As global markets experience fluctuations, with particular attention on the U.S. inflation rates and their impact on international indices, Hong Kong’s market remains a focal point for investors looking for growth opportunities. High insider ownership in companies listed on the SEHK is often seen as a positive signal of confidence in the company’s future prospects, making such stocks particularly interesting in these volatile times.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

|

Name |

Insider Ownership |

Earnings Growth |

|

iDreamSky Technology Holdings (SEHK:1119) |

20.2% |

104.1% |

|

Pacific Textiles Holdings (SEHK:1382) |

11.2% |

37.7% |

|

Fenbi (SEHK:2469) |

32.8% |

43% |

|

Tian Tu Capital (SEHK:1973) |

34% |

70.5% |

|

Adicon Holdings (SEHK:9860) |

22.4% |

28.3% |

|

DPC Dash (SEHK:1405) |

38.2% |

90.2% |

|

Zylox-Tonbridge Medical Technology (SEHK:2190) |

18.7% |

79.3% |

|

Beijing Airdoc Technology (SEHK:2251) |

28.7% |

83.9% |

|

Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) |

13.9% |

100.1% |

|

Ocumension Therapeutics (SEHK:1477) |

23.1% |

93.7% |

Let’s uncover some gems from our specialized screener.

Simply Wall St Growth Rating: ★★★★☆☆

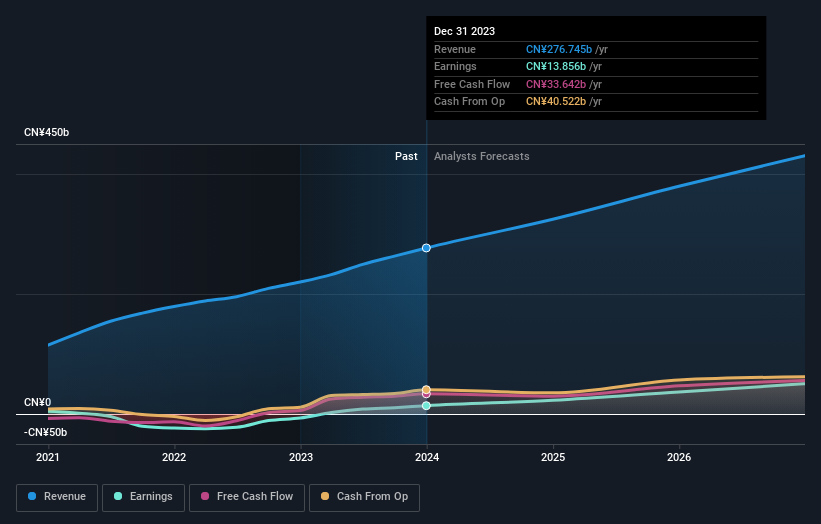

Overview: BYD Company Limited operates in the automobile and battery sectors across China, Hong Kong, Macau, Taiwan, and internationally, with a market capitalization of approximately HK$766.97 billion.

Operations: The company’s revenue is generated primarily from its automobiles and batteries segments.

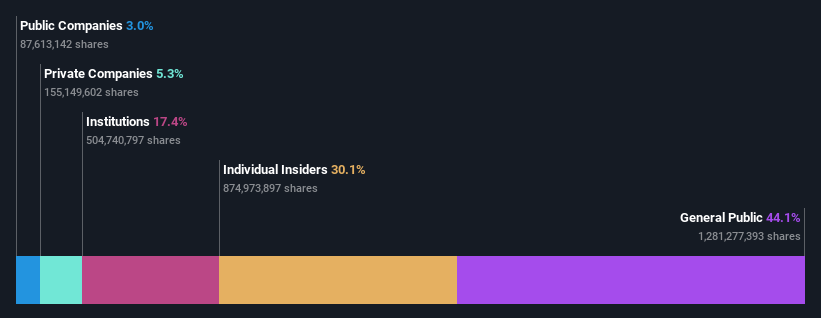

Insider Ownership: 30.1%

Earnings Growth Forecast: 15.3% p.a.

