We are in the heart of the second-quarter earnings season for the Auto-Tires-Trucks sector. So far, seven S&P 500 sector components — Tesla, General Motors, Ford, LKQ Corp, Genuine Parts, O’Reilly and PACCAR — have reported quarterly numbers. Of these companies, all but General Motors missed earnings expectations.

Per the Earnings Trend report dated Jul 24, the auto sector’s earnings for the second quarter of 2024 are expected to decline 10.4% on a year-over-year basis. Revenues are estimated to rise 1.6% year over year.

Auto companies like Oshkosh Corp. OSK, Carvana CVNA, BorgWarner BWA, AutoNation AN and Penske Automotive PAG are scheduled to release their results tomorrow. Before checking the key projections for these stocks, let’s take a look at the general factors that are likely to shape the companies’ upcoming results.

Things to Note

In the second quarter, the U.S. new-car market slowed down a bit amid affordability issues and increased borrowing costs. This situation was exacerbated by a cyberattack that disrupted key software, forcing dealers to work hard to maintain sales. June’s seasonally adjusted annual rate tallied 15.3 million units, compared with 16.22 million in June 2023.

Per J.D. Power and GlobalData, in June, light-vehicle retail inventory reached 2.8 million, up 55% from a year earlier. Amid the rising inventory, automakers and dealers are ramping up incentives and sweetening deals. This surge in incentives reflects a shift toward a buyer’s market, placing increased pressure on retailers. Per J.D. Power, average transaction prices of vehicles in June declined 3% year over year to $44,857. While consumers may benefit from lower vehicle prices, dealers might grapple with squeezed profit margins.

What’s in Store for OSK, CVNA, BWA, AN & PAG?

Let us see how these auto stocks are poised ahead of their results, which are slated to be reported on Jul 31.

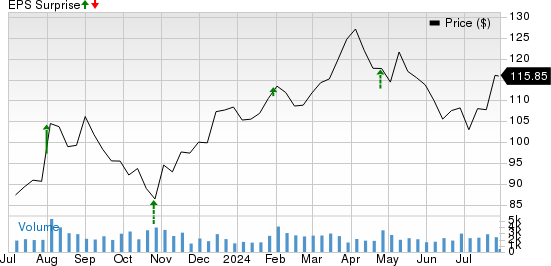

Oshkosh is scheduled to report second-quarter results before the opening bell. In the trailing four quarters, the automotive equipment provider topped earnings estimates on all occasions, the average surprise being 39%.

Oshkosh Corporation Price and EPS Surprise

Oshkosh Corporation price-eps-surprise | Oshkosh Corporation Quote

Our proprietary model indicates that a company needs to have the right combination of two key ingredients — a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) — to increase the odds of an earnings beat. You can see the complete list of today’s Zacks #1 Rank stocks here.

Our proven model does not conclusively predict an earnings beat for OSK this earnings season. This is because it has an Earnings ESP of +1.97% and a Zacks Rank #4 (Sell). You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Frequent business wins and a comprehensive offering of innovative new products are expected to have fueled Oshkosh’s order book. Amid sustained demand for innovative products, Oshkosh has decided to add capacity across its operations, which are poised to fortify the company’s market presence, enabling accelerated growth and bolstering financial performance. The Zacks Consensus Estimate for OSK’s second-quarter revenues and earnings is pegged at $2.78 billion and $3 per share, implying an uptick of 15% and 11.5%, respectively.

On the flip side, ramp-up costs associated with the production of NGDV are expected to have weighed on the margins of the company’s Defense segment. OSK also expects margins for the Access Equipment unit to be down in the to-be-reported quarter due to higher new product development spending. Massive investments and capital spending, along with supply chain challenges, are expected to have played spoilsport.

Carvana is set to report second-quarter results after market close. Over the trailing four quarters, the e-retailer of used cars topped earnings estimates thrice and missed on the other occasion, the average surprise being 54.8%.

Carvana Co. Price and EPS Surprise

Carvana Co. price-eps-surprise | Carvana Co. Quote

Our proven model predicts an earnings beat for CVNA this earnings season. This is because it has an Earnings ESP of +3,699.93% and a Zacks Rank #1. The Zacks Consensus Estimate for the to-be-reported quarter is breakeven earnings on revenues of $3.2 billion. The bottom-line projection indicates a year-over-year jump of 100%. The Zacks Consensus Estimate for quarterly revenues suggests a year-over-year increase of 7.8%.

Demand for used vehicles remained strong in the quarter under discussion, which is expected to have benefited Carvana. We forecast retail units sold to increase 17.1% year over year to 89,593 vehicles in the second quarter of 2024. Additionally, the company’s cost-cutting efforts are paying off. We forecast the metric to increase 57.5% year over year to $244.2 million on the back of enhanced operational efficiency across the business, with several technology, process and product initiatives underway.

