Reshoring to the U.S. could be a solid growth opportunity for Eaton Corp. PLC (NYSE:ETN)as companies pull out of China and invest in domestic or nearshore facilities. Eaton’s electrical equipment and industrial applications may be poised to see increased demand from reindustrialization due to strong exposure to key sectors ,an attractive valuation despite premium and solid performance amid new records.

With the U.S. government investing $2 trillion in development projects and both political parties supporting domestic manufacturing, the reshoring trend is expected to accelerate over the years.

The U.S. witnessed a manufacturing construction boom in the fourth quarter of 2023, driven by an increase in reshoring following a poorly managed pandemic in China. Investment in facilities reached a record $210 billion, while Foreign Direct Investments (FDI) into China increased at the slowest pace in 30 years in 2023. U.S. companies pulled out billions from China in net outflows as industrials looked to return to domestic bases or nearshore locations like Canada and Mexico.

Economic growth in China is expected to decline from 5.20% in 2023 to 4.60% in 2024 and decline to 3.40% by 2028 due to long-term structural issues such as debt, demography and the mishandling of the pandemic, according to the International Monetary Fund. The economic situation is accelerating the reshoring trend.

Given the current economic and political situation in the U.S., reshoring might provide a nonpartisan advantage to U.S. companies. Both presidential candidates, Donald Trump and Kamala Harris, have shown support for policies supporting domestic manufacturing. The Biden administration has been cracking down on advanced chip exports to China, and Trump initiated the trade war himself.

As U.S. imports of Chinese goods suffer, Eaton may be one of the biggest beneficiaries of the reshoring trend. The company’s strong performance in the electrification equipment and industrial applications sectors might see increased demand as companies return and invest in new or upgraded facilities.

As an industrial company, Eaton may not seem all that special on the surface. Its price-earnings ratio of 31.60 is slightly above the benchmark and its recent earnings release did not prevent the stock from being dragged down by wider market jitters.

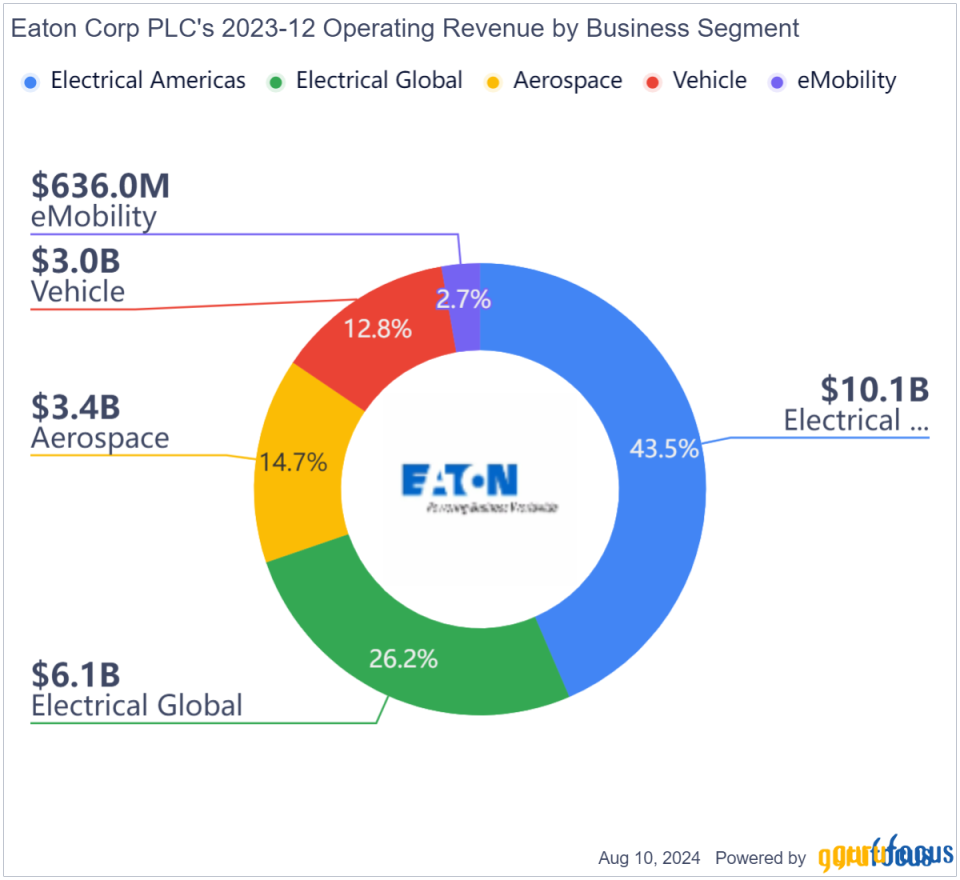

While Eaton’s share price remains relatively expensive, it makes a solid long-term growth opportunity, driven by a significant order backlog and exposure to high-growth sectors like aviation, electrification and clean power. The company’s Electrical Americas segment, which represents 43.50% of operating revenue, reported a 27% year-over-year increase in order backlog and 14% in Aerospace, supported by the reshoring or reindustrialization trend.

