“Škoda Auto enters the second half of the year with great momentum from the first six months. I’m grateful to see how well customers are responding to the most varied and most updated product lineup in our history, as we prepare to further expand our all-electric range this October by unveiling the Škoda Elroq compact SUV. Škodians have been working diligently to make our company even more competitive, which we see reflected in a return on sales of 8.4%, in line with our targets. Even as we remain watchful for new challenges in this dynamic market, our H1 results allow us to be cautiously optimistic and we are moving ahead with well-founded confidence.”

Klaus Zellmer, Škoda Auto CEO

“The financial results in the first half of the year show that we are on the right track to steer our brand through this industry transformation. We have improved all our key financials, including a strong net cash flow as a result of increased operating profit and working capital, allowing us to continually align Škoda’s overall market position to future requirements and steadily finance the sustainable development of our products, production sites and digitalisation processes. By consistently implementing our Next Level Efficiency+ programme, we aim to maintain our profitability above 8% in the near future. To this end, we will continue to strictly follow efficiency measures, utilise synergies within the Brand Group Core and invest in future-oriented areas such as advancing the implementation of Artificial Intelligence throughout our company processes. We intend to leverage our current strong position to further future-proof our company.”

Holger Peters, Škoda Auto Board Member for Finance, IT and Legal Affairs

“We have just recently secured the fourth place in European registrations for the first time ever. This great achievement was driven by our balanced and updated portfolio, our successful brand campaign and especially by our dedicated dealer partners who made this success possible. Furthermore, we are continuously working on improving the customer journey, for example with the recently successfully launched new MyŠkoda app featuring enhanced functionality – inside and outside the car.”

