As the Hang Seng Index recently posted a 2.14% gain, investors are keeping a close eye on high-growth opportunities in Hong Kong. In this dynamic market environment, stocks with strong insider ownership often signal confidence from those who know the company best, making them attractive for potential growth. In this article, we explore three high-growth SEHK stocks that boast substantial insider ownership and could be well-positioned to capitalize on current market conditions.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

|

Name |

Insider Ownership |

Earnings Growth |

|

Laopu Gold (SEHK:6181) |

36.4% |

34.7% |

|

Akeso (SEHK:9926) |

20.5% |

55.1% |

|

Pacific Textiles Holdings (SEHK:1382) |

11.2% |

37.7% |

|

Fenbi (SEHK:2469) |

31.2% |

22.4% |

|

Zylox-Tonbridge Medical Technology (SEHK:2190) |

18.7% |

69.8% |

|

Zhejiang Leapmotor Technology (SEHK:9863) |

14.6% |

77.8% |

|

Adicon Holdings (SEHK:9860) |

22.4% |

31.2% |

|

DPC Dash (SEHK:1405) |

38.2% |

104.2% |

|

Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) |

13.9% |

109.2% |

|

Beijing Airdoc Technology (SEHK:2251) |

28.6% |

93.4% |

We’ll examine a selection from our screener results.

Simply Wall St Growth Rating: ★★★★☆☆

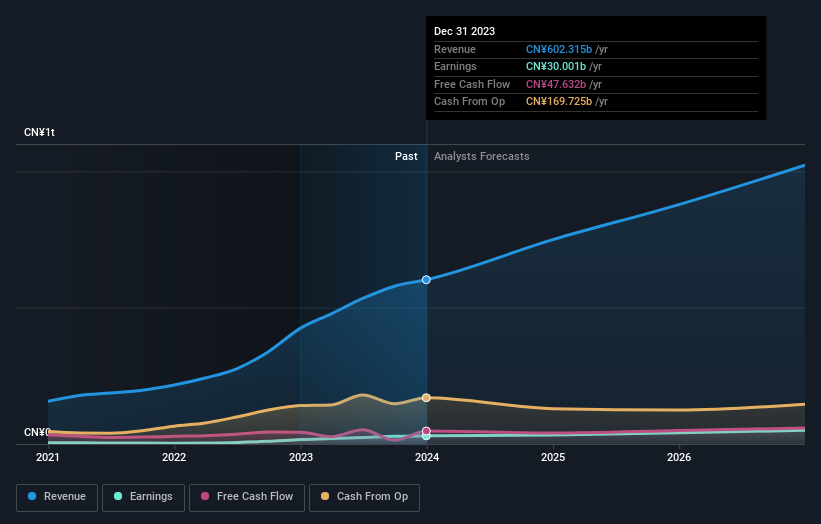

Overview: BYD Company Limited, along with its subsidiaries, operates in the automobiles and batteries sectors across the People’s Republic of China, Hong Kong, Macau, Taiwan, and internationally with a market cap of HK$761.44 billion.

Operations: BYD’s revenue is primarily derived from Automobiles and Related Products at CN¥507.52 billion, and Mobile Handset Components, Assembly Service, and Other Products at CN¥154.49 billion.

Insider Ownership: 30.1%

Earnings Growth Forecast: 15.2% p.a.

BYD has demonstrated solid growth, with earnings increasing 36.2% over the past year and forecasted revenue growth of 13.8% annually, outpacing the Hong Kong market’s 7.3%. The company’s recent unaudited results show significant production and sales volume increases year-over-year. Additionally, a strategic partnership with Uber aims to deploy 100,000 BYD electric vehicles globally, enhancing its market presence and supporting future growth prospects despite no substantial insider trading activity recently reported.

Simply Wall St Growth Rating: ★★★★★☆

Overview: LifeTech Scientific Corporation develops, manufactures, and trades interventional medical devices for cardiovascular and peripheral vascular diseases globally, with a market cap of HK$6.44 billion.

Operations: The company’s revenue is primarily derived from three segments: Structural Heart Diseases Business (CN¥523.01 million), Peripheral Vascular Diseases Business (CN¥725.13 million), and Cardiac Pacing and Electrophysiology Business (CN¥32.36 million).

Insider Ownership: 16%

Earnings Growth Forecast: 29.5% p.a.

LifeTech Scientific’s revenue is forecast to grow 21.5% per year, significantly outpacing the Hong Kong market’s 7.6%. Despite a slight decline in net income for the first half of 2024 (CNY 205.56 million vs. CNY 220.16 million last year), earnings are expected to grow at an annual rate of 29.5%. Insider activity has been positive, with more shares bought than sold in the past three months, indicating confidence from within the company despite lower profit margins this year compared to last year (19.4% vs. 28%).

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Angelalign Technology Inc. researches, develops, designs, manufactures, and markets clear aligner treatment solutions in the People’s Republic of China with a market cap of HK$8.76 billion.

Operations: The company generates revenue from Dental Equipment & Supplies amounting to CN¥1.72 billion.

Insider Ownership: 18.4%

Earnings Growth Forecast: 65.2% p.a.

Angelalign Technology’s earnings are forecast to grow 65.2% annually, outpacing the Hong Kong market’s 12%. Despite a drop in net profit margin from 13.1% to 2.5%, the company reported a significant revenue increase for H1 2024 (CNY 861.5 million vs. CNY 616.33 million last year). Trading at about 19% below its estimated fair value, analysts expect the stock price to rise by over 60%, reflecting strong insider confidence and growth potential despite recent financial challenges.

Key Takeaways

Want To Explore Some Alternatives?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SEHK:1211 SEHK:1302 and SEHK:6699.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com