The electric vehicle (EV) sector is currently experiencing a rough ride, with NIO Inc. NIO emerging as a notable casualty. China-based EV maker NIO has been in the red territory for a while now. Year to date, shares of the company have plummeted 50.6%, underperforming the industry as well as its key rivals like Li Auto LI and XPeng XPEV. As NIO currently hovers around 72% below its 52-week high, should investors consider this a buying opportunity?

YTD Price Performance

Image Source: Zacks Investment Research

What’s Behind NIO’s Dismal Run on the Bourses?

The stock plunge mirrors the broader EV market challenges. For starters, the slower-than-expected adoption of EVs impacted NIO’s first-quarter deliveries, which declined 40% sequentially. The Chinese EV market, notoriously competitive with new entrants, has forced companies like NIO to cut prices and offer huge incentives to drive sales. This pricing pressure has, in turn, eroded NIO’s profit margins, which fell to 9.2% in the first quarter of 2024, down 270 basis points sequentially. Amid the challenges, the company incurred a wider-than-expected loss in the first quarter of 2024.

Adding to these domestic challenges, NIO faces headwinds from the international trade arena. The European Commission recently imposed additional duties of up to 38% on Chinese EVs. Given that Europe is the only market outside of China where NIO operates, these tariffs might exacerbate the company’s struggles, though the impact is likely to be relatively contained due to the minuscule proportion of NIO’s sales outside China.

Evaluating the Stock’s Potential Upside

Investors should note that NIO began upgrading its models last year. With the completion of upgrades, the company’s deliveries have again started to pick up pace. NIO’s second-quarter 2024 deliveries rocketed 144% year over year to 57,373 units. In April, the company began delivering its upgraded ET7 model. A robust product portfolio, featuring models such as the ES6, ET5T, ES8, EC6, EL7, ET5, ET7 and EC7, is likely to drive NIO’s deliveries.

In May 2024, NIO launched ONVO, a new brand targeting the mainstream family market. L60, ONVO’s first product, is set for launch in September 2024. This move is expected to broaden NIO’s market reach and enhance its scale, with the company aiming for a vehicle margin above 15% for the ONVO brand in the long run.

NIO’s acquisition of two JAC plants is expected to reduce production costs, thus enhancing efficiency and competitiveness. As NIO ramps up production of its 2024 models and implements cost control measures, it forecasts a rebound in its vehicle margins, projecting a return to double-digit margins in the second quarter of 2024 and a further improvement in the latter half of the year.

NIO’s battery swap technology —part of NIO’s battery as a service (BaaS) strategy — provides an edge to the firm over its peers. On its first-quarter 2024 earnings call, NIO notified that it had installed 2,472 power swap stations worldwide. Encouragingly, NIO aims to build more than 1,000 new battery swap stations in 2024, which bodes well for its top-line growth.

Even from a valuation perspective, NIO’s price-to-sales (P/S) ratio is way lower than historical highs. NIO is currently trading at a forward sales multiple of 0.61, lower than its 5-year median of 2.04. The stock also remains attractively valued compared to its close peers like LI and XPEV.

Valuation

Image Source: Zacks Investment Research

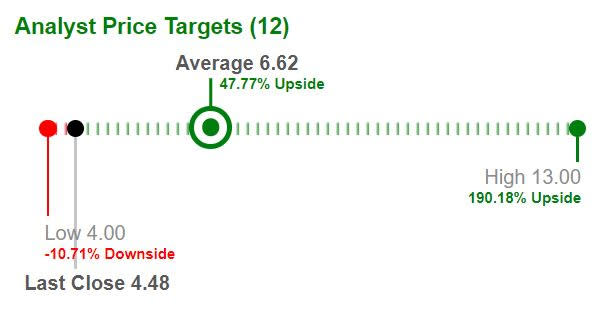

The Zacks average price target for NIO stands at $6.62 per share, indicating a potential upside of nearly 48% from the current level.

Image Source: Zacks Investment Research

Still Don’t Rush to Buy Now

The company’s efforts to revitalize its product line, expand its market reach and innovate with its battery technology are commendable. While existing shareholders should retain the stock, potential investors shouldn’t overlook the headwinds surrounding the company. The company is projected to remain unprofitable in the foreseeable future, with the Zacks Consensus Estimate for 2024 loss per share widening to $1.41. The consensus mark for 2025 loss per share is pegged at $1. Additionally, NIO may need to raise cash through dilutive means, which could negatively impact the stock.

Investors should also be cautious of NIO’s volatility and the broader sentiment surrounding Chinese American Depository Receipts (ADRs), which remains pessimistic. The EV sector, in general, is still grappling with mixed sentiments and market uncertainties, making NIO a riskier proposition for short-term investors. Only those with a higher risk tolerance and a long-term investment horizon should consider buying NIO shares now.

NIO currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NIO Inc. (NIO) : Free Stock Analysis Report

Li Auto Inc. Sponsored ADR (LI) : Free Stock Analysis Report

XPeng Inc. Sponsored ADR (XPEV) : Free Stock Analysis Report