The Hong Kong market has shown resilience amid global economic fluctuations, with the Hang Seng Index up nearly 2% despite weaker-than-expected economic activity in China. This backdrop of cautious optimism sets the stage for exploring growth companies with high insider ownership, which can be a promising indicator of strong future performance. In this article, we will examine three SEHK growth stocks that have demonstrated impressive earnings growth of up to 57%, highlighting what makes them stand out in today’s market environment.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

|

Name |

Insider Ownership |

Earnings Growth |

|

iDreamSky Technology Holdings (SEHK:1119) |

18.8% |

104.1% |

|

Adicon Holdings (SEHK:9860) |

22.4% |

28.3% |

|

Tian Tu Capital (SEHK:1973) |

34% |

70.5% |

|

Zhejiang Leapmotor Technology (SEHK:9863) |

15% |

76.4% |

|

Zylox-Tonbridge Medical Technology (SEHK:2190) |

18.7% |

79.3% |

|

Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) |

13.9% |

100.1% |

|

Value Partners Group (SEHK:806) |

23.4% |

59.5% |

|

Beijing Airdoc Technology (SEHK:2251) |

28.6% |

83.9% |

|

Beijing Fourth Paradigm Technology (SEHK:6682) |

22.8% |

104.5% |

|

DPC Dash (SEHK:1405) |

38.2% |

91.5% |

Let’s review some notable picks from our screened stocks.

Simply Wall St Growth Rating: ★★★★☆☆

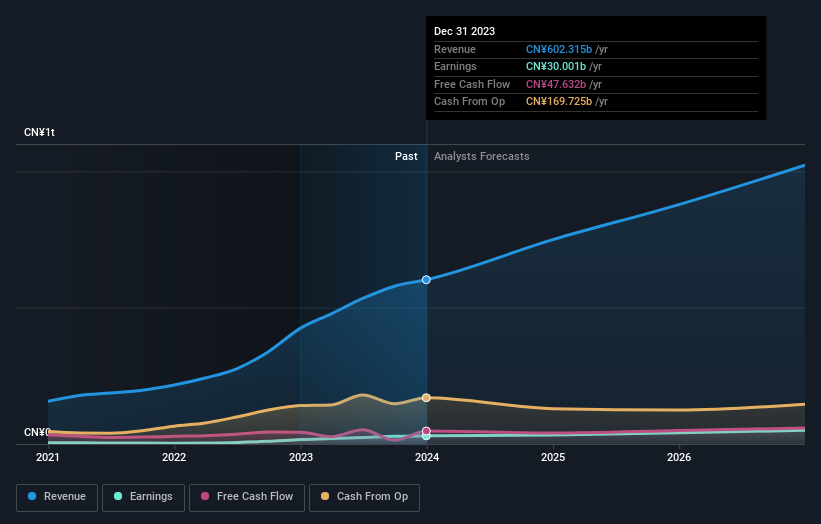

Overview: BYD Company Limited, along with its subsidiaries, operates in the automobiles and batteries sectors across the People’s Republic of China, Hong Kong, Macau, Taiwan, and internationally with a market cap of HK$703.73 billion.

Operations: The company’s revenue segments include CN¥324.69 billion from automobiles and CN¥50.17 billion from batteries.

Insider Ownership: 30.1%

Earnings Growth Forecast: 15.2% p.a.

BYD, a growth company with substantial insider ownership, is forecast to grow earnings at 15.22% per year and revenue at 14% per year, both outpacing the Hong Kong market. Recent strategic alliances, such as with Uber for electric vehicles and the inauguration of a new plant in Thailand with an annual capacity of 150,000 vehicles, underscore its expansion efforts. Despite trading below estimated fair value by 59.3%, BYD’s recent sales and production volumes have shown significant year-over-year increases.

