Legendary investor Warren Buffett has owned these stocks for a long time — here’s why you should buy them, too.

Warren Buffett has a knack for investing and making his money work for him like none other. The returns of Berkshire Hathaway, Buffet’s company, speak for themselves: Between 1964 and 2023, Class A shares of Berkshire generated a total return of 4,384,748% versus the S&P 500‘s total returns of 31,223% during the period.

Buffett also has a knack for spotting rock-solid companies and buying their stocks for the long term. Given Berkshire’s phenomenal performance over the decades, it’s no surprise, then, that investors often want to emulate Buffett’s investing style and invest in the stocks he owns. Here are three such no-brainer Warren Buffett stocks to buy right now.

One of the best Buffett dividend stocks

Buffett has gone big on oil stocks in recent years, with Chevron (CVX 0.19%) emerging as one of his top oil stocks. Chevron was Berkshire Hathaway’s fifth-largest holding as of March 31, 2024.

Chevron is one of the world’s largest integrated oil and gas companies and the second-largest publicly traded energy stock in the U.S. in terms of market cap, just behind ExxonMobil. Buffett loves companies that generate big cash flows and pay dividends; Chevron checks both boxes.

Chevron’s production hit an all-time high in 2023, partly because of its $7.6 billion all-stock acquisition of PDC Energy. In 2023, Chevron increased its dividend for the 36th consecutive year and returned a record $26.3 billion in cash to its shareholders, including $11.3 billion in dividends. The oil stock yields 4.2%.

Chevron is projecting 10% or more average annual growth in free cash flow through 2027 at a Brent crude oil price of $60 per barrel and targeting a 12% or higher return on capital employed (ROCE). ROCE, a measure of a company’s profitability and efficiency, is also one of Buffett’s favorite investing metrics. Although Chevron’s ROCE isn’t the highest in the industry, it has improved in recent years and should grow further. That, alongside Chevron’s potential cash flow and dividend growth, makes it a top Buffett stock to buy right now.

An intriguing Buffett bet on EVs

BYD (BYDDY 0.36%) was Charlie Munger’s favorite stock; the late vice chairman of Berkshire Hathaway perhaps prodded Buffett into buying the electric vehicle (EV) stock in 2008. Although Buffett has trimmed its stake in BYD in recent quarters, Berkshire Hathaway still owned a 4.94% stake in the Chinese EV giant as of June 16.

BYD is the world’s largest EV company, having produced more battery-electric vehicles (BEVs) and hybrid cars combined than Tesla in 2023. To put some numbers to that, BYD produced 3 million units last year, while Tesla produced 1.85 million EVs. Chances are, BYD’s EV production could surpass Tesla’s this year.

BYD is also aggressively expanding its global footprint, extending its reach to 62 countries in just the last three years. Thailand is BYD’s largest market outside China; the company is already the largest EV player in the country, with more than 40% market share. BYD’s latest new market is Indonesia, where it also plans to start production by 2026.

Given the pace at which BYD is expanding in high-potential EV markets like Europe and Southeast Asia, analysts at J.P. Morgan expect its global deliveries to hit 6 million units by 2026. BYD is also one of the world’s largest EV battery makers, which is a huge competitive advantage. Overall, BYD’s unparalleled foothold in the global EV and battery markets and its aggressive growth moves make it a compelling Buffett stock to buy now.

A no-brainer Buffett stock to buy

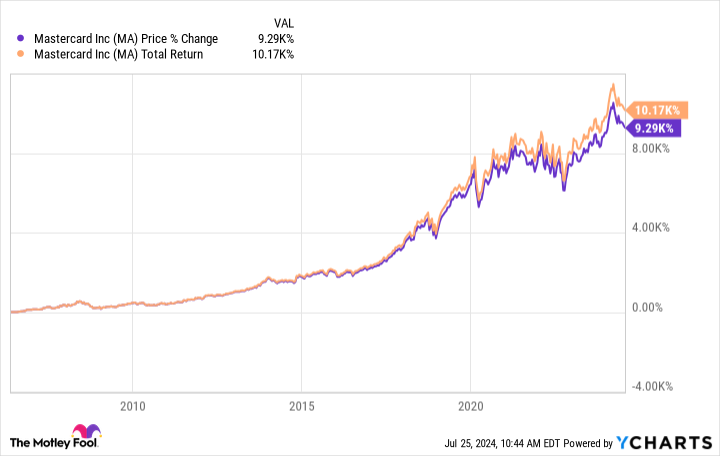

Berkshire Hathaway first bought shares of Mastercard (MA 2.00%) in 2011, and the stock has been a steady part of its portfolio since. Since going public in 2006, Mastercard stock has generated extraordinary returns thanks to the company’s duopoly in the massive global payments processing industry and torrid earnings and cash flow growth.

Mastercard doesn’t lend, but simply processes payments made using its co-branded cards on its network and collects fees in return. It’s an asset-light business that churns out high margins. Mastercard handled $9 trillion of transaction volume in 2023, which drove its revenue 13% higher to $25 billion. For every $1 in sales, Mastercard earned nearly $0.56 after paying its operating expenses. An operating margin of 56% is phenomenal for any business. Mastercard’s value-added services, such as cybersecurity, fraud detection, data analytics, and consulting, are also growing steadily.

Mastercard’s cross-border volume jumped 24% in 2023, reflecting its growth opportunities. Large, growing regions of the world, such as Southeast Asia, are still predominantly cash-driven societies, leaving plenty of room for growth for Mastercard. Last year, the company’s joint venture in China received approval from the government to start processing domestic transactions in the country.

Mastercard has solid growth opportunities ahead as it expands its consumer, business, and government payments network, extends its value-added businesses, and explores new network capabilities, like open banking and digital identity solutions. Mastercard is also a Dividend Achiever and one of the best Warren Buffett stocks you could buy right now.

JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. Neha Chamaria has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends BYD Company, Berkshire Hathaway, Chevron, JPMorgan Chase, Mastercard, and Tesla. The Motley Fool recommends the following options: long January 2025 $370 calls on Mastercard and short January 2025 $380 calls on Mastercard. The Motley Fool has a disclosure policy.