Shares of Goodyear Tire GT plunged 33.5% since the company reported second-quarter 2024 results. It reported second-quarter 2024 adjusted earnings per share (EPS) of 19 cents, surpassing the Zacks Consensus Estimate of 9 cents. The company had incurred a loss of 34 cents in the year-ago quarter.

The company generated net revenues of $4.57 billion, which declined 6.1% on a year-over-year basis and missed the Zacks Consensus Estimate of $4.79 billion due to lower replacement volume.

In the reported quarter, tire volume was 40.1 million units, down 1.7% from the year-ago period’s levels.

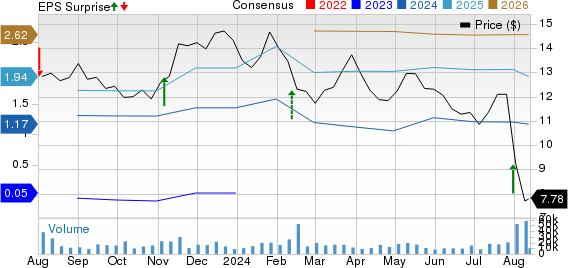

The Goodyear Tire & Rubber Company Price, Consensus and EPS Surprise

The Goodyear Tire & Rubber Company price-consensus-eps-surprise-chart | The Goodyear Tire & Rubber Company Quote

Segmental Performance

In the reported quarter, the Americas segment generated revenues of $2.69 billion, which declined 8.2% year over year and missed our estimate of $2.82 billion due to lower replacement volume and unfavorable price/mix. The segment registered an operating income of $241 million, which surged 134% from the year-ago period’s figures. The operating margin benefited from lower transportation costs, Goodyear Forward initiatives and favorable net price/mix. The figure surpassed our expectation of $224.4 million.

Revenues in the Europe, Middle East and Africa segment were $1.28 billion, down 4.6% from the year-ago period’s levels due to the adverse impact of foreign currency exchange rates and lower replacement volume. The figure also missed our estimate of $1.35 billion. The operating income for the segment was $35 million, which rose 284.2% on a year-over-year basis due to favorable net price/mix, a net gain on insurance recoveries and the Goodyear Forward plan.

Revenues in the Asia Pacific segment rose 1.2% year over year to $594 million due to higher original equipment volume but missed our estimate of $615.3 million. The segment’s operating profit was $63 million, up 57.5% from the year-ago quarter’s figure due to favorable net price/mix, higher volume and benefits from the Goodyear Forward plan. The figure, however, missed our estimate of $65.2 million.

Financial Position

Selling, general & administrative expenses rose to $731 million from $708 million in the year-ago period.

Goodyear had cash and cash equivalents of $789 million as of Jun 30, 2024, down from $902 million as of Dec 31, 2023.

Long-term debt and finance leases amounted to $6.83 billion as of Jun 30, 2024, the same as of Dec 31, 2023.

Capital expenditure in the quarter was $634 million, up from $536 million reported in the year-ago quarter.

Updated 2024 Outlook

Based on recent commodity rates, the company expects a benefit of $260 million on raw material costs in 2024, down from the previous estimate of a benefit of $325-$350 million.

Capital expenditures are expected to be $1.25 billion compared with the previous estimate of $1.2-$1.3 billion.

For the full year, interest expenses are estimated between $510 million and $530 million, down from the previously guided range of $520-$540 million. Depreciation and amortization is expected to be $1 billion.

Zacks Rank & Key Picks

GT currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the auto space are Dorman Products, Inc. DORM, BYD Company Limited BYDDY and Douglas Dynamics, Inc. PLOW, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The consensus estimate for DORM’s 2024 sales and earnings suggests a year-over-year growth of 3.71% and 35.46%, respectively. EPS estimates for 2024 and 2025 have improved 20 cents and 22 cents, respectively, in the past seven days.

The Zacks Consensus Estimate for BYDDY’s 2024 sales and earnings suggests year-over-year growth of 21.11% and 14.73%, respectively. EPS estimates for 2024 and 2025 have improved 14 cents and 19 cents, respectively, in the past seven days.

The Zacks Consensus Estimate for PLOW’s 2024 sales and earnings suggests year-over-year growth of 6.45% and 60.4%, respectively. EPS estimates for 2024 and 2025 have improved 15 cents and 2 cents, respectively, in the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Goodyear Tire & Rubber Company (GT) : Free Stock Analysis Report

Douglas Dynamics, Inc. (PLOW) : Free Stock Analysis Report

Dorman Products, Inc. (DORM) : Free Stock Analysis Report

Byd Co., Ltd. (BYDDY) : Free Stock Analysis Report