Martin Jahn, Škoda Auto Board Member for Sales and Marketing

Strong financial performance and focus on customer wishes

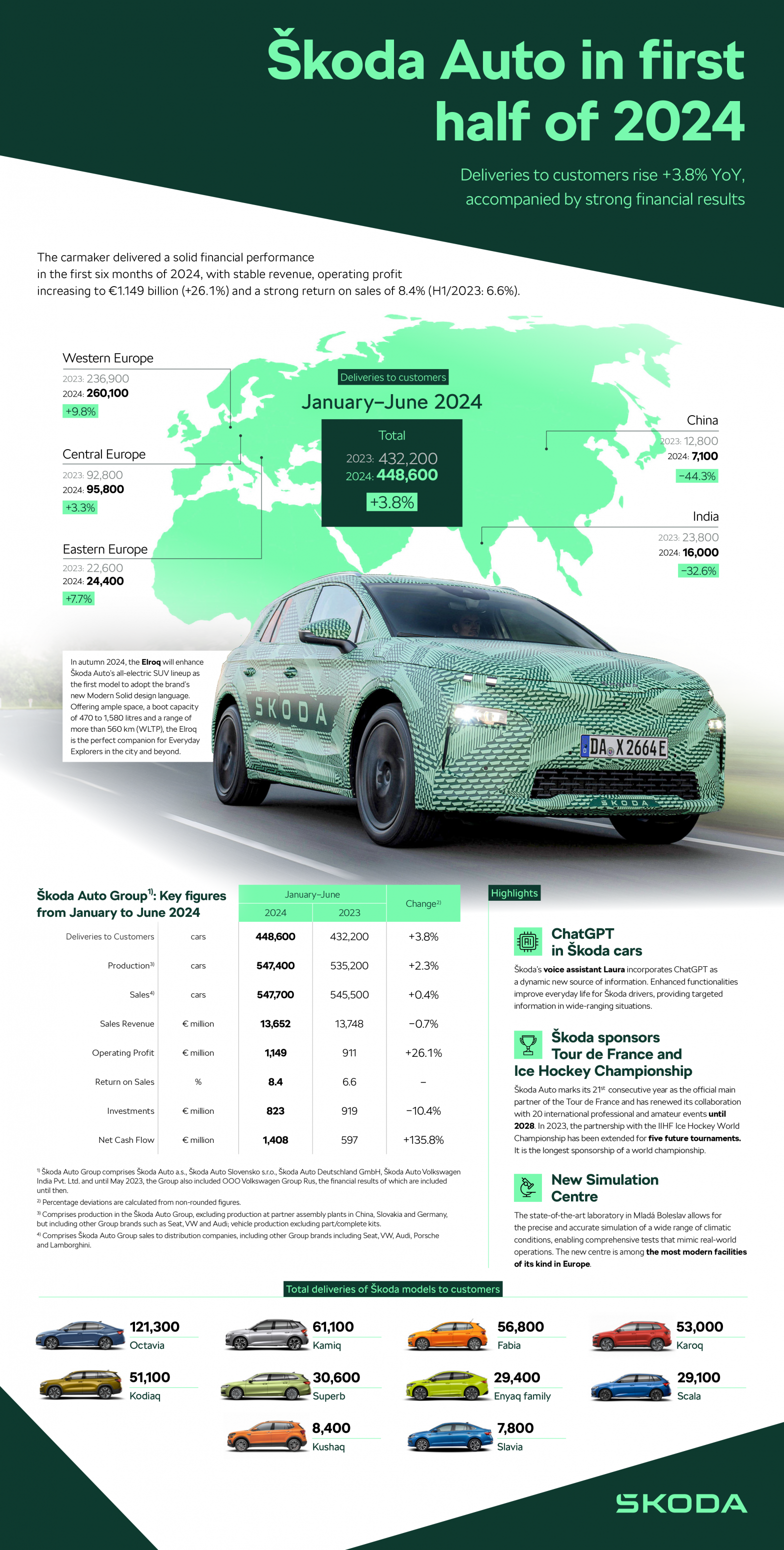

In the first six months of 2024, Škoda Auto demonstrated considerable financial strength. Operating profit rose to €1.149 billion (+26.1%) while the return on sales increased to 8.4% (H1/2023: 6.6%). Key to this success is the most comprehensive product lineup in the brand’s history, combining the best of both worlds. This supported a 3.8% year-on-year increase in deliveries to 448,600 vehicles globally.

The first half of the year saw the launches of the latest generations of the Superb and Kodiaq, as well as upgraded versions of the Scala, Octavia and Kamiq. One major driver is the Octavia, the brand’s best-selling model, with deliveries to customers increasing by 24.1% year-on-year.

Despite a volatile market, the Enyaq remains one of Europe’s most desirable BEVs. This all-electric SUV has seen particular success in Germany, where deliveries reached 9,600 units, marking a 22.4% increase.

Škoda’s strategy centres on meeting customer wishes. With its broadest and youngest-ever model portfolio, the brand offers modern ICEs, mild-hybrid powertrains, a new-generation plug-in hybrid powertrain that has increased the Superb’s and Kodiaq’s purely electric range to over 100 km, as well as all-electric options.

Historic milestone: Škoda Auto is the fourth best-selling brand in Europe

As part of its Next Level Strategy 2030, Škoda Auto set an ambitious target to rank among the top five best-selling brands in Europe. Surpassing this goal, Škoda achieved its best-ever European market position in the first half of 20242 and is currently the fourth best-selling brand by registrations in Europe.

This success can be attributed to a consistent focus on the specific needs of customers in each region. The best-performing markets were Germany (91,100 vehicles; +13,800), Poland (31,500; +4,300), France (21,500; +3,800) and the United Kingdom (37,600; +3,400). Significant growth was achieved in Southern European countries such as Croatia (5,500; +2,100), Spain (17,500; +1,900) and Italy (19,300; +1,800). Turkey (18,800; +1,300) also recorded a notable increase.

Record-breaking results in Germany

Deliveries of Škoda vehicles to customers in Germany rose by 17.8% in the first half of 2024, solidifying Germany as the brand’s largest global market. For the first time, Škoda climbed to fourth place in Germany, achieving a market share of 6.2%, a solid result in this highly competitive market. In particular, the statistics were positively influenced by deliveries in June when Škoda ranked second in registrations, setting another all-time-high. Other significant markets in terms of deliveries in the first six months include the Czech Republic (41,300 vehicles), the United Kingdom (37,600), Poland (31,500) and France (21,500).

