As global markets experience fluctuations, with the U.S. seeing a surprising dip in consumer prices and small-cap stocks outperforming, investors are keenly watching market dynamics and economic indicators. In such an environment, examining growth companies with high insider ownership on the SEHK can provide valuable insights, as these firms often demonstrate alignment between management’s interests and shareholder returns.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

|

Name |

Insider Ownership |

Earnings Growth |

|

iDreamSky Technology Holdings (SEHK:1119) |

20.2% |

104.1% |

|

Fenbi (SEHK:2469) |

32.8% |

43% |

|

Tian Tu Capital (SEHK:1973) |

34% |

70.5% |

|

Adicon Holdings (SEHK:9860) |

22.4% |

28.3% |

|

Zhejiang Leapmotor Technology (SEHK:9863) |

15% |

73.4% |

|

DPC Dash (SEHK:1405) |

38.2% |

90.2% |

|

Zylox-Tonbridge Medical Technology (SEHK:2190) |

18.7% |

79.3% |

|

Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) |

13.9% |

100.1% |

|

Beijing Airdoc Technology (SEHK:2251) |

28.7% |

83.9% |

|

Ocumension Therapeutics (SEHK:1477) |

23.1% |

93.7% |

Let’s uncover some gems from our specialized screener.

Simply Wall St Growth Rating: ★★★★☆☆

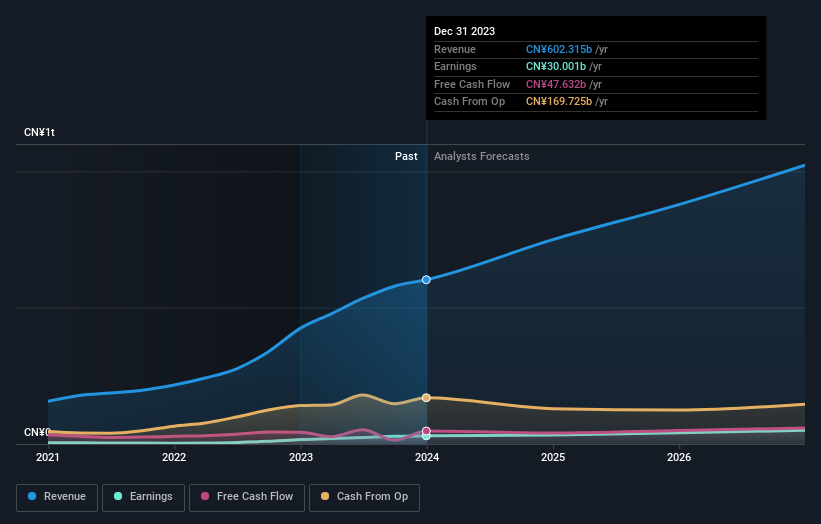

Overview: BYD Company Limited operates in the automobile and battery sectors across China, Hong Kong, Macau, Taiwan, and internationally, with a market capitalization of approximately HK$767.37 billion.

Operations: The company’s revenue is derived from its automobile and battery sectors across various regions including China, Hong Kong, Macau, and Taiwan.

Insider Ownership: 30.1%

Revenue Growth Forecast: 14.2% p.a.

BYD, a notable growth company in Hong Kong with substantial insider ownership, is trading at 48% below its estimated fair value. While its revenue growth of 14.2% per year and earnings growth of 15.3% per year are robust, they do not exceed the significant threshold of 20%. However, these figures still outpace the broader Hong Kong market’s averages. Recent announcements highlight strong sales and production volumes year-over-year, indicating a healthy operational scale which supports its growth narrative despite less aggressive forecasts.

Simply Wall St Growth Rating: ★★★★★☆

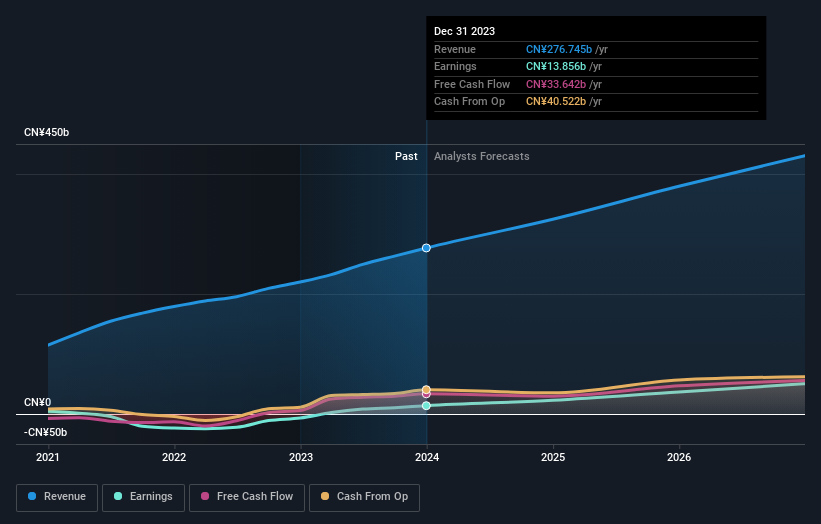

Overview: Meituan is a technology retail company based in the People’s Republic of China, with a market capitalization of approximately HK$722.17 billion.

Operations: The company generates revenue through technology retail operations in China.

Insider Ownership: 11.5%

Revenue Growth Forecast: 12.8% p.a.

Meituan, a growth company in Hong Kong with high insider ownership, is experiencing substantial earnings growth, forecasted at 31.3% annually, significantly outpacing the Hong Kong market average. Despite slower revenue growth projections of 12.8% compared to a desired 20%, recent strategic moves including a US$2 billion share buyback and substantial insider purchases underscore confidence in its trajectory. Additionally, governance enhancements and executive stability post high-profile retirements suggest robust internal confidence and strategic alignment for future growth.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Newborn Town Inc. is an investment holding company that operates in the global social networking business, with a market capitalization of approximately HK$4.49 billion.

Operations: The company generates revenue through its Innovative Business segment, which earned CN¥335.88 million, and its Social Networking Business segment, which brought in CN¥2.97 billion.

Insider Ownership: 20.1%

Revenue Growth Forecast: 15.7% p.a.

Newborn Town, while trading at 67.6% below its estimated fair value, shows robust potential with a forecasted revenue growth of 15.7% per year, outpacing the Hong Kong market’s 7.7%. Despite not having significant insider transactions in the past three months, its earnings have surged by 294.1% over the last year and are expected to continue growing at 12.1% annually. Recent amendments to company bylaws signal proactive governance, aligning with its strong projected Return on Equity of 27.7%.

Next Steps

Curious About Other Options?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SEHK:1211SEHK:3690 and SEHK:9911

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com