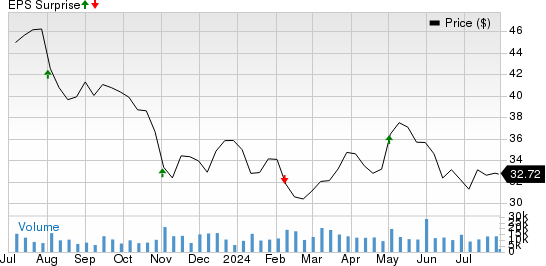

BorgWarner will report second-quarter results before the opening bell. Over the trailing four quarters, the auto equipment supplier topped earnings estimates thrice and missed on the other occasion, the average surprise being 10.3%.

BorgWarner Inc. Price and EPS Surprise

BorgWarner Inc. price-eps-surprise | BorgWarner Inc. Quote

Our proven model does not conclusively predict an earnings beat for BWA this earnings season. This is because it has an Earnings ESP of -2.56% and a Zacks Rank #3. The Zacks Consensus Estimate for the to-be-reported quarter earnings and revenues is pegged at 98 cents a share and $3.73 billion, suggesting a year-over-year decline of 27.4% and 17.5%, respectively.

Strategic acquisitions and frequent business wins are likely to have aided the company’s sales in the quarter to be reported. BorgWarner is also expected to have benefited from the electric vehicle adoption and expects hybrid and electric technologies to be its major revenue drivers.On the flip side, global light vehicle production in 2024 is expected to decline 1% year over year, thereby clipping the demand for BorgWarner’s offerings. The company has also been bearing the brunt of high SG&A costs over the past several quarters. This trend is expected to have continued in the to-be-reported quarter, weighing on operating margins.

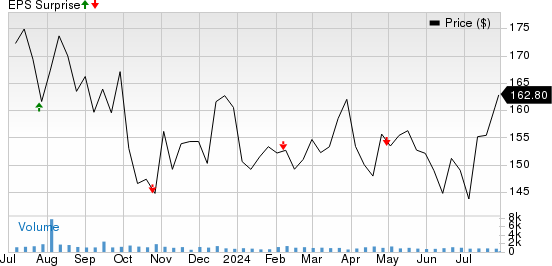

AutoNation is slated to report second-quarter results before the opening bell. In the trailing four quarters, the auto retailer topped earnings estimates on all occasions, the average surprise being 3.63%.

AutoNation, Inc. Price and EPS Surprise

AutoNation, Inc. price-eps-surprise | AutoNation, Inc. Quote

Our proven model does not predict an earnings beat for AutoNation this earnings season. This is because it has an Earnings ESP of -5.68% and a Zacks Rank #4. The Zacks Consensus Estimate for the company’s earnings is pegged at $4.31 per share, implying a 31.5% year-over-year decrease. The consensus mark for revenues is $6.76 billion, indicating a contraction of 2% year over year.

Inventory levels for new vehicles have been rising and are projected to increase throughout 2024 as much of the pent-up demand for the same has been released. The rising inventory presents a risk of margin pressure as the company may need to resort to discounting or other measures to move the excess inventory. The consensus mark for second-quarter gross profit for the new vehicle unit is pegged at $189.82 million, implying a decline from $288 million recorded in the year-ago period. The consensus mark for gross profit for the used vehicle segment is $119.3, suggesting a decrease from $134.3 million recorded in the second quarter of 2023.

Penske is slated to report second-quarter results before the opening bell. Over the trailing four quarters, the company topped earnings estimates once and missed on the other three occasions, the average negative surprise being 1.48%.

Penske Automotive Group, Inc. Price and EPS Surprise

Penske Automotive Group, Inc. price-eps-surprise | Penske Automotive Group, Inc. Quote

Our proven model predicts an earnings beat for PAG this earnings season. This is because it has an Earnings ESP of +3.62% and a Zacks Rank #3. The Zacks Consensus Estimate for the company’s earnings is pegged at $3.43 per share, implying a 22.2% year-over-year decrease. The consensus mark for revenues is $7.7 billion, up 3.04% year over year.

Last year, the company completed acquisitions worth more than $340 million in annualized revenues.So far in 2024, Penske has completed acquisitions representing nearly $2 billion in estimated annual revenues. The consensus mark for second-quarter revenues from the Retail Automotive unit is $6.67 billion, up from $6.4 billion reported in the corresponding quarter of 2023.

Projections for revenues from Retail Commercial Truck is $890.6 million, implying a 3.1% decline year over year. Revenues from the Commercial Vehicle unit are projected to increase roughly 9% year over year to $156 million. However, the company is bearing the brunt of rising SG&A expenses amid CarShop expansion, ramp-up of e-commerce activities and introduction of tools and technologies, which might have hurt operating margins.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BorgWarner Inc. (BWA) : Free Stock Analysis Report

Penske Automotive Group, Inc. (PAG) : Free Stock Analysis Report

AutoNation, Inc. (AN) : Free Stock Analysis Report

Oshkosh Corporation (OSK) : Free Stock Analysis Report

Carvana Co. (CVNA) : Free Stock Analysis Report