Westport Fuel Systems Inc. WPRT incurred a loss of 43 cents per share in the second quarter of 2024, narrower than the Zacks Consensus Estimate of a loss of 55 cents. The company had incurred a loss of 60 cents in the year-ago period.

WPRT registered consolidated revenues of $83.4 million, missing the Zacks Consensus Estimate of $86 million. The top line also fell from $85 million generated in the corresponding quarter of 2023. The company delivered an adjusted EBITDA of negative $2 million compared with negative $4 million recorded in the year-ago period.

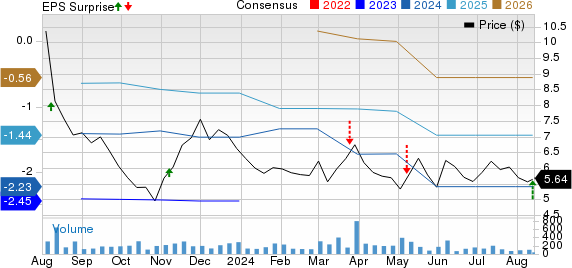

Westport Fuel Systems Inc. Price, Consensus and EPS Surprise

Westport Fuel Systems Inc. price-consensus-eps-surprise-chart | Westport Fuel Systems Inc. Quote

Segmental Takeaways

From the second quarter of 2024, Westport has started reporting its results under five reportable segments: HPDI JV, Light-Duty, High-Pressure Controls and Systems, Heavy-Duty OEM and Corporate.

HPDI JV: The segment reported net sales of $4.1 million and incurred an operating loss of $2 million in the second quarter of 2024.

Light-Duty: Net sales of the segment totaled $69.5 million, down from $73.7 million in the second quarter of 2023. The downside was mainly due to a decrease in sales in delayed original equipment manufacturer (OEM), independent aftermarket and fuel storage businesses.

The segment reported an operating income of $3.3 million against the year-ago quarter’s operating loss of $1.8 million. Gross profit increased to $15.1 million (22% of revenues) from the year-ago period’s $12.7 million (17% of revenues), primarily due to a change in sales mix.

High-Pressure Controls and Systems: Net sales of the segment totaled $3.4 million compared with $2.8 million in the year-ago period. Increased sales volumes in product and service revenues lead to a year-over-year rise. The segment incurred an operating loss of $0.9 million compared with the operating loss of $0.6 million reported in the corresponding quarter of 2023.

In the reported quarter, gross profit rose $0.1 million to $0.7 million, representing 21% of revenues. The company’s gross profit was $0.6 million or 21% of revenues in the second quarter of 2023.

Heavy-Duty OEM: Net sales of the segment totaled $10.5 million compared with $8.5 million in the year-ago period. An increase in product and engineering sales when the company wholly owned the HPDI business led to a year-over-year rise. The segment incurred an operating loss of $2.3 million compared with the loss of $3.3 million reported in the corresponding quarter of 2023.

Gross profit increased to $1.3 million (12% of revenues) compared with $1.1 million (13% of revenues) in the second quarter of 2023.

Corporate: The segment reported an operating loss of $5.4 million compared with an operating loss of $4.5 million reported in the year-ago period.

Financials

Westport had cash and cash equivalents (including restricted cash) of $41.5 million as of Jun 30, 2024, down from $54.85 million at the end of 2023. Long-term debt decreased to $26.36 million as of Jun 30, 2024, from $30.96 million as of Dec 31, 2023.

Key Releases From the Auto Space

Cummins Inc. CMI reported second-quarter 2024 adjusted earnings of $5.26 per share, beating the Zacks Consensus Estimate of $4.85. The bottom line also rose from $5.18 per share recorded in the year-ago period. Consolidated net sales rose to $8.8 billion compared with $8.64 billion recorded in the year-ago quarter. The top line also surpassed the Zacks Consensus Estimate of $8.28 billion. CMI had cash and cash equivalents of $1.59 billion as of Jun 30, 2024, compared with $2.18 billion as of Dec 31, 2023. The company had a long-term debt of $5.42 billion, up from $4.8 billion as of Dec 31, 2023.

BorgWarner BWA reported adjusted earnings of $1.19 per share for second-quarter 2024, down from $1.35 per share recorded in the prior-year quarter. The bottom line, however, surpassed the Zacks Consensus Estimate of 98 cents. It reported net sales of $3.60 billion, missing the Zacks Consensus Estimate of $3.73 billion. The top line also declined 2% year over year. As of Jun 30, 2024, BWA had $1.29 billion in cash/cash equivalents/restricted cash compared with $1.53 billion as of Dec 31, 2023. As of Jun 30, long-term debt was $3.28 billion, down from $3.70 billion recorded as of Dec 31, 2023.

Gentex Corp. GNTX reported second-quarter 2024 adjusted EPS of 37 cents, which missed the Zacks Consensus Estimate of 52 cents and fell 21.3% year over year. It reported net sales of $573 million, which missed the Zacks Consensus Estimate of $623 million and fell 1.7% from the year-ago period. Gentex had cash and cash equivalents of about $260.2 million as of Jun 30, 2024. The company had nearly 13.2 million shares remaining for buyback as of Jun 30.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BorgWarner Inc. (BWA) : Free Stock Analysis Report

Cummins Inc. (CMI) : Free Stock Analysis Report

Westport Fuel Systems Inc. (WPRT) : Free Stock Analysis Report

Gentex Corporation (GNTX) : Free Stock Analysis Report