Continued electrification and greater accessibility: all-electric Elroq, new Enyaq, Škoda Epiq and ‘Small BEV’ project

Škoda Auto is going to expand its EV portfolio. This autumn, the brand will be launching the new Elroq, a compact SUV targeting Europe’s largest market sub-segment by volume. Boasting a distinctive design, this new SUV is the first Škoda model to incorporate the Modern Solid design language – developing the exterior design of Škoda’s EV portfolio even further. With its compact size and range of more than 560 km (WLTP), the vehicle is the perfect companion for Everyday Explorers in the city and beyond.

This spring, Škoda presented a concept car that paves the way for another model of the six electric vehicles the brand plans to launch in the coming years: the Škoda Epiq, an urban crossover priced at around €25,000. The new Enyaq, the successor of Škoda’s first electric SUV, is scheduled to arrive next year. Additionally, Škoda will be introducing a small electric vehicle developed within the Brand Group Core in 2027.

Škoda Auto Group1) – Comparison of key figures, January to June 20242)

| January–June 2024 | January–June 2023 | Change | ||||

| Deliveries to customers | cars | 448,600 | 432,200 | +3.8% | ||

| Production3) | cars | 547,400 | 535,200 | +2.3% | ||

| Sales4) | cars | 547,700 | 545,500 | +0.4% | ||

| Sales revenue | € million | 13,652 | 13,748 | −0.7% | ||

| Operating profit | € million | 1,149 | 911 | +26.1% | ||

| Return on Sales | % | 8.4 | 6.6 | – | ||

| Investments | € million | 823 | 919 | −10.4% | ||

| Net cash flow | € million | 1,408 | 597 | +135.8% |

1) Škoda Auto Group comprises Škoda Auto a.s, Škoda Auto Slovensko s.r.o., Škoda Auto Deutschland GmbH, Škoda Auto Volkswagen India Pvt. Ltd. and until May 2023, the Group also included OOO Volkswagen Group Rus, the financial results of which are included until then.

2) Percentage deviations are calculated from non-rounded figures.

3) Comprises production in the Škoda Auto Group, excluding production at partner assembly plants in China, Slovakia and Germany, but including other Group brands such as Seat, VW and Audi; vehicle production excluding part/complete kits.

4) Comprises Škoda Auto Group sales to distribution companies, including other Group brands including Seat, VW, Audi, Porsche and Lamborghini.

Worldwide deliveries in the first half of the year by selected market region

| Market region | January–June 2024 | January–June 2023 | Change | ||

| Western Europe | 260,100 | 236,900 | +9.8% | ||

| Germany (largest market) | 91,100 | 77,300 | +17.8% | ||

| Central Europe | 95,800 | 92,800 | +3.3% | ||

| Czech Republic | 41,300 | 43,900 | −6.0% | ||

| Eastern Europe | 24,400 | 22,600 | +7.7% | ||

| China | 7,100 | 12,800 | −44.3% | ||

| India | 16,000 | 23,800 | −32.6% | ||

| Total (worldwide) | 448,600 | 432,200 | +3.8% |

Škoda brand deliveries to customers in the first half of 2024

(in units, rounded, listed by model; +/- in % compared to previous year):

| Model | January–June 2024 | Change |

| Škoda Octavia | 121,300 | +24.1 % |

| Škoda Kamiq | 61,100 | +4.7 % |

| Škoda Fabia | 56,800 | +17.5 % |

| Škoda Karoq | 53,000 | +0.7 % |

| Škoda Kodiaq | 51,100 | −9.0 % |

| Škoda Superb | 30,600 | −11.5 % |

| Škoda Enyaq | 29,400 | −5.9 % |

| Škoda Scala | 29,100 | −6.2 % |

| Škoda Kushaq | 8,400 | −33.5 % |

| Škoda Slavia | 7,800 | −17.6 % |

1) The figure of 448,600 vehicles reflects worldwide deliveries to customers as the most accurate data reflecting Škoda cars sold to end customers, rounded to the nearest hundred. Besides the above, Škoda publishes the production volumes at its plants and sales, i.e. vehicle deliveries to dealers in each market. For more information, see the notes beneath the summaries on the following pages.

2) Official registration statistics of the European Automobile Manufacturers’ Association (ACEA), includes EU27 region, Iceland, Norway, Switzerland and United Kingdom.