As global markets exhibit mixed performances with notable shifts towards value and small-cap stocks, investors are keenly observing these movements for potential opportunities. In this context, identifying undervalued stocks becomes particularly compelling, offering a strategic avenue for those looking to capitalize on market inefficiencies during times of economic recalibration and sector rotations.

Top 10 Undervalued Stocks Based On Cash Flows

|

Name |

Current Price |

Fair Value (Est) |

Discount (Est) |

|

UMB Financial (NasdaqGS:UMBF) |

US$94.71 |

US$189.13 |

49.9% |

|

Fenix Resources (ASX:FEX) |

A$0.385 |

A$0.77 |

49.9% |

|

MaxiPARTS (ASX:MXI) |

A$2.00 |

A$3.99 |

49.9% |

|

Truecaller (OM:TRUE B) |

SEK35.66 |

SEK71.28 |

50% |

|

NSE (ENXTPA:ALNSE) |

€25.50 |

€50.92 |

49.9% |

|

Sachem Capital (NYSEAM:SACH) |

US$2.61 |

US$5.21 |

49.9% |

|

Fluence Energy (NasdaqGS:FLNC) |

US$15.96 |

US$31.80 |

49.8% |

|

Super Hi International Holding (SEHK:9658) |

HK$12.92 |

HK$25.84 |

50% |

|

Zijin Mining Group (SEHK:2899) |

HK$16.20 |

HK$32.32 |

49.9% |

|

TF Bank (OM:TFBANK) |

SEK260.00 |

SEK518.39 |

49.8% |

Let’s explore several standout options from the results in the screener.

Overview: HubSpot, Inc. operates globally, offering a cloud-based CRM platform to businesses across the Americas, Europe, and Asia Pacific, with a market capitalization of approximately $24.45 billion.

Operations: The company generates its revenue primarily from its Internet Software & Services segment, totaling approximately $2.29 billion.

Estimated Discount To Fair Value: 11%

HubSpot, recently in the spotlight due to halted acquisition talks with Alphabet, remains a compelling case for cash flow-based valuation. Despite the market’s initial negative reaction to the news, dropping share prices by 12%, HubSpot shows resilience with a strong financial forecast. The company is expected to grow its revenue by 15.3% annually and become profitable within three years, surpassing average market growth rates. Currently trading at US$479.82—below its estimated fair value of US$539.29—HubSpot presents an undervalued opportunity based on its future cash flows and profitability prospects.

Overview: Smartsheet Inc. operates as an enterprise platform that helps teams and organizations plan, capture, manage, automate, and report on work, with a market capitalization of approximately $6.68 billion.

Operations: The company generates its revenue primarily from the Internet Software & Services segment, totaling approximately $1.00 billion.

Estimated Discount To Fair Value: 49.6%

Smartsheet, with a current price of US$48.29, is significantly undervalued by 49.6%, assessed against a fair value estimate of US$95.82. This valuation discrepancy highlights its potential despite recent financial results showing a narrowed net loss to US$8.86 million from last year’s US$29.87 million on revenues of US$262.98 million, up from US$219.89 million. Forecasts suggest robust growth with expected revenue increases and profitability within three years, backed by innovations like new AI features enhancing enterprise decision-making capabilities.

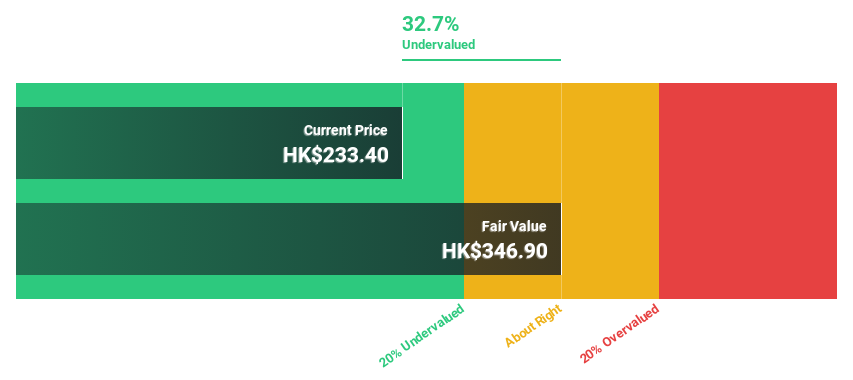

Overview: BYD Company Limited operates in the automobile and battery sectors across China, Hong Kong, Macau, Taiwan, and internationally, with a market capitalization of approximately HK$779.12 billion.

Operations: The company’s revenue is primarily derived from its automobile and battery sectors.

Estimated Discount To Fair Value: 47%

BYD’s recent operational achievements, including the inauguration of its Thailand plant and robust sales growth, underscore its strategic expansion and market penetration. Despite trading below our fair value estimate by over 20% at HK$246, with a calculated fair value of HK$464.53, BYD exhibits strong fundamentals with revenue forecasted to grow at 14.2% annually—outpacing the Hong Kong market’s 7.8%. However, earnings are expected to grow moderately by 15.3% per year, indicating potential yet tempered profitability enhancements ahead.

Key Takeaways

Searching for a Fresh Perspective?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NYSE:HUBS NYSE:SMAR and SEHK:1211.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com