investors, it’s free and covers every market in the world.

Looking For Alternative Opportunities?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SEHK:1211 SEHK:700 and SHSE:600989.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com