BYD, a prominent name in Hong Kong’s growth sectors with significant insider ownership, showcases robust year-on-year increases in production and sales volumes as of June 2024, indicating strong operational momentum. Despite trading at 48.2% below estimated fair value, which suggests potential undervaluation, its revenue and earnings growth are expected to outpace the market at 14.2% and 15.3% per year respectively. However, it’s worth noting that the anticipated earnings growth does not surpass the high-growth threshold significantly.

Simply Wall St Growth Rating: ★★★★★☆

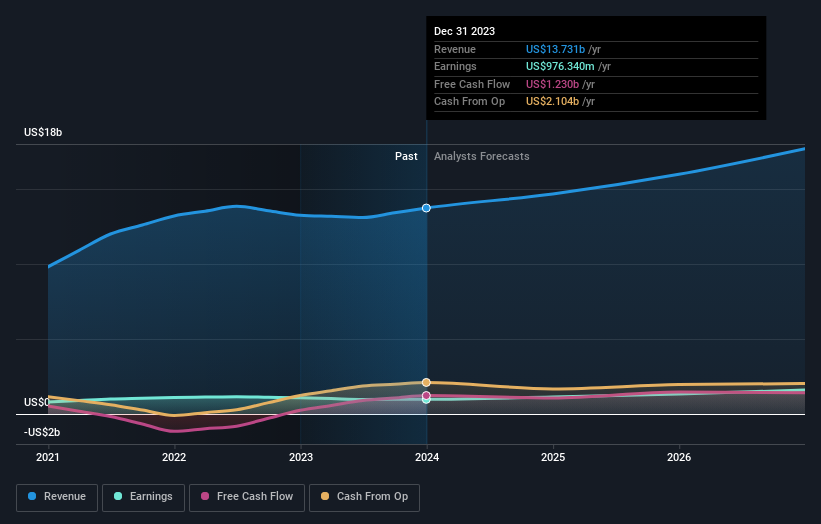

Overview: Meituan is a technology retail company based in the People’s Republic of China, with a market capitalization of approximately HK$728.63 billion.

Operations: The company generates revenue from technology retail operations in China.

Insider Ownership: 11.5%

Earnings Growth Forecast: 31.3% p.a.

Meituan, a growth-oriented company in Hong Kong with significant insider transactions, has demonstrated substantial earnings growth of 568.2% over the past year and is expected to continue this trend with a forecasted annual earnings increase of 31.26%. Despite recent executive changes and no major insider purchases in the last three months, Meituan’s revenue growth projections remain strong at 12.8% annually, outpacing the local market’s average. Additionally, Meituan recently announced a HK$2 billion share repurchase program, underscoring its ongoing commitment to shareholder value.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Techtronic Industries Company Limited, operating internationally with a focus on North America and Europe, designs, manufactures, and markets power tools, outdoor power equipment, and floorcare and cleaning products with a market capitalization of approximately HK$183.25 billion.

Operations: The company’s revenue is primarily generated from power equipment, contributing $12.79 billion, and floorcare and cleaning products, adding $0.97 billion.

Insider Ownership: 25.4%

Earnings Growth Forecast: 14.9% p.a.

Techtronic Industries, a notable entity in Hong Kong’s growth sector with significant insider ownership, is undergoing leadership changes with Steven Richman stepping in as CEO following Joseph Galli Jr.’s retirement. The company recently initiated a share repurchase program reflecting strong financial health, aiming to buy back 10% of its shares. While its revenue growth at 8.1% per year surpasses the local market average, earnings are expected to grow at 14.9% annually, indicating robust future potential despite not being extraordinarily high.

Seize The Opportunity

Searching for a Fresh Perspective?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SEHK:1211 SEHK:3690 and SEHK:669.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com