As global markets navigate through a complex landscape marked by trade tensions and shifting investment trends, the Hong Kong market has shown resilience with specific sectors poised for growth. In this context, companies with high insider ownership on the SEHK stand out as potentially strong performers, reflecting a commitment from those who know them best.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

|

Name |

Insider Ownership |

Earnings Growth |

|

iDreamSky Technology Holdings (SEHK:1119) |

20.2% |

104.1% |

|

Pacific Textiles Holdings (SEHK:1382) |

11.2% |

37.7% |

|

Fenbi (SEHK:2469) |

30.6% |

43% |

|

Tian Tu Capital (SEHK:1973) |

34% |

70.5% |

|

Adicon Holdings (SEHK:9860) |

22.4% |

28.3% |

|

Zhejiang Leapmotor Technology (SEHK:9863) |

15% |

73.4% |

|

DPC Dash (SEHK:1405) |

38.2% |

90.2% |

|

Beijing Airdoc Technology (SEHK:2251) |

28.7% |

83.9% |

|

Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) |

13.9% |

100.1% |

|

Ocumension Therapeutics (SEHK:1477) |

23.3% |

93.7% |

Below we spotlight a couple of our favorites from our exclusive screener.

Simply Wall St Growth Rating: ★★★★☆☆

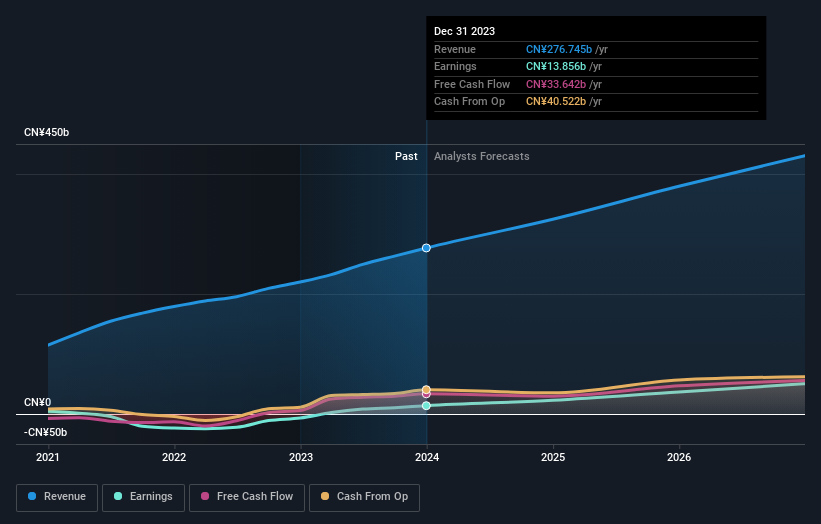

Overview: BYD Company Limited operates in the automobile and battery sectors across China, Hong Kong, Macau, Taiwan, and internationally, with a market capitalization of approximately HK$785.42 billion.

Operations: The company’s revenue is primarily derived from its automobile and battery sectors across various regions including China, Hong Kong, Macau, and Taiwan.

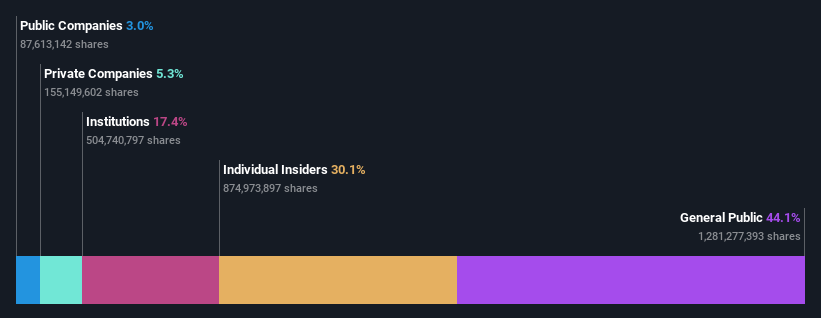

Insider Ownership: 30.1%

Return On Equity Forecast: 22% (2027 estimate)

