- UK new heavy vehicle market grows 2.6% in Q2 as overall uptake stabilises following bumper 2023.

- Rigid demand rises 9.7% and takes greater share of registrations as market continues to normalise.

- Zero emission truck uptake rises 30.0% in the quarter but still only 0.6% market share.

SEE HGV REGISTRATIONS BY BRAND

DOWNLOAD PRESS RELEASE AND DATA TABLE

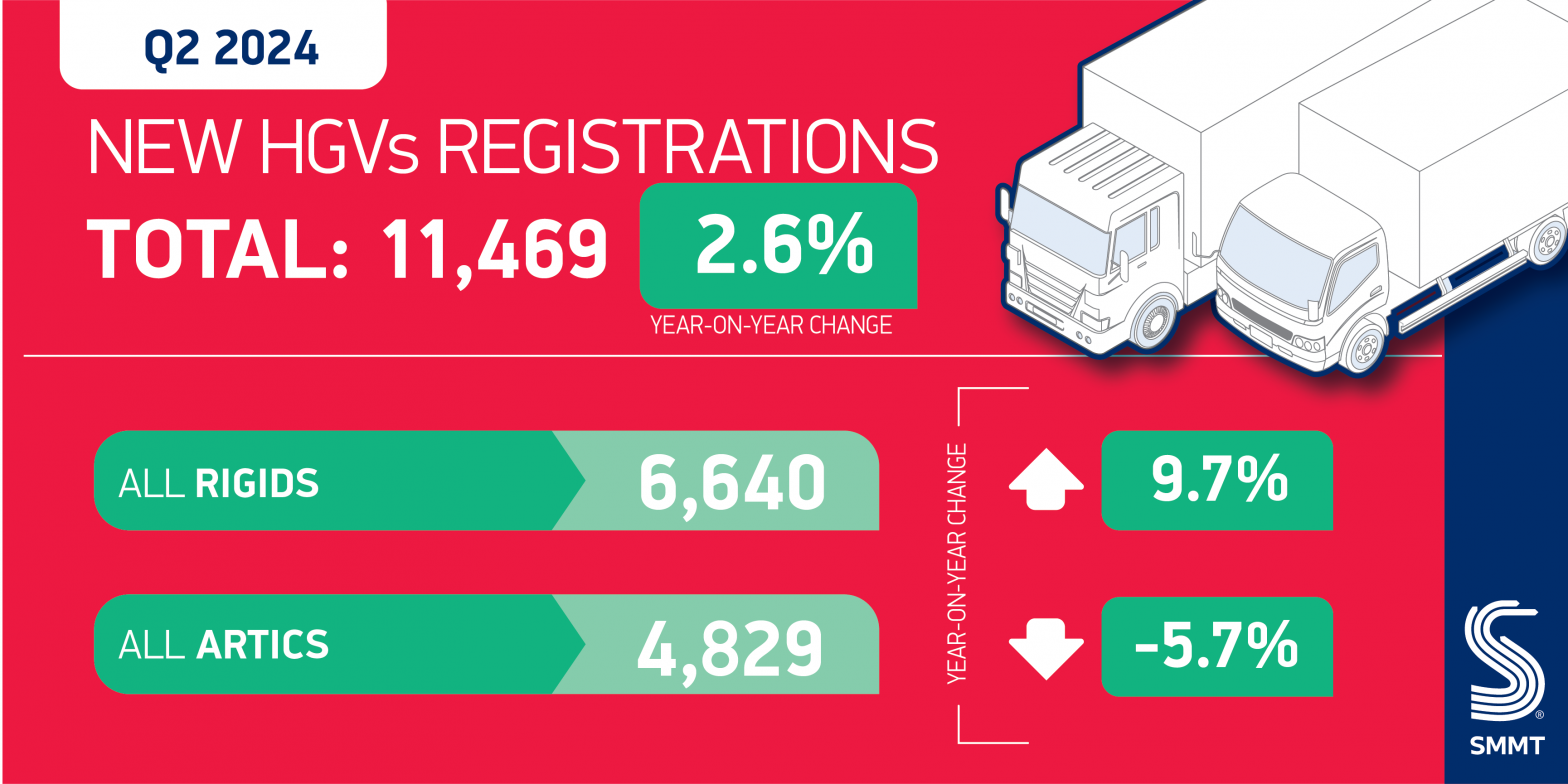

New heavy goods vehicle (HGV) registrations rose 2.6% in Q2 2024, reversing the decline recorded in the first quarter of the year, according to the latest figures published today by the Society of Motor Manufacturers and Traders (SMMT).

Spring saw 11,469 new HGVs enter service, with growth driven by a rise in rigid truck uptake as the market continues to normalise following the fulfilment of pent-up demand in 2023. Rigids rose 9.7% in Q2 to reach 6,640 units, taking a 57.9% market share, up from 54.2% in the same quarter last year. Conversely, artic volumes declined by -5.7% to 4,829 units.

The weighting of the market towards rigids was reflected in the composition of the top body types, with businesses investing more in box vans (up 17.3%), curtainsiders (up 14.9%), tippers (up 11.4%) and refuse vehicles (up 14.1%), while tractor unit volumes fell -7.4%.

Nationally, England took the lion’s share of new HGV registrations, with volumes rising 1.6% to reach 9,827 units. Northern Ireland recorded the largest growth, up by 30.6%, which saw it overtake Wales to become the UK’s third largest HGV market.

Zero emission vehicle (ZEV) uptake also continued to grow, buoyed by ever-expanding choice. Uptake rose by 30.0% to achieve a 0.6% share of market, up from 0.4% in Q2 last year. However, market share remains low compared with the car and van sectors1, demonstrating the ongoing challenge in convincing operators to switch from fossil fuels.

With just over a decade to go until the end of sale of non-ZEV HGVs weighing less than 26 tonnes, operators continue to face a grant system that is lengthy and covers fewer than half of all available models. Progress on the rollout of HGV-specific charging facilities also remains lacklustre. While more are expected to come online in the coming months, the UK currently has just one dedicated truck public charging location. Reforming the grant, plus investment in infrastructure within a national plan, would provide more confidence to operators and encourage greater uptake.

Mike Hawes, SMMT Chief Executive, said,

The truck market’s return to growth after a slower start to the year demonstrates its robustness and resilience – particularly as overall uptake continues to keep pace with last year and the pent-up demand that fuelled volumes. The UK’s place as Europe’s second largest zero emission truck market also demonstrates Britain’s potential to be a leader in the ZEV truck transition. Delivering that ambition, however, requires compelling incentives and infrastructure which will put operators on a confident path to 2035 and beyond.

Notes to editors

1 BEV H1 2024 market shares: Cars 16.6%; LCVs 4.7%