Data centers and power generation also represented a substantial 40% of Eaton’s projects over the last year. The company’s equipment is already in high demand due to the growth of data centers driven by artificial intelligence. This implies a continuous strong demand for its transformers, transmission assemblies and switchgear.

Analysts project an average price target of $344 per share for the stock in the following 12 months, representing a nearly 20% upside from current levels.

Eaton is financially strong, consistently outperforming with revenue growth in recent years. Revenue grew 11.78% in 2023 and 9.49% in the past 12 months. In the quarter ending June 30, the company reported quarterly revenue growth of 8.25%.

Revenue in the Electrical Americas segment increased from representing 40.95% to 43.53% in 2023 and is expected to increase more in 2024. Notably, Eaton generates 60.70% of its revenue from the U.S. market, which aligns with consumer preferences for U.S.-made products.

The company has also seen its profitability rise, with operating and profit margins increasing 18.16% and 37.53% last quarter and segment margins rising a record 23.70%. Earnings per share grew a record 33% year over year to $2.48, with a 9% rise in organic sales growth.

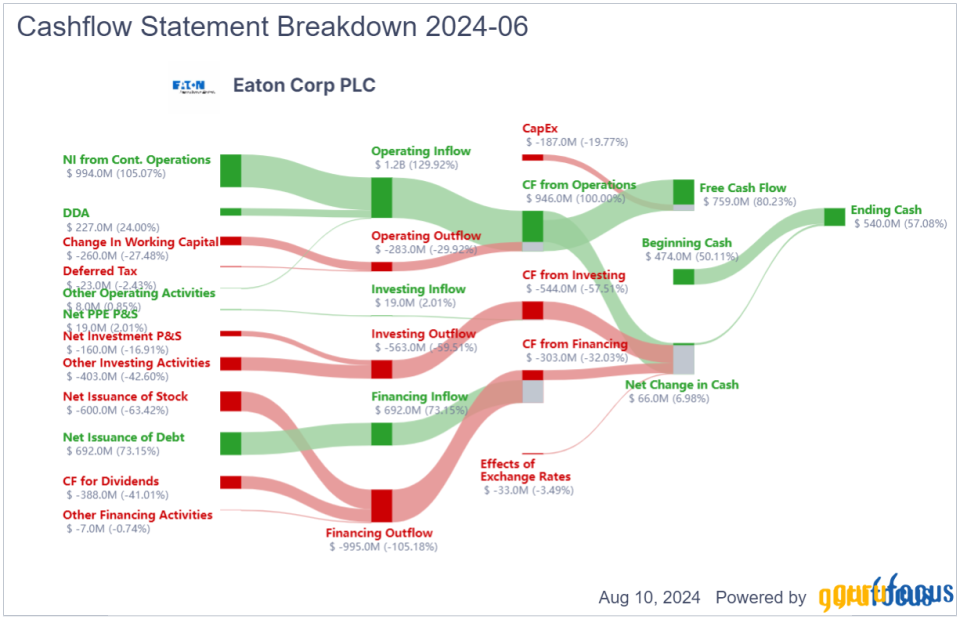

Eaton’s operational efficiency has also translated into strong cash flow and profitability. In the second quarter, the company reported a record operating cash flow of $946 million and free cash flow of $759 million, up 11% and 10% from the prior-year period, respectively.

Eaton raised guidance for the full year, targeting higher earnings and organic growth. The company expects organic growth of 7% to 9% from 6.50% to 8.50%, with segment margin guidance to 22.80% to 23.20% from 22.4% to 22.8%. Both suggest that the company sees substantial improvements in operational efficiency and profitability.

Craig Arnold, Eaton’s chairman and CEO, said following the Aug. 1 report:

“We continue to see strong demand across our markets due to electrification, energy transition and reindustrialization resulting in record earnings and continued backlog growth. We’re making capacity investments in key product lines to support structurally higher growth, and we remain confident in our outlook. As a result, we are increasing our guidance for the year.”

The potential increase in domestic sourcing could improve delivery times and reduce transportation costs, benefiting its operational efficiency.

As U.S. companies shift operations from China, reshoring may drive the stock higher as Eaton has strong exposure to high-growth sectors.

Despite a premium valuation, Eaton’s consistent revenue growth, record earnings and impressive order backlog have analysts expecting the stock to increase 20% just in the following 12 months.

Although the company may not be the flashiest investment, its solid fundamentals and encouraging growth potential make it a solid long-term addition to a portfolio.

However, investors may want to pay attention to whether reshoring worsens inflation if it leads to higher borrowing costs going forward.

This article first appeared on GuruFocus.