08 July 2024

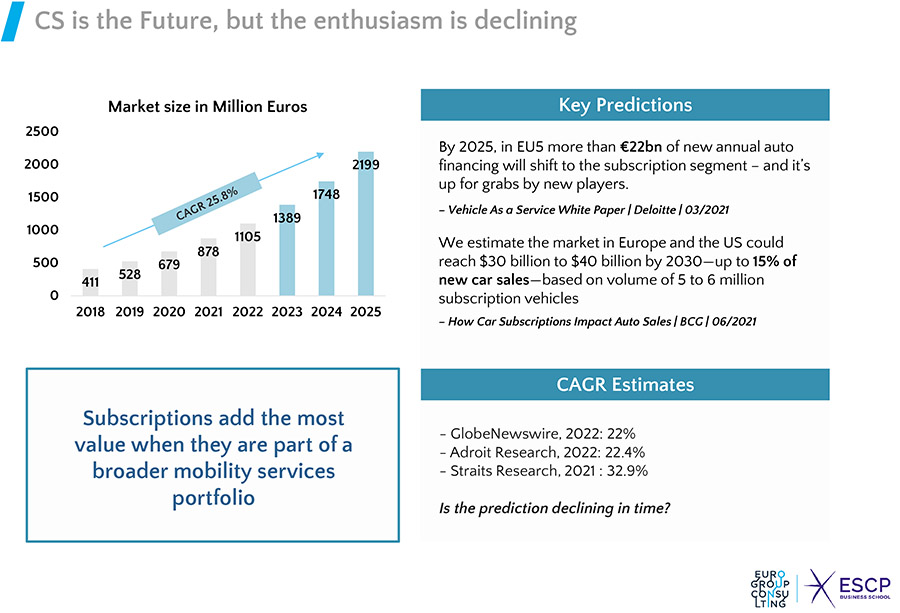

Car subscription services could become an important area of the automotive market in the coming years, according to a new report from Eurogroup Consulting. A smooth drive could see the market in Europe and the United States reach between $30 billion to $40 billion by 2030, however, there remain several obstacles on the road ahead.

But first, what is the difference between leasing a car and getting a car subscription? The main differences are that leasing a car is typically for a set period of time, where a customer pays a fixed amount per month, and insurance needs to be contracted separately. Leasing is simple, but strict.

Car subscriptions, on the other hand, are far more flexible and typically for a shorter period. It can be seen as something in between leasing and renting a car. Car subscriptions usually have no joining fee, and the contract can be for as long as a customer wants – from a month to a few years.

So the appeal to car subscription services for consumers is clear – and automotive companies could benefit from the opportunity.

For example, Eurogroup Consulting notes that automotive players should leverage technology, rental companies should adopt more flexible subscription options, and companies that want to enter into the world of subscription services should explore partnerships.

“In theory, short term rental operators would be in a dominant position to win the market… but in practice, the tourist and seasonal segment will take precedence over their profitability,” the report notes.

There are several real market needs where car subscription services could prove to be very valuable. For example, consider B2B scenarios where an organizations needs to hire courtesy cars for employees or for events. The B2C side of the market is likely to be geared towards those in temporary work situations or those with new work habits like hybrid telecommuting.

“The customer’s willingness and ability to pay for flexibility is limited,” notes the report. “The premium averages 10% to 20% on top of the standard pricing (excluding niche customer segments), because it is hard for the final customer to appreciate the value of such freedom.”

Eurogroup Consulting notes that the advantage lies with companies that are backed by OEM and mobility finance players. But these companies need to find a way to increase profitability by ensuring maximum utilization of cars, lower costs with strategic partnerships, and add new revenue streams like advertising and add-on services.

Currently, one of the most popular and successful car subscription services is offered by international rental company Hertz. Other major car rental companies are also offering subscription services, including Sixt and SimpleCar.

In other cases, subscription services are offered directly from car manufacturers. For example, Porsche offers two pricing tiers for those that want to pay top dollar for a no-string-attached sports car. Volvo also offers its own subscription service for a more modest monthly fee.