Simply Wall St Growth Rating: ★★★★☆☆

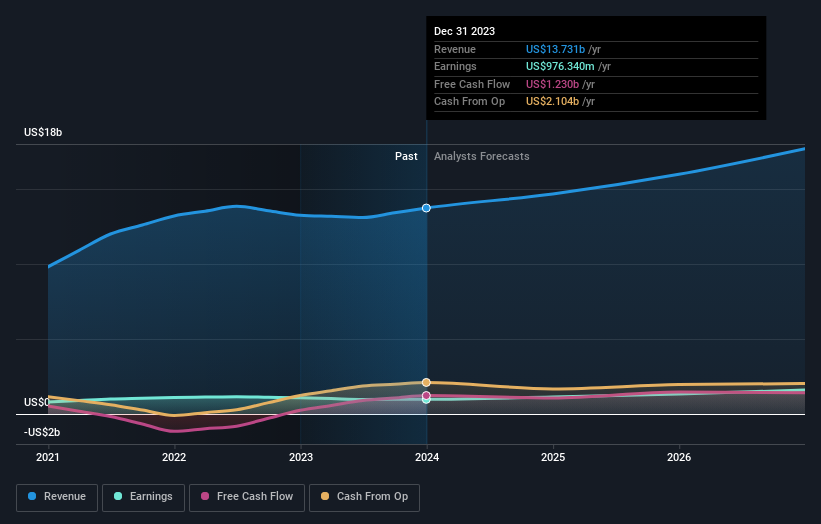

Overview: Techtronic Industries Company Limited designs, manufactures, and markets power tools, outdoor power equipment, and floorcare and cleaning products across North America, Europe, and internationally with a market cap of HK$190.40 billion.

Operations: The company’s revenue segments include $13.23 billion from Power Equipment and $965.09 million from Floorcare & Cleaning products.

Insider Ownership: 25.4%

Earnings Growth Forecast: 15.3% p.a.

Techtronic Industries, exhibiting strong insider ownership, is forecast to grow earnings at 15.27% per year and revenue at 8.4% per year, both surpassing the Hong Kong market’s growth rates. Recent financials show a net income increase to US$550.37 million for H1 2024 from US$475.78 million a year ago. The company announced an interim dividend of HKD 1.08 per share and appointed Steven Richman as CEO, reflecting robust leadership continuity and strategic direction.

Simply Wall St Growth Rating: ★★★★★☆

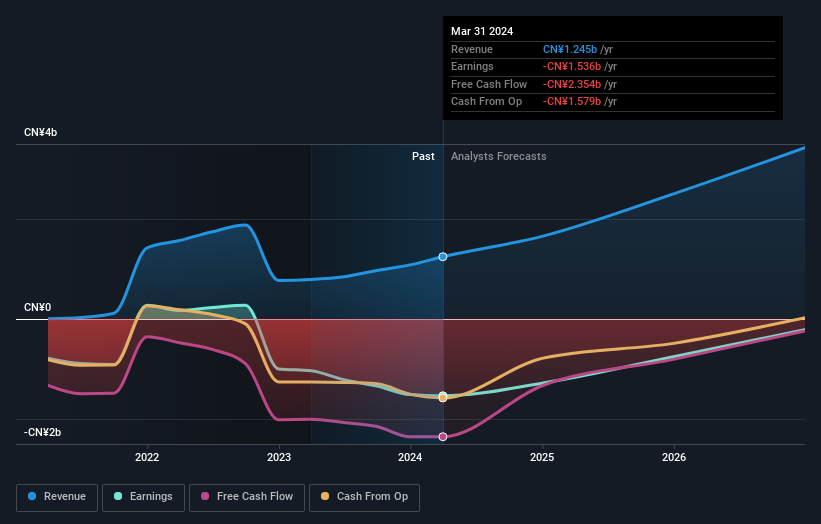

Overview: RemeGen Co., Ltd. is a biopharmaceutical company focused on developing and commercializing biologics for autoimmune, oncology, and ophthalmic diseases in Mainland China and the United States, with a market cap of HK$13.06 billion.

Operations: The company generates revenue through the discovery, development, and commercialization of biologics targeting autoimmune, oncology, and ophthalmic diseases in Mainland China and the United States.

Insider Ownership: 16.2%

Earnings Growth Forecast: 57.6% p.a.

RemeGen, with significant insider ownership, reported H1 2024 sales of CNY 741.76 million, up from CNY 419.07 million a year ago, despite a net loss increase to CNY 780.46 million. The company’s innovative drug telitacicept entered a phase III trial in the U.S., targeting myasthenia gravis and recently gained approval in China for rheumatoid arthritis treatment. Forecasts indicate robust revenue growth at 27% per year and profitability within three years, though share price volatility remains high.

Next Steps

Ready To Venture Into Other Investment Styles?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SEHK:1211 SEHK:669 and SEHK:9995.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com