President, EMEA Christopher Delaney purchased 18,292 shares of Goodyear Tire & Rubber Co (NASDAQ:GT) on August 6, 2024, as reported in a recent SEC Filing. Following this transaction, the insider now owns 165,469 shares of the company.

Goodyear Tire & Rubber Co, a leading manufacturer in the global tire industry, provides a range of tires for automobiles, commercial trucks, light trucks, SUVs, race cars, airplanes, farm equipment, and heavy earth-moving machinery.

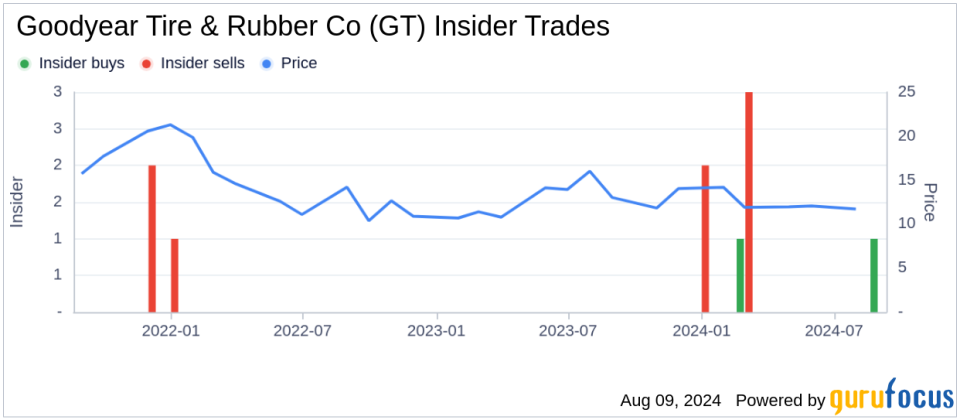

Over the past year, the insider has increased their holdings by 18,292 shares, with no recorded sales. This recent acquisition aligns with a broader pattern of insider activity at the company, which includes 2 insider buys and 5 insider sells over the past year.

Shares of Goodyear Tire & Rubber Co were priced at $8.20 on the day of the transaction. The company’s market cap stands at approximately $2.19 billion.

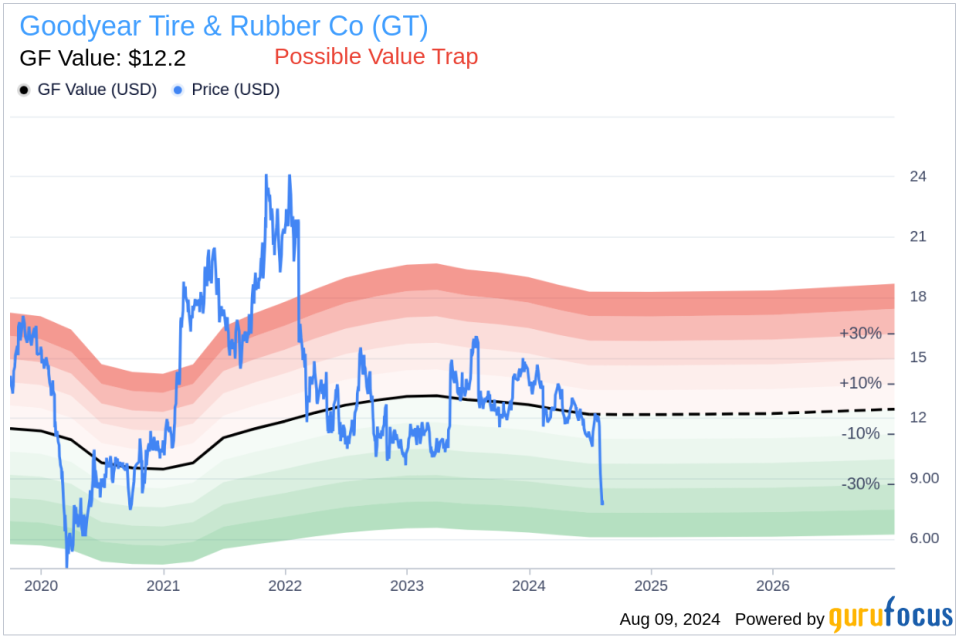

The stock’s valuation metrics, such as the price-earnings ratio, price-sales ratio, price-book ratio, and price-to-free cash flow, contribute to the GF Value calculation. The GF Value of $12.20 suggests that the stock is currently undervalued, with a price-to-GF-Value ratio of 0.67, indicating it is a possible value trap and warrants caution.

This insider buying event could signal a positive outlook from the insider regarding the company’s future performance, despite the current market valuation suggesting caution. Investors might consider watching the company’s performance and market trends closely following this insider activity.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.