As the Hang Seng Index recently gained 2.14%, reflecting a cautiously optimistic sentiment among investors despite broader economic concerns, attention is increasingly turning towards growth companies with high insider ownership in Hong Kong. In the current market environment, stocks that exhibit robust growth potential and significant insider ownership can be particularly appealing, as they often indicate strong confidence from those closest to the company’s operations and strategic direction.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

|

Name |

Insider Ownership |

Earnings Growth |

|

Laopu Gold (SEHK:6181) |

36.4% |

34.7% |

|

Akeso (SEHK:9926) |

20.5% |

55.0% |

|

Fenbi (SEHK:2469) |

31.2% |

22.4% |

|

Pacific Textiles Holdings (SEHK:1382) |

11.2% |

37.7% |

|

Zylox-Tonbridge Medical Technology (SEHK:2190) |

18.7% |

69.8% |

|

Zhejiang Leapmotor Technology (SEHK:9863) |

15% |

76.4% |

|

Adicon Holdings (SEHK:9860) |

22.4% |

35.8% |

|

DPC Dash (SEHK:1405) |

38.2% |

100.5% |

|

Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) |

13.9% |

109.2% |

|

Beijing Airdoc Technology (SEHK:2251) |

28.6% |

93.4% |

Let’s uncover some gems from our specialized screener.

Simply Wall St Growth Rating: ★★★★☆☆

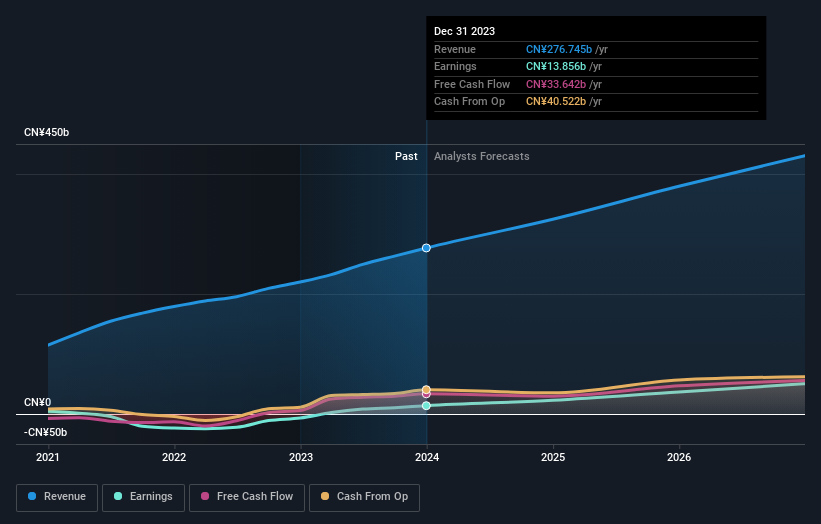

Overview: BYD Company Limited, along with its subsidiaries, operates in the automobiles and batteries sectors across the People’s Republic of China, Hong Kong, Macau, Taiwan, and internationally, with a market cap of approximately HK$747.85 billion.

Operations: The company’s revenue segments include CN¥507.52 billion from automobiles and related products, and CN¥154.49 billion from mobile handset components, assembly services, and other products.

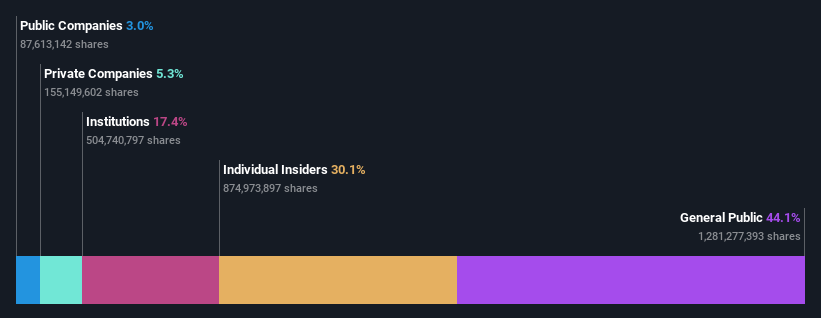

Insider Ownership: 30.1%

Earnings Growth Forecast: 15.2% p.a.

BYD has demonstrated robust growth with high insider ownership. Recent earnings for the half year ended June 30, 2024, reported sales of CNY 294.77 billion and net income of CNY 13.63 billion, showing substantial year-over-year increases. The company’s strategic partnership with Uber to deploy 100,000 electric vehicles globally highlights its expansion efforts. Forecasts indicate BYD’s revenue will grow faster than the Hong Kong market at an annual rate of 13.8%.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Meituan operates as a technology retail company in the People’s Republic of China with a market cap of approximately HK$739.72 billion.

Operations: The company generates revenue from two main segments: New Initiatives (CN¥77.56 billion) and Core Local Commerce (CN¥228.13 billion).

Insider Ownership: 11.3%

Earnings Growth Forecast: 25.8% p.a.

Meituan has shown strong growth with high insider ownership. For the half year ended June 30, 2024, it reported sales of CNY 155.53 billion and net income of CNY 16.72 billion, both significantly up from a year ago. The company announced a $1 billion share repurchase program, reflecting confidence in its valuation. Analysts forecast earnings to grow at an annual rate of 25.8%, outpacing the Hong Kong market’s expected growth rate of 10.9%.

Simply Wall St Growth Rating: ★★★★★★

Overview: Akeso, Inc., a biopharmaceutical company with a market cap of HK$42.47 billion, researches, develops, manufactures, and commercializes antibody drugs.

Operations: The company’s revenue primarily comes from the research, development, production, and sale of biopharmaceutical products, amounting to CN¥1.87 billion.

Insider Ownership: 20.5%

Earnings Growth Forecast: 55.0% p.a.

Akeso exhibits high insider ownership and significant growth potential. Analysts forecast earnings to grow 55.03% annually, with revenue expected to increase by 32.5% per year, surpassing the Hong Kong market’s growth rate. Despite recent financial setbacks, including a net loss of CNY 238.59 million for H1 2024, its innovative drug developments like ivonescimab show promise in clinical trials and have gained priority review status in China, indicating strong future prospects.

Summing It All Up

Want To Explore Some Alternatives?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SEHK:1211 SEHK:3690 and SEHK:9926.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com