Adient ADNT reported adjusted earnings per share (EPS) of 32 cents for the third quarter of fiscal 2024. Earnings fell from 98 cents recorded in the year-ago period and missed the Zacks Consensus Estimate of 67 cents.

The company generated net sales of $3.72 billion, which decreased 8% year over year and missed the Zacks Consensus Estimate of $3.81 billion.

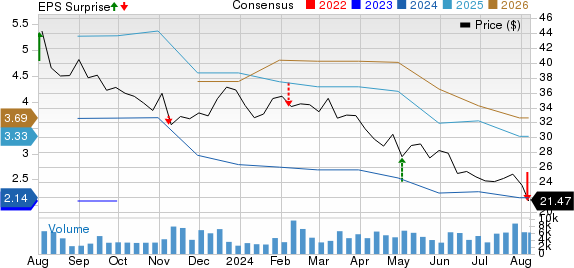

Adient Price, Consensus and EPS Surprise

Adient price-consensus-eps-surprise-chart | Adient Quote

Segmental Performance

Adient currently operates through three reportable segments — Americas, including North America and South America; Europe, which includes the Middle East and Africa (EMEA); and Asia Pacific/China (Asia).

In the reported quarter, the Americas segment recorded revenues of $1.74 billion, which declined 8.6% from the year-ago period and missed the Zacks Consensus Estimate of $1.76 billion. The segment recorded an adjusted EBITDA of $99 million, which increased from $95 million recorded in the prior-year quarter and beat the Zacks Consensus Estimate of $67 million, driven by efficiencies in material margin, freight and engineering.

The EMEA segment registered revenues of $1.29 billion, which declined 10.4% year over year and missed the Zacks Consensus Estimate of $1.35 billion. The segment recorded an adjusted EBITDA of $25 million, which significantly dropped from the $103 million generated in the year-ago period. It also missed the Zacks Consensus Estimate of $91 million due to unfavorable business performance from lower levels of customer releases.

In the fiscal third quarter, revenues in the Asia segment came in at $712 million, which declined 4% year over year and missed the Zacks Consensus Estimate of $729 million. The segment’s adjusted EBITDA rose 1% year over year to $101 million and beat the Zacks Consensus Estimate of $95 million due to efficiencies in the material margin, launch and labor.

Financial Position

Adient had cash and cash equivalents of $890 million as of Jun 30, 2024, compared with $1.11 billion as of Sep 30, 2023.

As of Jun 30, 2024, long-term debt amounted to $2.4 billion.

Capital expenditures totaled $70 million compared with $60 million in the prior-year quarter.

During the quarter under review, ADNT repurchased nearly 2.6 million shares for $75 million.

Revised Guidance for 2024

Adient now envisions fiscal 2024 revenues to be $14.6 billion, down from the previous guidance of $14.80-$14.90 billion. Adjusted EBITDA is estimated to be $870 million, down from the prior guidance of $900-$920 million. Equity income is projected to be $80 million.

Free cash flow is anticipated to be $250 million. Capex and cash tax are estimated to be $285 million and $100 million, down from previous estimates of $310 million and $105 million respectively. The company expects interest expenses to be $185 million.

Zacks Rank & Key Picks

ADNT currently carries a Zacks Rank #5 (Strong Sell).

Some better-ranked stocks in the auto space are Dorman Products, Inc. DORM, BYD Company Limited BYDDY and Douglas Dynamics, Inc. PLOW, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The consensus estimate for DORM’s 2024 sales and earnings suggests a year-over-year growth of 3.85% and 34.58%, respectively. EPS estimates for 2024 and 2025 have improved 47 cents and 33 cents, respectively, in the past seven days.

The Zacks Consensus Estimate for BYDDY’s 2024 sales and earnings suggests year-over-year growth of 21.11% and 9.93%, respectively. EPS estimates for 2024 and 2025 have improved 19 cents and 29 cents, respectively, in the past 30 days.

The Zacks Consensus Estimate for PLOW’s 2024 sales and earnings suggests year-over-year growth of 6.45% and 60.4%, respectively. EPS estimates for fiscal 2024 and 2025 have improved 15 cents and 2 cents, respectively, in the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Douglas Dynamics, Inc. (PLOW) : Free Stock Analysis Report

Dorman Products, Inc. (DORM) : Free Stock Analysis Report

Adient (ADNT) : Free Stock Analysis Report

Byd Co., Ltd. (BYDDY) : Free Stock Analysis Report