- UK car production declines -14.4% in July as model changeovers and temporary supply chain constraints restrict output.

- Export volumes down -16.3% but domestic demand holds up, declining by just 672 units.

- Production output value in first seven months of 2024 holds level, despite volume decline.

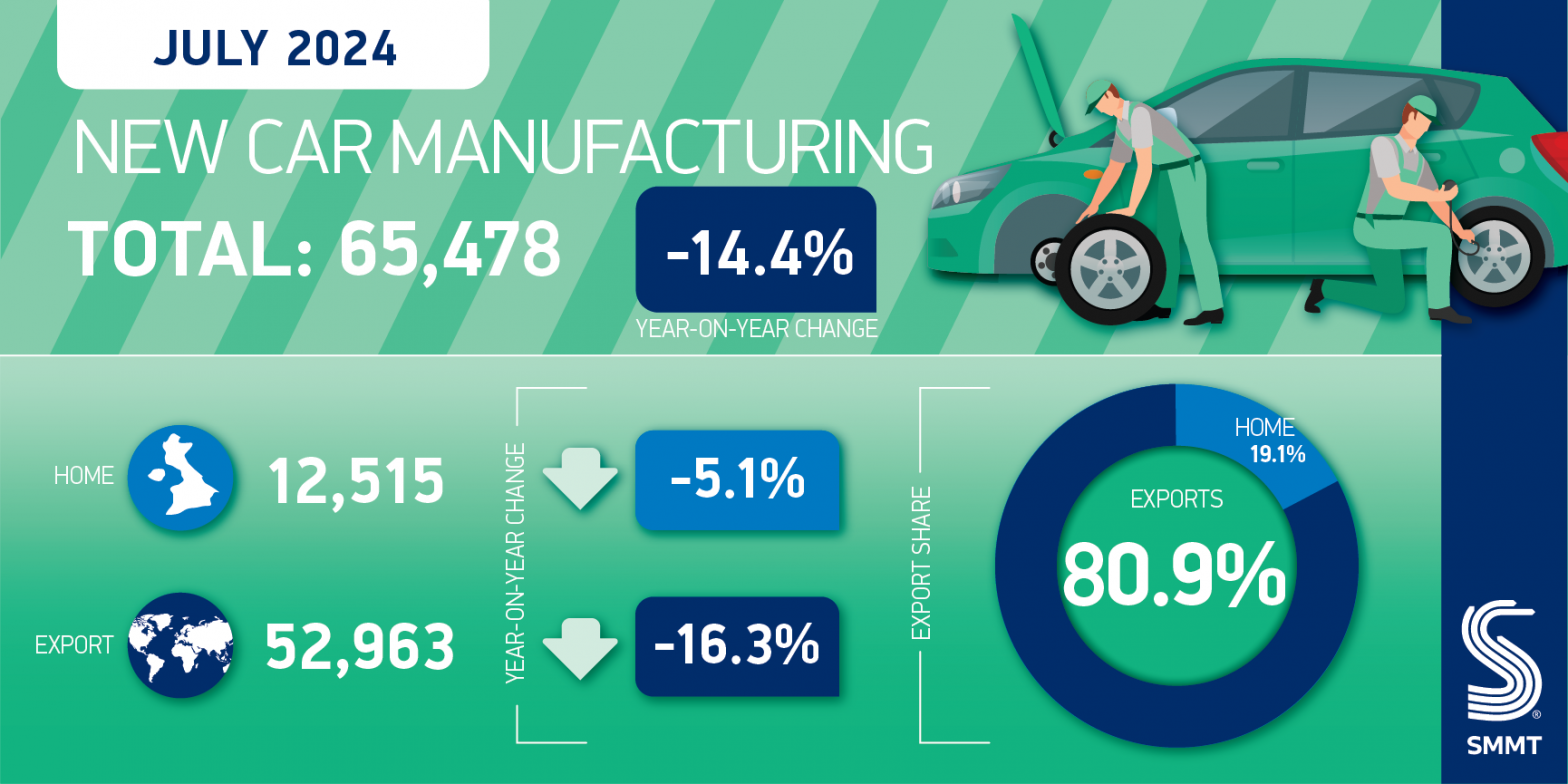

UK car production fell by -14.4% in July, according to new figures published today by the Society of Motor Manufacturers and Traders (SMMT). Factory lines rolled out 65,478 vehicles in the month, with the decline in output due predominantly to model changeovers and temporary supply chain challenges.

Despite a -18.6% decline in volume, electrified (battery electric, plug-in hybrid and hybrid) vehicle manufacturing maintained a relatively stable 37.5% share of output, compared with 39.5% in July 2023.

Production for the UK market fell slightly, by -5.1%, although in volume terms this represented just 672 fewer units. More than four in five (80.9%) cars produced in July were destined for customers overseas, with the five largest markets by volume encompassing the EU (51.3% of exports), US (17.6%), China (8.6%), Turkey (5.5%) and Japan (3.1%). Total export volumes for the month fell -16.3%.

Year to date, domestic production remains up 14.8% while export volumes are down -14.3%. However total output was still calculated to be worth more than £20 billion at factory gate prices – unchanged on the same period last year, demonstrating the high value of UK automotive production.1

Mike Hawes, SMMT Chief Executive, said,

Following significant growth last year, some readjustment in output was to be expected. Indeed, an ongoing degree of volatility is likely as the industry restructures to transition to zero emission vehicle production. As the billions already committed to new models start to deliver a return, volume growth will resume, providing we seize every opportunity to enhance our global competitiveness. We need investment in skills, healthy markets, cheaper green energy, and fair trade deals that help British-built vehicles reach international customers more easily, all of which should be wrapped in an over-arching industrial strategy that ensures automotive continues to be a key driver of economic growth.

Notes to editors

1. Average 2024 factory gate price: £41,800; 2023: £38,200 (inflation adjusted)