BYD, a prominent growth company in Hong Kong with substantial insider ownership, has recently been trading at 47.1% below its estimated fair value. Over the past year, BYD’s earnings increased by 52.7%, with forecasts suggesting a robust annual growth of 15.3%, outpacing the Hong Kong market’s average of 11.5%. Additionally, revenue is expected to grow at an annual rate of 14.2%, again surpassing the local market forecast of 7.8%. Recent strategic expansions include inaugurating a new plant in Thailand and launching the Dolphin model as their eight millionth new energy vehicle, marking significant milestones in global outreach and production capabilities.

Simply Wall St Growth Rating: ★★★★★☆

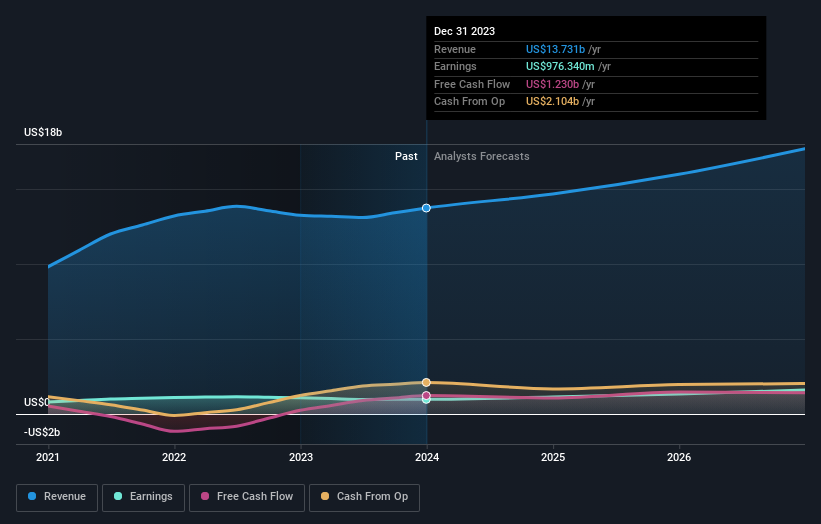

Overview: Meituan is a technology retail company based in the People’s Republic of China, with a market capitalization of approximately HK$740.55 billion.

Operations: The company generates its revenue through technology retail operations in China.

Insider Ownership: 11.5%

Return On Equity Forecast: 20% (2027 estimate)

Meituan, a key growth company in Hong Kong, is expected to see its earnings grow by 31.3% annually, significantly outpacing the local market’s 11.5%. Despite trading 65.2% below its estimated fair value and experiencing large one-off items impacting financial results, Meituan has demonstrated substantial insider buying over recent months. Recent corporate actions include a US$2 billion share repurchase program and amendments to company bylaws to support governance enhancements.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Techtronic Industries Company Limited, with a market capitalization of HK$179.77 billion, operates globally in designing, manufacturing, and marketing power tools, outdoor power equipment, and floorcare and cleaning products primarily in North America and Europe.

Operations: The company’s revenue is primarily generated from power equipment, contributing $12.79 billion, and floorcare and cleaning products, adding $0.97 billion.

Insider Ownership: 25.4%

Return On Equity Forecast: 20% (2026 estimate)

Techtronic Industries, while not the top in its class, shows promising growth with earnings forecasted to grow at 14.9% annually, outpacing the Hong Kong market’s 11.4%. Insider activity is positive with substantial buying over selling in recent months, signaling confidence from within. Additionally, a recent share repurchase program aims to enhance shareholder value. Leadership changes include appointing Steven Richman as CEO, following Joseph Galli Jr.’s retirement, ensuring experienced oversight continues.

Summing It All Up

Curious About Other Options?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SEHK:1211 SEHK:3690 and SEHK:669.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com